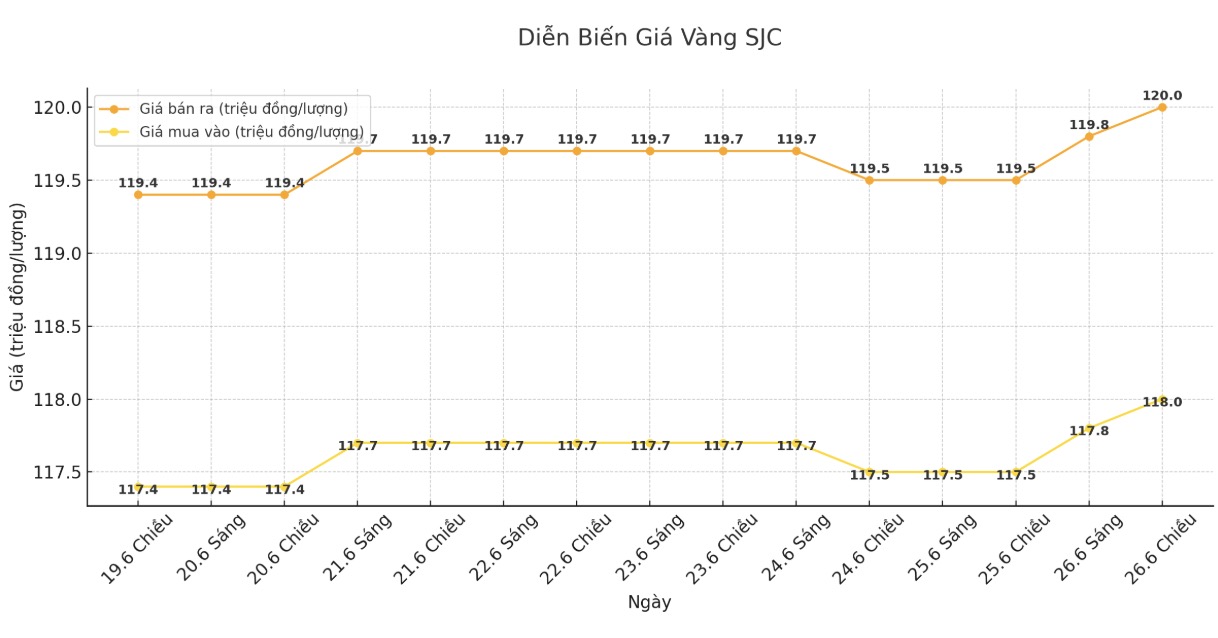

SJC gold bar price

As of 6:00 a.m. on June 27, the price of SJC gold bars was listed by Saigon Jewelry Company at VND118-120 million/tael (buy in - sell out); increased by VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118-120 million VND/tael (buy - sell); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118-120 million VND/tael (buy in - sell out); increased by 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.2-120 million VND/tael (buy - sell); increased by 400,000 VND/tael for buying and increased by 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.8 million VND/tael.

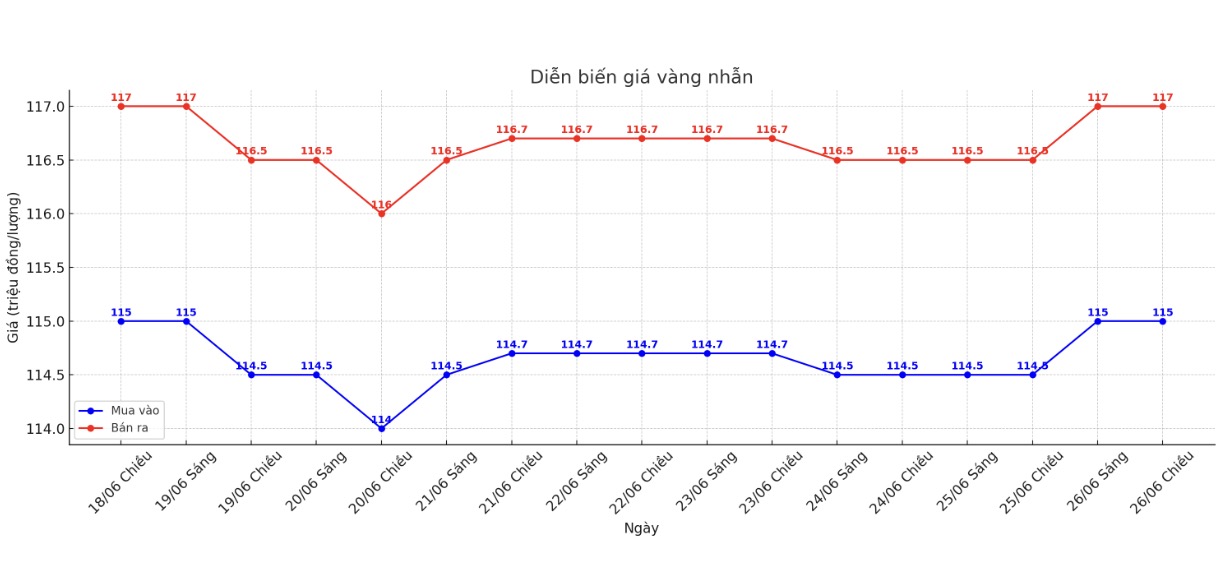

9999 gold ring price

As of 6:00 a.m. on June 27, DOJI Group listed the price of gold rings at VND115-117 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.8-116.8 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

