A sharp decline in US new home sales shows that the prolonged stagnation of the real estate market still cannot bring new upward momentum to gold, as this precious metal continues to struggle due to weak safe-haven demand.

According to the report released on Wednesday by the US Bureau of Population and the Department of Housing and Urban Development, new home sales last month fell nearly 14%, down to a seasonal adjustment of 623,000 units/year, from a adjustment of 722,000 units in April.

Compared to May 2024, new home sales have decreased by 6.3%.

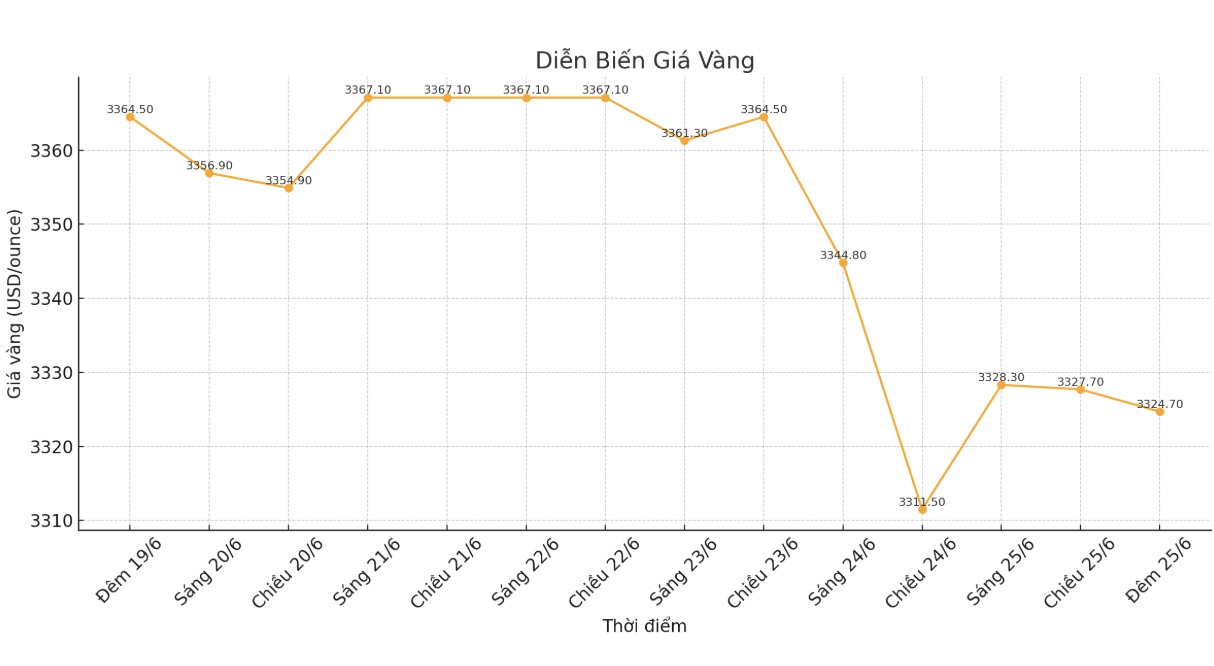

Although the real estate figures are disappointing, the gold market has almost no reaction. The last spot gold price was recorded at 3,321.64 USD/ounce, almost unchanged on the day.

Typically, falling new home sales in the US are seen as a signal that the economy is slowing down, which could increase demand for shelter for safe-haven assets such as gold. In the context of increasing concerns about recession, investors are often looking to gold as a channel to preserve value. However, the quiet reaction of gold prices this time shows that the market is lacking clear momentum, as support from real estate is overwhelmed by the decline in geopolitical tensions and interest rate expectations are still high.

Some analysts believe that gold prices are stagnant as tensions in the Middle East have cooled down after US President Donald Trump called for a ceasefire between Israel and Iran. The decline in safe-haven demand has pushed gold prices close to the important support level right above the 3,300 USD/ounce mark.

Although geopolitical instability is still a bit supportive, some experts say that the downside risk of gold is generally controlled, in the context of the US economy continuing to weaken.

Economists said the prolonged weakness of the housing market is not a very optimistic signal for the economy in general. This industry is still under pressure from rising housing prices and high mortgage rates.

According to the report, the trung tam selling price of new houses in May 2025 is 426,600 USD, while the average price is 522,200 USD.

Deposit prices have increased by 3.7% compared to 411,400 USD in April and increased by 3% compared to the same period last year.

Economic experts say that housing prices have increased sharply in recent years due to limited supply. However, this trend may be changing, the number of newly opened houses as of the end of May 2025 is 507,000 units, an increase of 1.4% compared to April and an increase of 8.1% over the same period last year.

See more news related to gold prices HERE...