Rich Checkan - Chairman and CEO of Asset Strategies International is one of the experts who gave a positive assessment of gold prices. He stressed that the risk of US public debt is climbing strongly.

Meanwhile, Sean Lusk - co-head of commercial risk prevention at Walsh Trading, expressed a more cautious view in the short term but maintained the view that prices will increase to the medium and long term.

This expert believes that interest rate cuts are not in line with the current context. According to him, normally, only when the economy is weak does it take to reduce interest rates. Meanwhile, the economy is still stable, with stocks at a record high. Inflation has cooled down, food and energy prices have both fallen.

Sean Lusk believes that cutting interest rates at this time could push up living expenses and recreate the inflation problem that the US Federal Reserve (FED) wants to solve. He also pointed out that part of the downward pressure comes from concerns about the real estate market, which is struggling due to high borrowing costs.

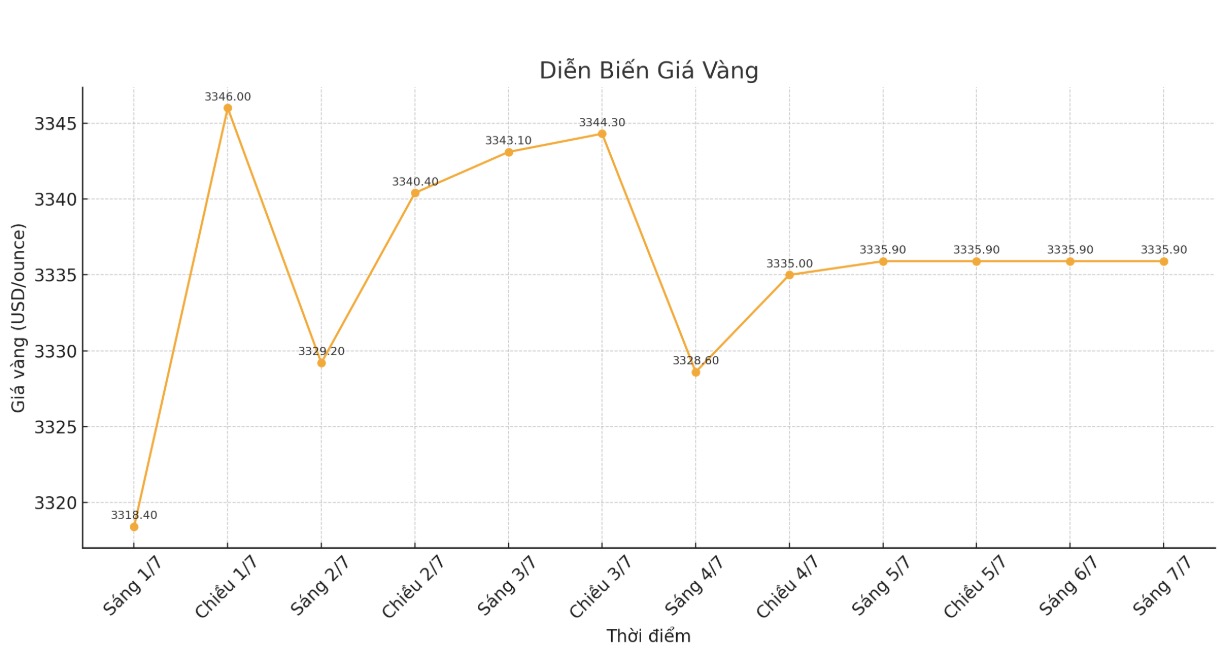

Regarding gold prices, Lusk assessed that the precious metal is being overbought above the threshold of 3,300 USD/ounce and is likely to adjust to the range of 3,123 - 3,225 USD, although the long-term trend is still positive. He predicted that any price decline will be temporary and gold prices will continue to increase in 2025, especially as the market gradually becomes more certain about trade agreements and economic policies.

On the contrary, Adrian Day - Chairman of Adrian Day Asset Management, said that gold prices will face correction pressure. There is a possibility of a series of negative factors appearing together, including a number of tariff agreements and increased speculation about the FED cutting interest rates in July in the context of slowing gold purchases by central and Chinese banks outside the official market. However, any adjustment could be shallow and short-term," he said.