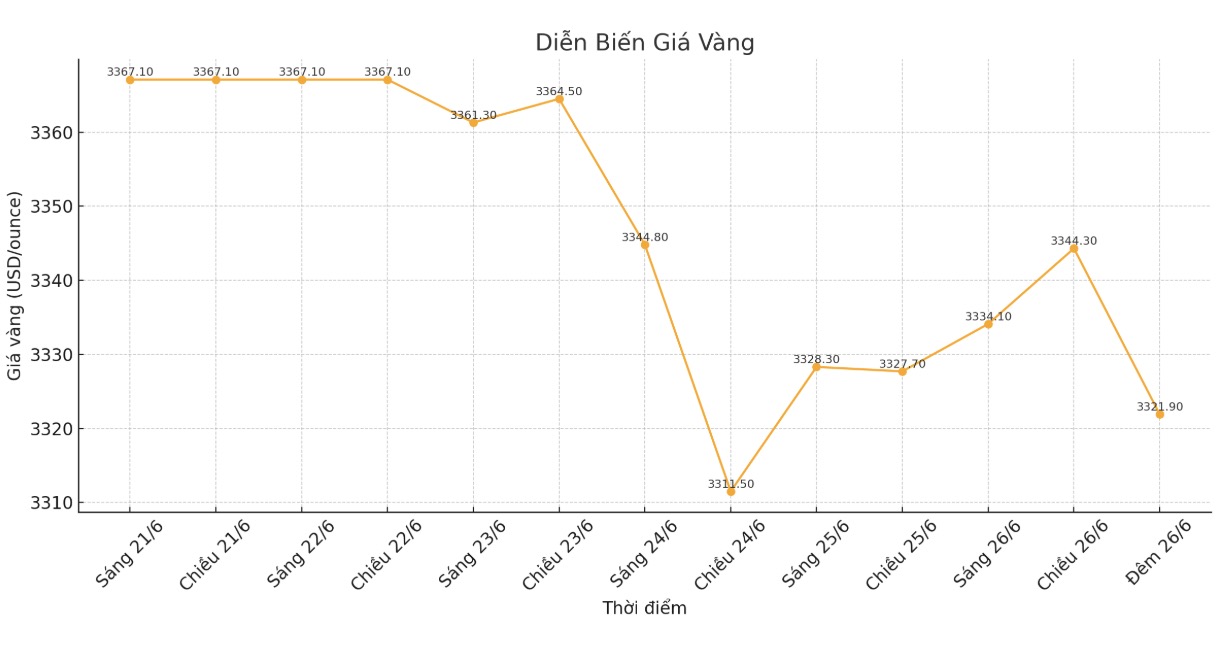

World gold price

After a sharp increase on the afternoon of June 26, world gold prices reversed and decreased sharply last night. Recorded at 22:55 on June 26, spot gold was listed at 3,321.9 USD/ounce.

Gold price forecast

Gold prices are still supported by a weakening USD index. However, the precious metal's gains remained modest as tensions in the Middle East have eased significantly this week.

August gold contract increased by 6 USD, to 3,348.40 USD/ounce. July delivery silver price increased by 0.374 USD, to 36.485 USD/ounce.

Asian and European stock markets traded in opposite directions to positions overnight. US stock indexes are expected to open in green. Risk avocation sentiment has calmed this week, although investor risk appetite is not really strong. The ceasefire agreement between Israel and Iran appears to be still being maintained.

US President Donald Trump on Wednesday criticized Federal Reserve Chairman Jerome Powell and said he is considering a few replacement candidates when Powell's term ends next year.

Technically, the August gold contract is having a short-term advantage. The next upside target for buyers is to close above $3,476.30/ounce. The target for the sellers to reduce prices is to push the contract below the important technical support level at 3,300 USD/ounce.

The first resistance level was the peak of the third session of 3,385 USD/ounce, followed by 3,400 USD/ounce. The first support level was the low of $3,325.5 an ounce on Wednesday, followed by a low of $3,308.3 an ounce this week.

The US PCE core inflation index, due out on Friday, is of particular interest to investors because it is the Federal Reserve's preferred inflation measure.

The development of this index could have a direct impact on monetary policy expectations. If core inflation rises higher than expected, the Fed could maintain higher interest rates for longer, strengthening the USD and putting downward pressure on gold.

Conversely, if the data shows that inflation cools down, expectations of a Fed cutting interest rates soon will increase, creating momentum for gold prices to increase. The market is currently in a state of waiting, with many investors expecting a decrease in core PCE to be a factor that will push gold above the resistance level in the coming time.

In the outside market, the USD index continued to decline, reaching its lowest level in 3.5 years. Slightly sweet crude oil prices (nymex) increased slightly, trading around 65.25 USD/barrel. The yield on the 10-year US government bond is currently at 4.27%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...