Update deposit interest rates at Agribank

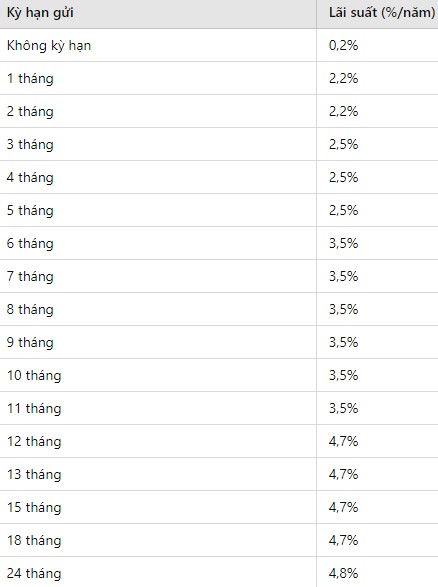

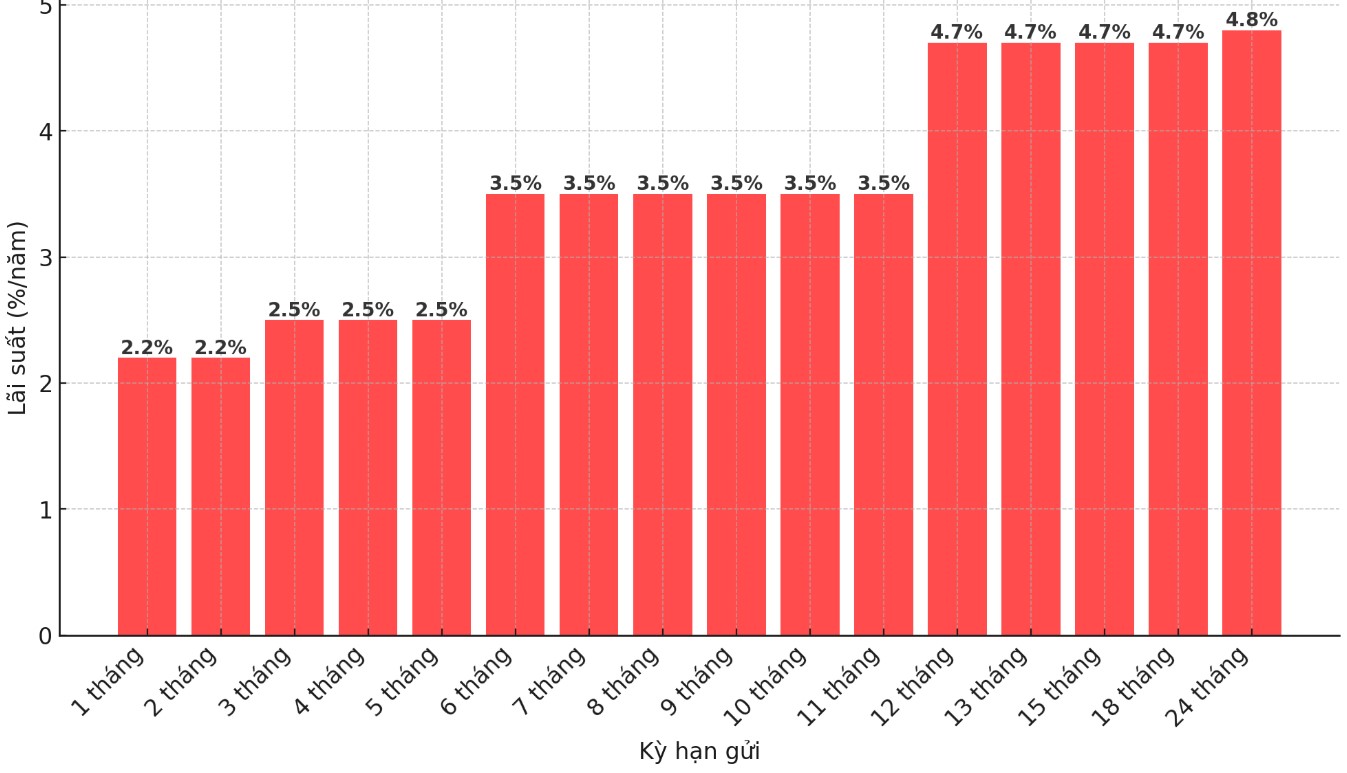

Below is the table of savings interest rates for individual customers at Agribank on February 23, 2025:

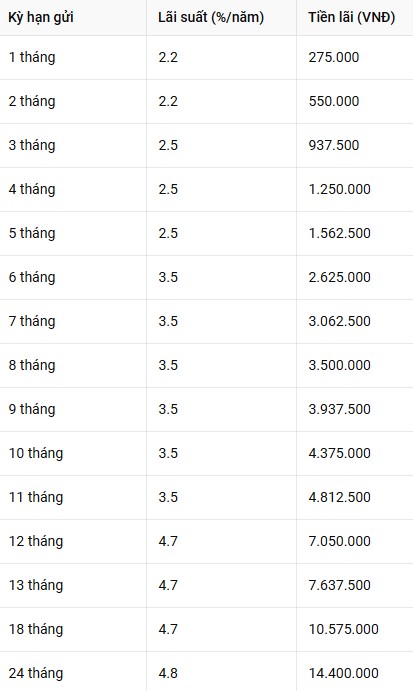

How to receive interest if you deposit 150 million VND at Agribank

Formula for calculating bank deposit interest:

Interest = Deposit x interest rate (%)/12 months x deposit term

With a deposit of 150 million VND at Agribank, customers can receive the following interest:

Note that the above interest amount is calculated according to the interest payment method at the end of the term and is for reference only. For the most detailed and updated information, customers should contact the nearest Agribank branch directly or visit the bank's official website.

Choosing a deposit term depends on your financial needs. If you need flexibility, you should choose a short term such as 1-6 months to easily withdraw money when needed without losing interest. However, short-term interest rates are often lower.

On the contrary, if you have a long-term idle amount and do not plan to use it in the near future, you should choose a long term such as 12-24 months to enjoy a higher interest rate. However, the disadvantage of long terms is that deposits cannot be withdrawn ahead of schedule without affecting interest rates.

Therefore, before deciding, consider between liquidity and profit to make the right choice.

See more news related to interest rates HERE...