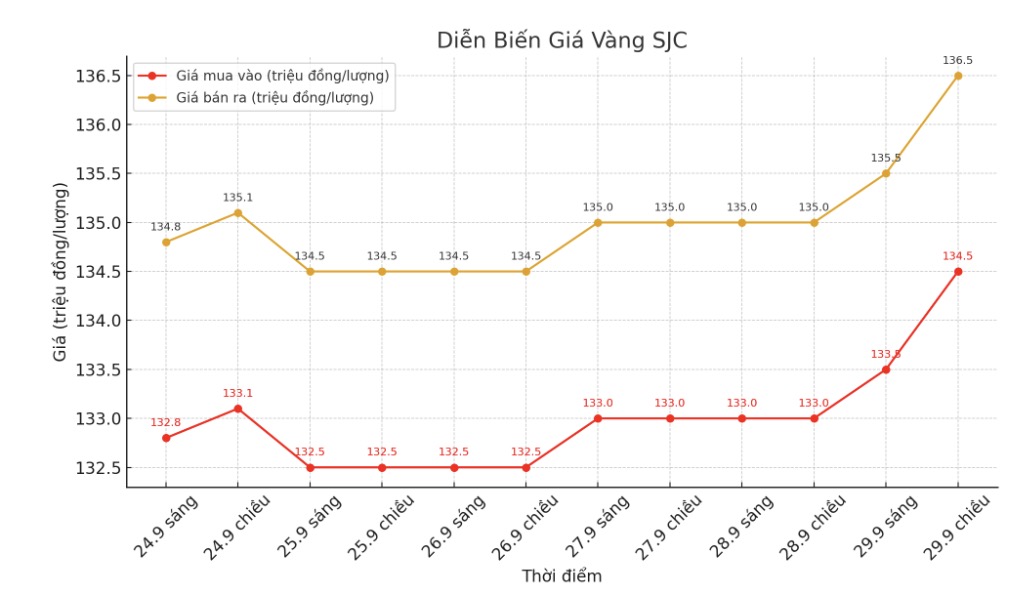

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 135.3-137.3 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions compared to a day before. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 134.8-136.8 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions compared to a day ago. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 133.3-136.8 million VND/tael (buy - sell), down 700,000 VND/tael for buying and up 300,000 VND/tael for selling compared to a day ago. The difference between buying and selling prices is at 3.5 million VND/tael.

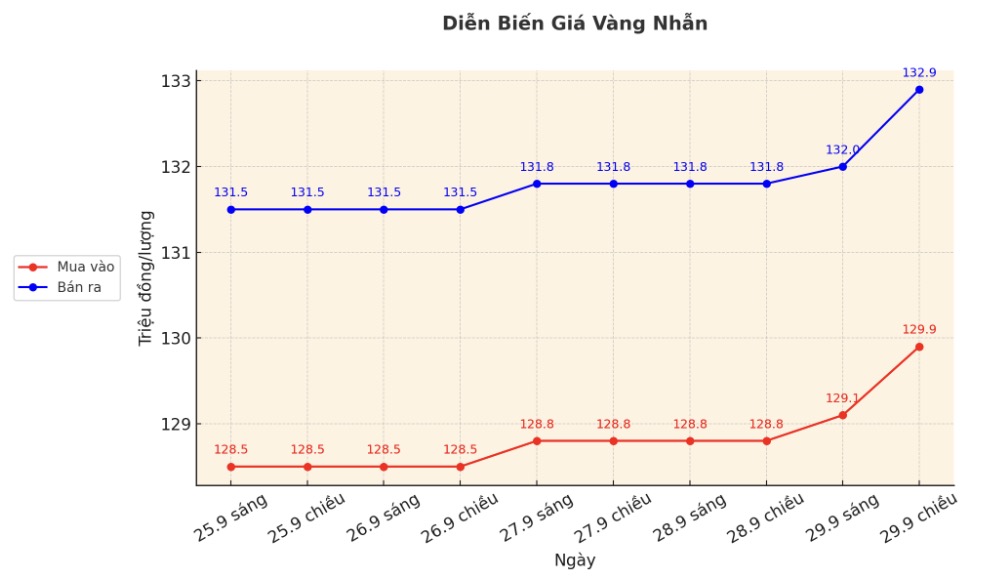

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 131-134 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both directions compared to a day before. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 131.4-134.4 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

