Many banks reduce interest rates, long terms lose 6%/year

Following the direction of the Prime Minister and the State Bank of Vietnam (SBV) on stabilizing interest rates, banks continue to adjust deposit interest rates down.

Bac A Bank: Reduced for the second time in the month, the 12-36 month term decreased by 0.2%/year, to only 5.4 - 5.8%/year.

Saigonbank: The 12-36 month term decreased by 0.2%/year, currently the highest rate is only 5.9%/year.

VIB: For the first time after 3 months of interest rate reduction, the entire 1-36 month term decreased by 0.1%/year.

BVBank: Reduced from 0.1 - 0.3%/year for terms of 6 months or more.

KienlongBank: Strongly reduced up to 0.7%/year for long terms, bringing the entire interest rate down to below 6%/year.

Thus, the 6%/year mark has almost disappeared from the market, only remaining in some banks applying to very large deposits.

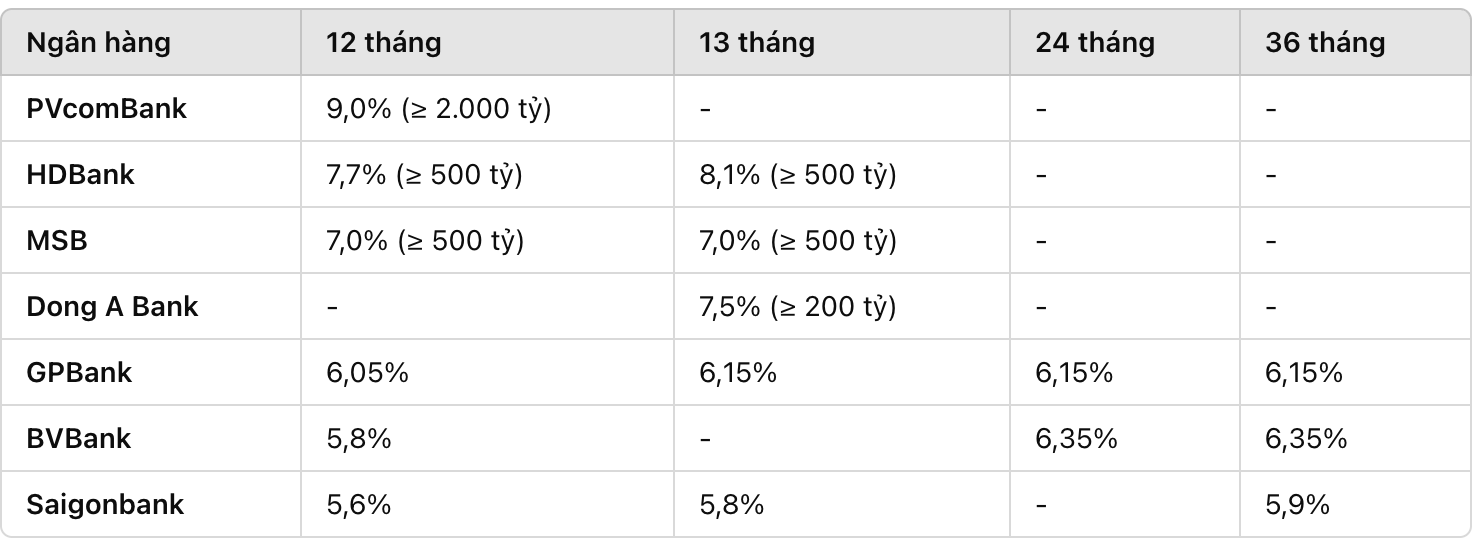

Highest interest rates at banks today

Although interest rates continue to decrease, some banks still maintain levels above 7%/year, but are accompanied by strict conditions.

Interest rate forecast for January 3: Continue to decrease or remain stable?

Associate Professor, Dr. Pham Manh Hung, Deputy Director of the Institute of Banking Research ( banking Academy), commented: "Department interest rates are likely to continue to move sideways or decrease slightly next month. Currently, the difference between deposits and outstanding credit has not yet put great pressure on the banking system, so there is no factor that causes interest rates to increase sharply. The State Bank is also controlling interest rates quite well to support economic growth."

According to Mr. Hung, the group of state-owned commercial banks will continue to maintain stable interest rates, while some private banks can flexibly adjust to attract customers.

In general, the interest rate level is unlikely to increase again in March. In addition to the above reasons, inflation is still controlled, helping the savings channel still attract cash flow, limiting the pressure to increase interest rates.

In addition, other investment channels such as real estate and stocks have not really become attractive again.

According to the forecast, lending interest rates may decrease by 0.2 - 0.5%/year in the coming time, if the deposit interest rate level continues to cool down.