Gold prices rose to a record high on Wednesday, thanks to safe-haven inflows after the US government's official shutdown and weak labor figures, increasing expectations of the US Federal Reserve (FED) cutting interest rates.

On October 1, the US government officially closed after the Senate rejected a temporary spending bill, opening a budget crisis that would have caused the government to close for the 15th time since 1981, according to the US Treasury Department.

The reason comes from the long-standing disagreement between Republicans and Democrats in approving a $1.7 trillion budget package to maintain the operations of federal agencies.

Democrats opposed the bill because Republicans did not accept the additional provision to extend health benefits for millions of Americans. Meanwhile, the Republican side believes that this issue needs to be addressed separately. The disagreement has forced about 750,000 federal employees to temporarily take time off work, causing an estimated $400 million in losses each day. The closure also slowed down job reports, slowed down aviation operations, stopped many scientific studies and delayed payments to US soldiers.

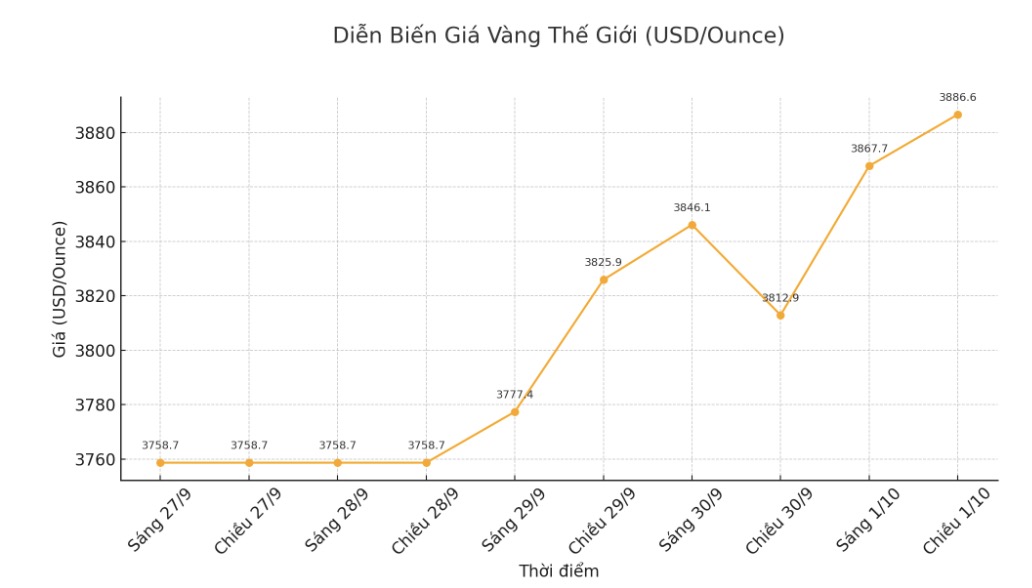

At 6:13 GMT (ie 13,13 USD on October 1 - Vietnam time), the US December gold futures increased by 0.4% to 3,887.4 USD/ounce.

The US dollar index (.DXY) fell to its lowest level in more than a week, making gold priced in greenback more attractive to international buyers. Wall Street futures contract decreased.

Nicholas Frappell - global director of organizational markets at ABC Refinery - said: "Gold is benefiting from concerns about a weakening USD, the tense political situation related to the US government's closure, as well as general geopolitical instability".

He said the outlook remains positive, with gold likely heading towards $3,900/ounce, possibly even $4,000/ounce.

The US government has been largely shut down due to deep disagreements between the Congress and the White House on the budget, opening up the risk of a prolonged deadlock that could put thousands of federal employees out of work.

The closure could also delay the release of key economic data, including the non-farm payrolls report on Friday.

The JOLTS report released on Tuesday showed that the number of recruitment positions in the US only increased slightly in August, while recruitment decreased. Traders are now predicting the Fed will cut interest rates by 25 basis points this month and again in December.

The ADP jobs report will be released later in the day, which is expected to bring further signals to the labor market.

According to Michael Hsueh - precious metals analyst at Deutsche Bank - risks that could curb gold's increase include the USD reversing to increase prices, a surprisingly strong FED policy, and fiscal reform in the US.

Gold is considered a safe haven in the context of economic and political instability, and benefits from a low interest rate environment due to no interest. Since the beginning of the year, gold has increased by more than 47%.

Meanwhile, markets in China - the world's largest gold consumer - are still closed for the Mid-Autumn Festival holiday and will reopen on October 9.

In India, gold imports from August to September have almost doubled. Over the past few weeks, banks and gold shops have been rushing to clear large amounts of gold, an unnamed Indian government official told Reuters. Its been a long time since weve seen such a bustling scene.

In other developments, spot silver prices rose nearly 0.5% to $46.90 an ounce, reaching their highest level in more than 14 years. platinum prices fell 0.7% to $1,563.50, while palladium fell 0.9% to $1,245.43.