The profit-taking move comes after gold set a record and silver hit a 14-year peak on Monday, according to Jim Wyckoff, senior analyst at Kitco.

However, the precious metal's decline was limited by concerns about the risk of the US government having to close due to deep disagreements between the Democrats and the Republicans.

Republicans have introduced a bill to "continue spending" until November 21 but do not include health benefits already associated with the Obamacare program. Meanwhile, the Democrats strongly opposed, considering this a move to eliminate essential social security policies for millions of people.

Republican leader in the Senate, John Thune, blamed the Democrats for not cooperating to keep the government running. In contrast, Sen. Chu Chu Schumer and Representative Hakeem Jeffries accused Trump of trying to paralyze the government for political advantage. Vice President J.D. Vance also admitted: "We are moving straight to a government shutdown."

International organizations and financial markets are closely following the developments. Some analysts warn that if the US government shuts down, confidence in government bonds could decline, while economic growth is under threat. Even the ability to repay public debt - an issue that caused great controversy at the beginning of the year - could return to the agenda.

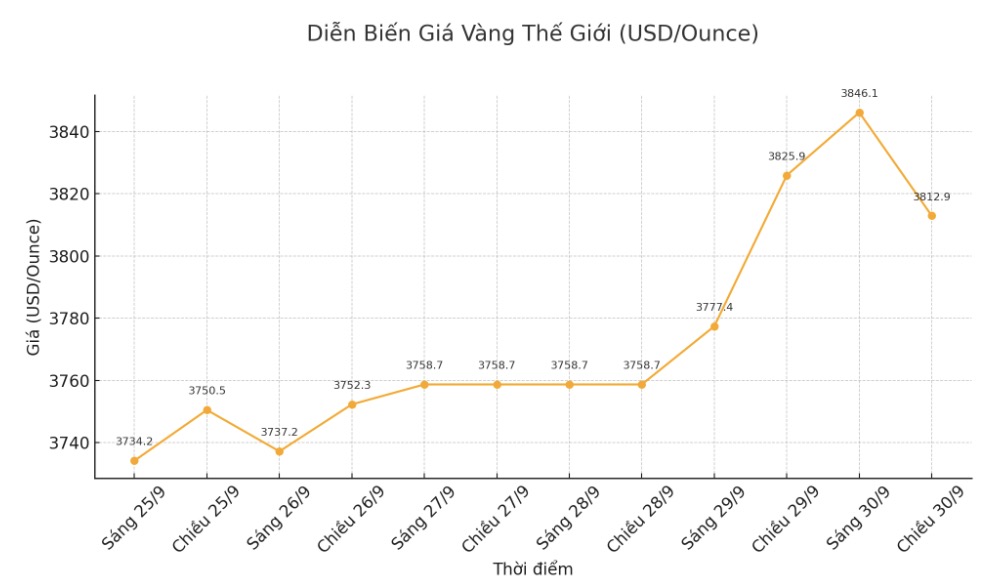

December gold contract is currently down 12.4 USD to 3,842 USD/ounce. December silver contract decreased by 0.631 USD to 46.75 USD/ounce.

Global stocks fluctuated in different directions last night. The US stock index is expected to open down when the New York session begins. Today is also the last trading day of the month and quarter, so it has a special technical significance.

Technically, December gold delivery contracts are still in a strong uptrend in the short term. The next upside target for buyers is to close above the resistance zone of $4,000/ounce. The short-term goal of the sellers is to push the price below the solid support zone of 3,700 USD/ounce.

The first resistance level was at 3,875 USD/ounce, followed by this week's peak of 3,899.2 USD/ounce. First support was at an all-night low of $3,820,600, then $3,800/ounce.

In outside markets, the USD index decreased slightly, crude oil fell to around 63 USD/barrel, and the yield on the 10-year US Treasury note was 4.13%.

See more news related to gold prices HERE...