Phu Quy listed the price of gold rings at 130.6-133.6 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions compared to a day ago. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

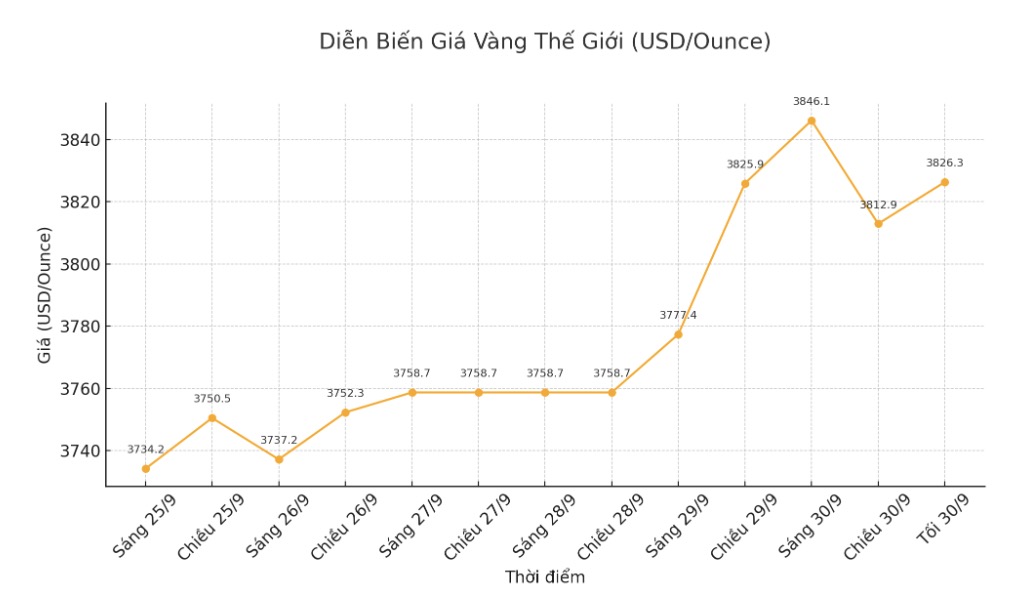

World gold price

The world gold price was listed at 9:00 p.m. at 3,826.3 USD/ounce, down 3.7 USD.

Gold price forecast

World gold prices recorded a deep correction on the afternoon of September 30, mainly due to short-term profit-taking activities from speculators.

The profit-taking move comes after gold set a record and silver hit a 14-year peak on Monday, according to Jim Wyckoff, senior analyst at Kitco.

However, the precious metal's decline was limited by concerns about the risk of the US government having to close due to deep disagreements between the Democrats and the Republicans.

Since the beginning of the year, gold has benefited from low interest rates and the context of economic and geopolitical instability. Many securities companies also raised their gold price prospects. The world's largest gold ETF SPDR Gold Trust said its holdings increased by 0.89% to 1,005.72 tons last weekend.

" spending on official buying and capital flows into ETFs plays a key role in gold's strength, while demand for jewelry and recycled supply are factors that hold back," notes Deutsche Bank.

Independent analyst Ross Norman said that silver and platinum are driven by increased industrial activity thanks to lower interest rates and higher storage demand as countries want to ensure supply amid uncertainty in the global supply chain.

Notable economic data this week

Wednesday: ADP Private sector Employment Report (US), ISM Manufacturing PMI.

Thursday: Application for weekly unemployment benefits (US).

Friday: US Non-farm Payrolls, ISM Services PMI.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...