Lukman Otunuga - Senior market analyst at FXTM - said he is standing on the sidelines until gold prices clearly break the resistance or support threshold.

On the graph, if gold breaks out solidly above $4,030/ounce, it could signal a further uptrend, with the 21-day moving average (SMA) at $4,080/ounce and $4,130/ounce being important milestones to watch. Conversely, if prices remain weak below the psychological threshold of $4,000/ounce, gold could be pulled back to the $3,960/ounce and $3,925/ounce regions, Otunuga said.

Fawad Razaqzada - Market Analyst at Forex.com - said he does not have any strong views at the moment as the market is in a tug-of-war situation.

The $3,930/ounce level is the support zone that gold found earlier in the week, so breaking below this threshold will be quite technically important. On the other hand, gold needs to surpass $4,045/ounce to activate technical buying power - this was last week's peak.

In fact, the weakening of the US dollar due to signs of a slowdown in the US labor market (according to Challenger's report) and declining consumer confidence (according to the University of Michigan's report) are all factors supporting gold prices. However, this precious metal is moving in the same direction as the stock market. This is the problem: when stocks are in trouble, gold cannot find new shelter to break above $4,000/ounce, he said.

Meanwhile, Adrian Day - Chairman of Adrian Day Asset Management said that although gold may need more time to consolidate, he remains optimistic in the short term.

The factors that have driven gold prices over the past three years remain unchanged, while the possibility of further instability is present, if the US Supreme Court cancels Donald Trump's tariffs. In fact, the recent adjustment is not deep enough - but new developments can overwhelm the market, he said.

Alex Kuptsikevich - Head of Market Analysis at FxPro, is one of the experts who is pessimistic about gold. He said that investors cannot ignore the losses that the two recent weeks of selling off have caused to the market.

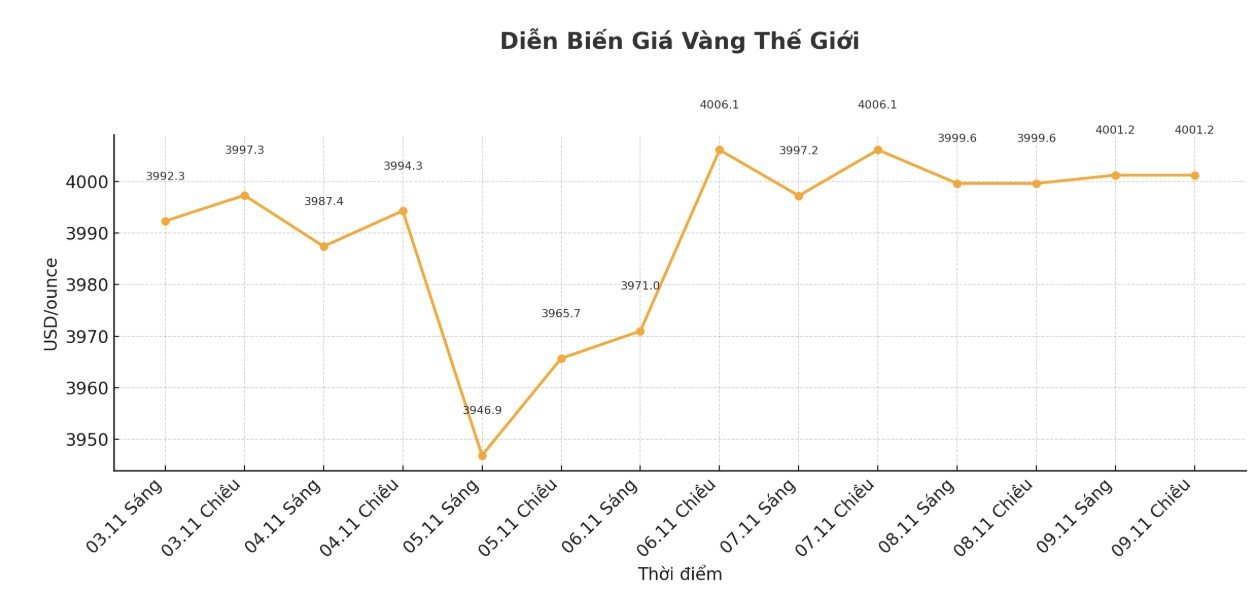

The uptrend has been broken. Gold has stabilized around $4,000/ounce over the past ten days, ending the week at almost the same level as when it opened. Selling efforts to push prices below $3,900/ounce have all encountered strong buying pressure. This supporting factor comes from the fact that the US Supreme Court is reviewing the legality of the US tariffs.

If Donald Trump fails, the tax will have to be refunded, causing a spike in budget deficits and public debt, leading to chaos in the financial market. These concerns are prompting investors to seek safe-haven assets.

However, it all seems to be an attempt to extend an old card game, which can only delay the inevitable. HSBC, Bank of America and Societe Generale still maintain their forecast of gold prices reaching 5,000 USD/ounce. However, golds rally has broken, and selling on the stock is becoming more reasonable.

See more news related to gold prices HERE...