The Dollar Index (DXY) is recording an unprecedented weakness this week, hitting its lowest bottom compared to major trading partners since February 2022.

This four-session streak of declines is the USD's most sustained weakening period since March, showing complex resettlement strategies from investment institutions in the context of expectations of policy changes by the US Federal Reserve (FED).

The long-term weakness of the US dollar reflects a combination of monetary policy uncertainty and political momentum that goes beyond traditional currency valuation models.

The index's decline to February 2022 shows a fundamental reshaping of assumptions about the strength of the USD, affected by multidimensional pressures beyond the scope of conventional economic indicators.

Analysis perspectives show that many factors are affecting at the same time, including the gap in the Fed's policy message, the impact of political inheritance instability, the restructuring of the position of investment institutions, and the adjustment of relative value between currencies.

This suggests that institutional investors are reassessing their position against the USD in the context of uncertainty, opening up opportunities for sophisticated multidimensional investment strategies.

The semi-annual hearing of Fed Chairman Jerome Powell in the National Assembly disappointed the market when he continued to maintain a "wait and see" stance, without giving any clear signals about the possibility of a rate adjustment in July. This has created a policy space that the currency market is understanding as the ability to maintain a tight monetary policy for a longer period of time.

Ironically, the lack of a specific easing message has weakened the US dollar, suggesting investors have placed expectations on a softer stance. The report by the Wall Street Journal that US President Donald Trump is considering announcing a replacement for Chairman Powell as early as September has added political uncertainty to monetary policy expectations.

Shortening the transition period from 3-4 months as usual to earlier can fundamentally change the independence of the FED and create a policy impact many months earlier than the time of actual change.

Political pressure surrounding interest rate policy is creating a complex environment, where market expectations are not only based on economic data, but also include the probability of political inheritance, central bank prestige, assumptions about policy continuity and institutional independence. These show that the currency market is pricing in political risks, far surpassing the traditional economic platform.

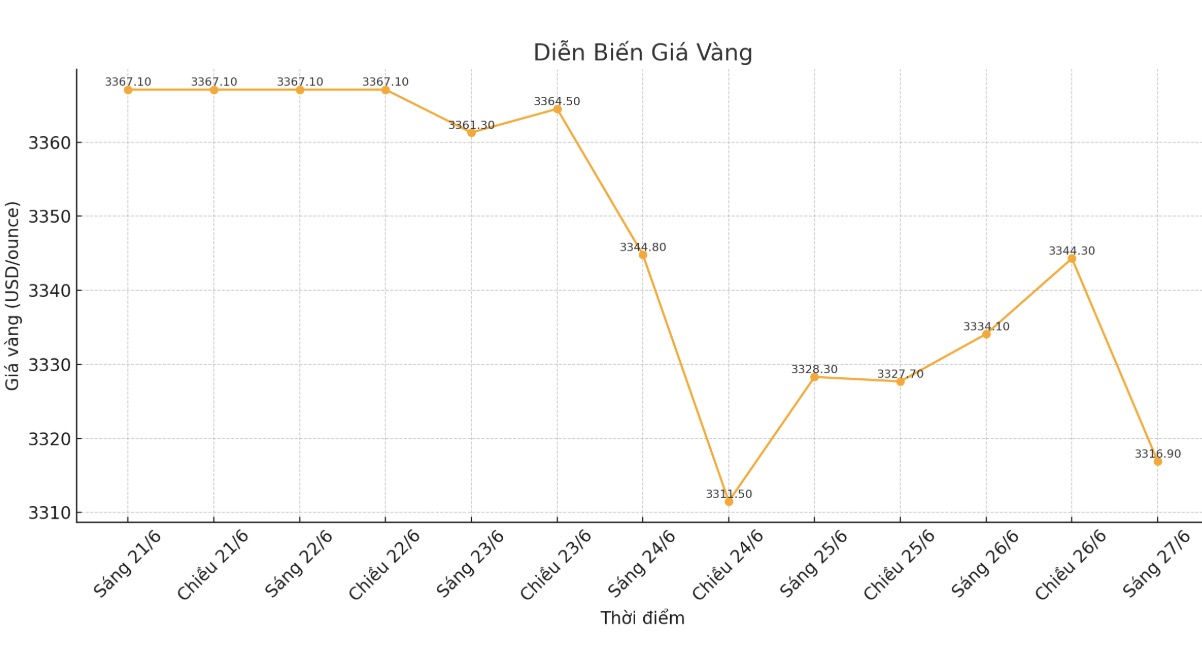

Gold's quiet reaction to the weakening of the US dollar shows that the precious metals market is currently operating on momentum beyond the usual counter correlation. Despite the sharp decline in the USD, gold prices remained almost unchanged until 5:00 p.m. ET, showing that if there were no supporting factors from the USD, gold prices could have fallen sharply.

The phase difference between gold futures and spot gold markets brings a remarkable perspective. While gold futures have broken through the 50-day moving average and viewed it as a resistance zone, spot gold has recovered and remained above this technical threshold. This shows that the spot market is expected to increase in the short term, while futures contracts are still cautious.

Silver showed outstanding strength, increasing 1.18% in the spot market to 36.55 USD and 1.26% in futures contracts to 36.56 USD. The breakeway near the price of 36.83 USD is the resistance zone that silver has only broken through once in the past 12 years. This could signal a long-term supply-demand imbalance, increased industrial demand, protective position against monetary policy, and the ability to maintain technical upward momentum.

The current market requires a readjustment of traditional linear assumptions between currencies and precious metals, taking into account more complex political and policy variables.

See more news related to gold prices HERE...