As of December 23, 2024, the price of SJC gold bars was commonly listed by large enterprises such as Saigon Jewelry Company SJC, DOJI and Bao Tin Minh Chau at 82.3 - 84.3 million VND/tael (buy - sell). After exactly one year, by December 23, 2025, the price of SJC gold bars at these brands had skyrocketed to 157 - 159 million VND/tael.

Comparing the two time frames, the buying price of SJC gold has increased to 74.7 million VND per tael, while the selling price also increased by 74.7 million VND per tael. With the difference between buying and selling remaining around 2 million VND/tael, buyers of SJC gold bars from the end of 2024 and selling at the present time are making a profit of about 72.7 million VND/tael.

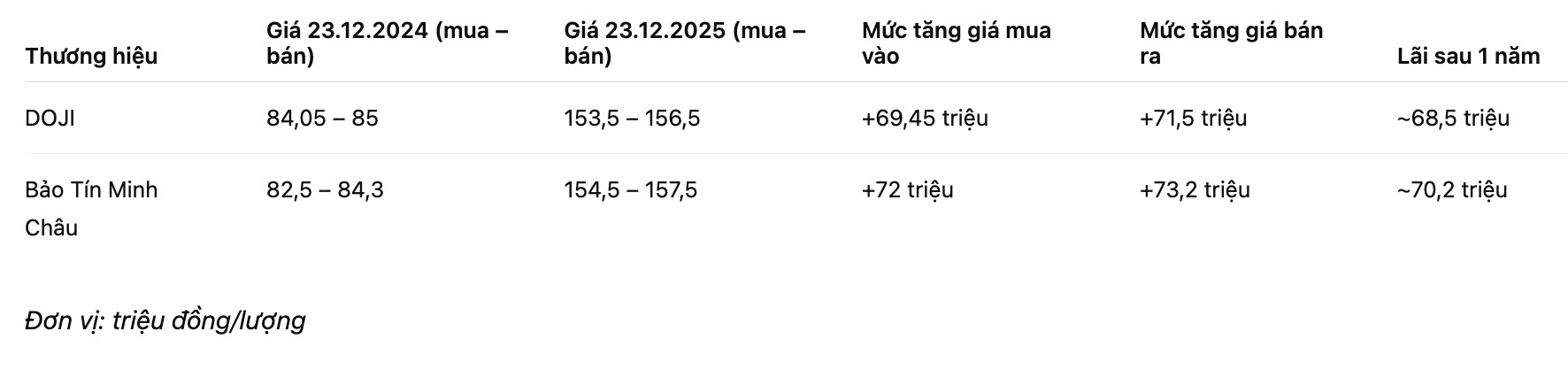

Not only gold bars, 9999 round gold rings also recorded a strong price increase. At DOJI, the price of Hung Thinh Vuong gold rings on December 23, 2024 was listed at 84.05 - 85 million VND/tael. Up to now, the price has increased to 153.5 - 156.5 million VND/tael.

Thus, the purchase price of gold rings at DOJI has increased by 69.45 million VND per quantity, while the selling price has increased by 71.5 million VND per quantity. Buyers of DOJI gold rings a year ago are currently making a profit of about 68.5 million VND per tael.

At Bao Tin Minh Chau, 9999 round gold rings at the end of 2024 are priced at 82.5 - 84.3 million VND/tael. By December 23, 2025, the price had increased sharply to 154.5 - 157.5 million VND/tael. The increase in the buying price is up to 72 million VND per quantity, while the selling price increases by about 73.2 million VND per quantity, helping gold ring buyers here record a profit of about 70.2 million VND per quantity.

In the international market, world gold prices also increased sharply for a year, from 2,618.4 USD/ounce to 4,488.2 USD/ounce, equivalent to an increase of nearly 1,870 USD/ounce (equivalent to an increase of more than 71%.

Although gold brings attractive profits to early buyers, people should not follow the fear of missing out on opportunities (FOMO) and rush to buy gold when the price has risen too high. In fact, the gap between buying and selling prices is still large, posing a potential risk of losses if gold prices turn to decrease.

In the context of the world gold price showing signs of weakening, the domestic gold market could be affected and adjusted down sharply in the coming time. People need to consider carefully before putting money down, avoid chasing the hot increase to limit the risk of losing money when the market reverses.

See more news related to gold prices HERE...