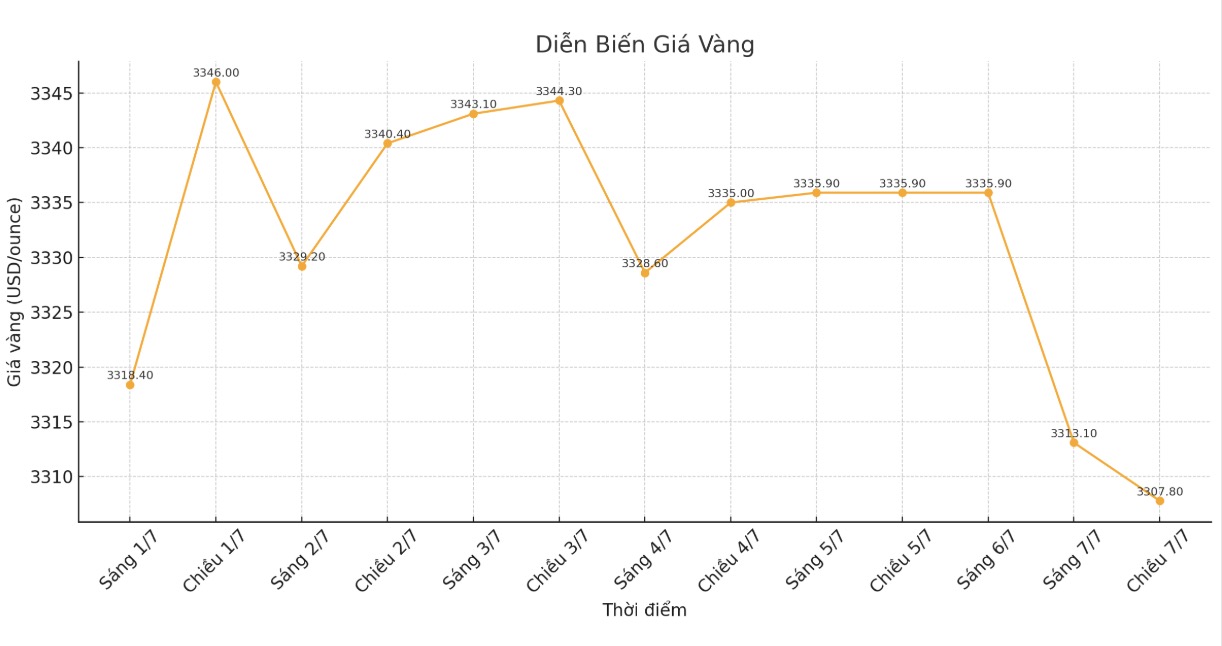

This afternoon (July 7), world gold prices have fallen to a nearly weekly low. The reason for this move is the increase in the USD, in the context that investors are waiting for detailed information about trade before the tax deadline of US President Donald Trump.

Spot gold fell 0.8% to $3,309.09/ounce at 8:45 GMT. US gold futures fell 0.7% to $3,319 an ounce.

Nitesh Shah, commodity strategist at WisdomTree, commented: "We are seeing a slight correction due to the short-term increase of the USD, which could come from the strong US economic data, making the need for immediate interest rate cuts not really urgent."

The USD index rose 0.4% against major currencies, making gold more expensive for buyers holding other foreign currencies.

Last week, data showed surprisingly positive US job growth in June. At the same time, concerns about inflation caused by tariffs have raised expectations that the US Federal Reserve (FED) will slow down the pace of interest rate cuts.

The minutes of the Fed's most recent meeting, scheduled to be released this weekend, could provide further clues on the roadmap for interest rate adjustments.

Meanwhile, Mr. Donald Trump said the US is getting closer to completing some trade deals in the coming days and will notify other countries of higher tariffs before July 9, with the time of application starting from August 1.

In April, Trump announced a basic 10% tax rate for most states and a "way back and forth" tax rate of up to 50%, with an initial deadline of Wednesday this week.

The 9-day period of low tax rates is expiring, and no significant trade agreements have been reached. This shows that net trade may decline this year, which is not good for the economy and will likely support gold prices, Shah added.

Mr. Trump also threatened to impose an additional 10% tax on countries that side with the BRICS' "anti-US policies".

In other precious metals, spot silver fell 0.9% to $3.56/ounce, platinum lost 2.5% to $1,357.25 and palladium fell 2.1% to $1,111.21.

Update on domestic gold prices

Recorded at 16:30, the domestic price of SJC gold bars was adjusted down by some businesses such as DOJI Group, Saigon Jewelry Company SJC, Bao Tin Minh Chau to 118.5-120.5 million VND/tael.

Regarding gold rings, each unit lists a different price. Bao Tin Minh Chau listed the price of gold rings at 115.2-118.2 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

DOJI Group listed the price of gold rings at 115-117 million VND/tael (buy in - sell out). The difference between buying and selling is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.9-116.9 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.