In the neutral group, Colin Cieszynski - Chief Market Strategist at SIA Wealth Management, said that the Fed is in a dilemma. The Fed is stuck. Inflation has fallen, so the Fed should have had space to cut rates. However, the economy is strong, and normally, when the economy is strong, interest rates will increase because inflation tends to increase" - he said.

He warned that interest rate cuts could create a negative signal for the market. According to him, when the FED lowers interest rates, many people will not consider it a sign of a stabilization of the economy, but will consider it an emergency measure only used when the economy falls into recession.

If we cut interest rates aggressively, history shows that the Fed often does it when the economy is in trouble, at that time stocks increase and growth improves, he explained.

However, he stressed that cutting interest rates while the economy remains strong could stimulate a return to inflation, especially when tariffs also put pressure on prices. I think the Fed is still worried about that, not current inflation, but next year's inflation, if tariffs increase costs, or if the Fed cuts too much when the economy is still good, he said.

However, he said that early interest rate cuts do not create a big boost for gold. I dont think it will make a big change. I think people were expecting that, he said.

He emphasized that the decline in the USD is a factor holding gold prices. Euro/USD has increased by 14% over the past six months. The British bang increased by 10%. The yuan increased by 8%. The Canadian dollar and the Australian dollar both rose about 6%. These are huge fluctuations in currency in just six months, but hardly anyone mentioned. Gold is where you see the collapse of the dollar," he said.

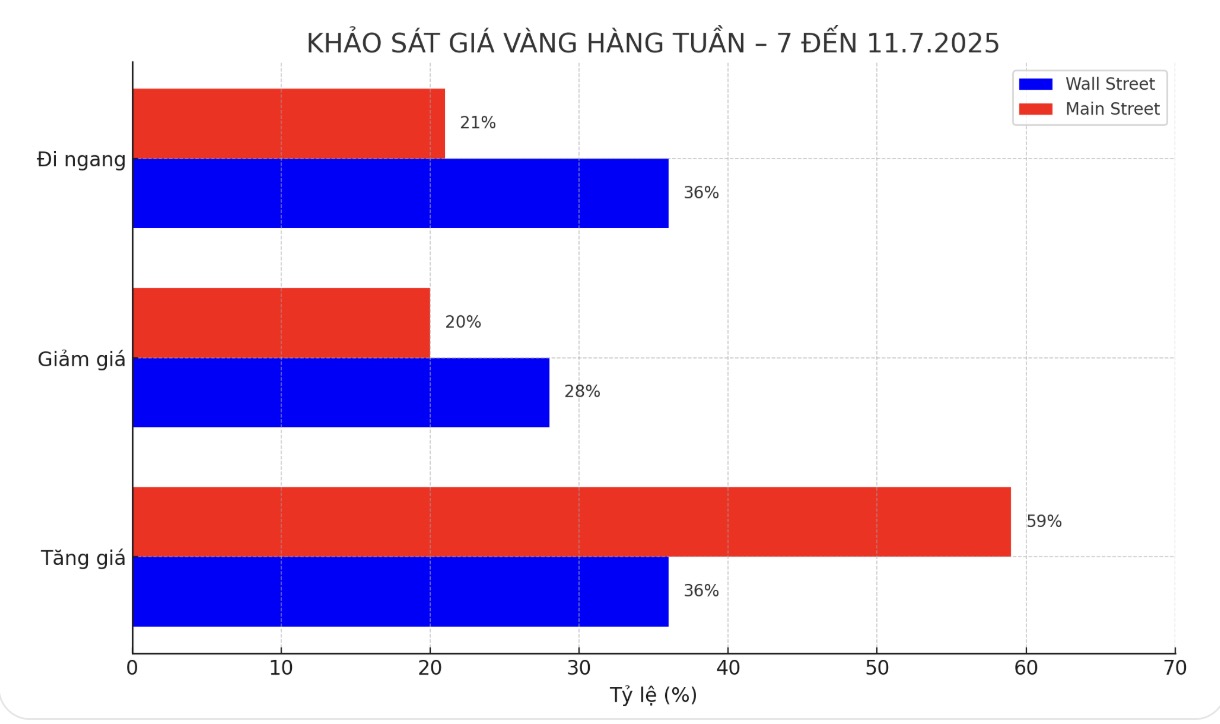

Darin Newsom - Senior market analyst at Barchart.com, also commented that gold will continue to trade sideways. I still see gold as a safe haven asset, especially as the deadline for US tariff restoration approaches.

See more news related to silver prices HERE...