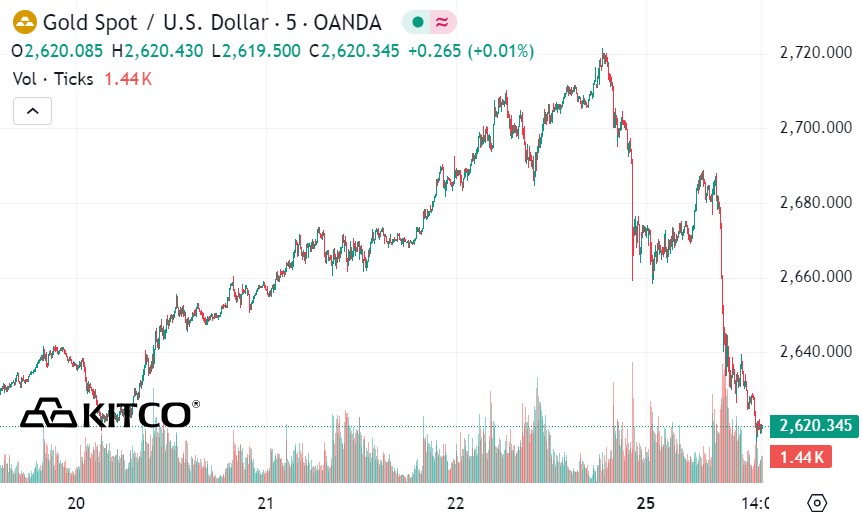

According to Kitco, the sharp decline in gold and silver prices on Monday was due to increased investor risk sentiment, large profit-taking pressure, and a sell-off from short-term futures traders.

US financial markets started the Thanksgiving-shortened trading week on a more upbeat note, weighing on safe-haven metals amid reports that Israel and Hamas may be close to a ceasefire.

Israel could be just days away from reaching a ceasefire agreement with Hezbollah in Lebanon, according to the Israeli ambassador to the US, Bloomberg reported.

Gold prices continued to fall after Axios reported that Israel and Lebanon have accepted the terms of a ceasefire agreement. However, the parties have not yet officially announced the agreement.

Traders are also analyzing President-elect Donald Trump's pick for Treasury Secretary Scott Bessent, seen as a choice that would bring more stability to the U.S. economy and financial markets. The nomination has eased concerns about the upcoming inflation agenda, reducing the appeal of gold as a hedge against inflation.

The Bessent news is a factor that could lead to a drop in gold prices on Monday, along with profit-taking pressure after last week's rally, according to UBS Group AG commodities analyst Giovanni Staunovo.

Investors are now focused on the outlook for monetary policy, after a report showed U.S. business activity grew at its fastest pace since April 2022. Traders are pricing in a less than 50% chance of the Fed cutting interest rates next month.

A slew of data this week could provide clues about the Fed’s interest rate path. These include minutes from the central bank’s November meeting, consumer confidence and data on personal expenditures (PCE), the Fed’s preferred inflation gauge.

Still, gold has rallied about 30% this year, supported by central bank buying and the Fed’s move to cut interest rates. Safe-haven demand has also surged amid escalating tensions between Russia and Ukraine. Most banks remain bullish on the outlook for gold, with Goldman Sachs Group Inc. and UBS predicting prices will continue to rise through 2025.

"Gold prices continue to reflect the interaction between geopolitical risks and a less dovish outlook from the Fed. The news of rising inflation may increase the possibility of the Fed keeping rates unchanged in December," said Jun Rong Yeap, market strategist at IG Asia Pte.

In related markets, Nymex crude oil futures fell, trading around $69.25 a barrel. The yield on 10-year US Treasury bonds is currently around 4.2%.

The bulls have quickly lost their short-term technical advantage. Gold is forming a strong bearish pattern on the daily bar chart. The next target for the bulls is a close above the strong resistance level of $2,723.20 per ounce. Meanwhile, the bears aim to push the price below the strong support level of $2,600 per ounce.

See more news related to gold prices HERE...