Investors need to be careful

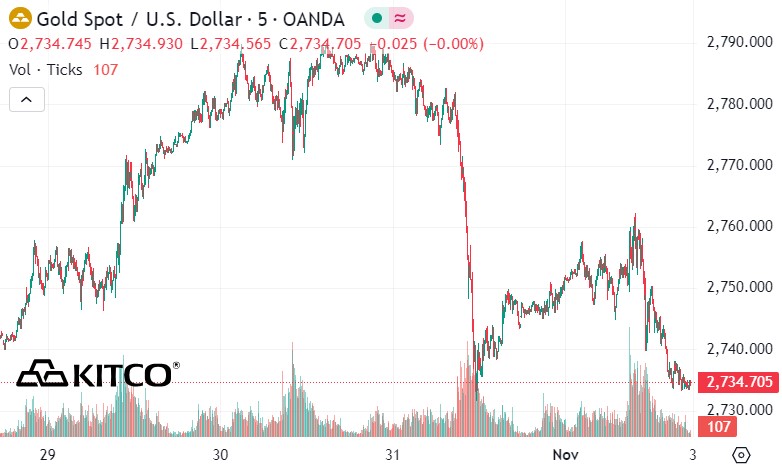

According to Kitco, last week gold not only faced strong selling pressure after reaching $2,800/ounce, but its weekly price increase streak also ended.

Gold's late-week performance raises the risk that the precious metal could continue to decline as Americans go to the polls next week.

Many analysts have noted that the news of a feud between former President Donald Trump and Vice President Kamala Harris is a major factor behind gold's recent rally.

Many believe that as fundamental support weakens, gold is starting to see a change in its technical outlook. Some analysts believe that the precious metal is even overbought.

"There is no doubt that gold prices have risen too fast and too strongly, investors need to be very cautious," said Naeem Aslam, chief investment officer at Zaye Capital Markets.

Phillip Streible, chief market strategist at Blue Line Futures, said he expects market volatility to ease after the U.S. election next Tuesday, which could hurt gold’s appeal as a safe-haven asset.

Alex Kuptsikevich - Chief Market Analyst at FxPro - said he expects gold prices to fall in the coming period as the FED has become less dovish than in early October.

“We believe these factors are what has triggered the start of the gold sell-off. It is too early to talk about a major correction, but the market is clearly cooling down, taking profits and reducing risk ahead of the election and the Fed meeting next week. A typical correction could take gold to $2,680-2,700/oz before new upside momentum emerges,” he said.

While the near-term downside risks in the gold market are increasing, Streible added that investors should not confuse the correction with a broader downturn. He noted that falling prices will likely continue to attract buyers.

“Geopolitical uncertainty is on the rise. In this context, we believe that central banks will continue to buy gold. It is better to have a ‘hard asset’ that can be easily converted into any currency.”

Gold may be sensitive to Fed monetary policy decisions

Besides information about US politics, analysts also warned investors that gold prices may be sensitive to the monetary policy decision of the US Federal Reserve (FED) next week.

Although the market has priced in a 25 basis point rate cut at the upcoming FOMC meeting, there is still a lot of uncertainty surrounding future rate cuts, especially as inflation remains relatively high.

On Thursday, the core personal consumption expenditures index (excluding volatile food and energy prices) — the Fed’s preferred inflation gauge — rose 2.7% over the past 12 months. Inflation has been at that level for the past three months.

Analysts point out that the Fed may face challenges in having to cut interest rates aggressively until 2025 if inflation remains high.

Barbara Lambrecht, Commodity Analyst at Commerzbank, highlighted the growing risks for gold.

“We are skeptical about whether a sharp rise of around $300/oz within two months is justified. After all, the main drivers are still lacking, as market expectations for a rate cut have declined significantly since early October,” she noted.

Economic data to watch next week

Monday: Reserve Bank of Australia monetary policy decision.

Tuesday: Institute for Supply Management (ISM) purchasing managers index (PMI), US presidential and congressional elections.

Thursday: Bank of England monetary policy decision, US weekly jobless claims, US Federal Reserve monetary policy decision.

Friday: University of Michigan Consumer Psychology Preliminary.