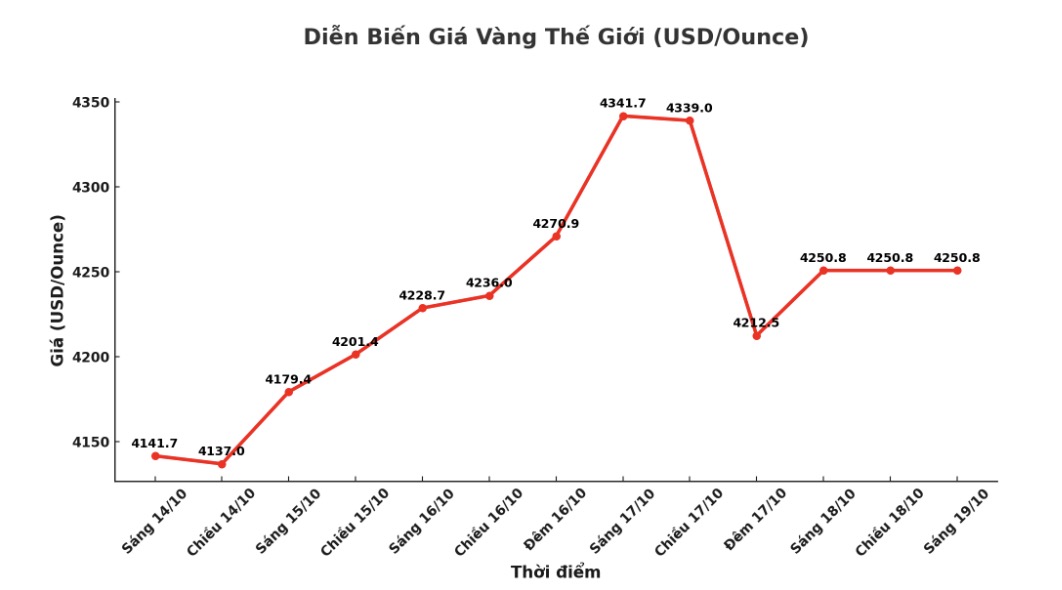

Mr. Michael Moor - founder of Moor Analytics - commented that gold prices may decrease this week. According to him, the short-term trend of gold is leaning down, unless prices recover and return to the important support zone in short-term technical analysis. He said that many technical price points are currently showing that selling pressure is getting stronger.

Meanwhile, Jim Wyckoff - senior analyst at Kitco - predicted that gold prices will " decrease slightly or go sideways". He said the market needs a technical adjustment after the recent strong increase.

Mr. Adrian Day - Chairman of Adrian Day Asset Management - said that gold prices may move sideways: "After strong increases in the past week and month, the market may fluctuate slightly. I do not expect any sharp decline, as the factors driving gold demand over the past three years remain intact. A short break to consolidate is not a bad thing, and it does not change the long-term trend.

Mr. Bob Haberkorn - senior commodity broker at RJO Futures - said that the gold sell-off last Friday actually originated from the silver market.

I think this is a phenomenon of weak hands being eliminated from the market, he said. It all started with silver. Gold was fine at the time, but the increase in deposits on the CME and Shanghai exchanges triggered a sell-off, which saw gold fall as a result.

He emphasized: Basically, there is no change other than increasing deposits.

However, Mr. Haberkorn said that the market's reaction to the increase in deposit this time shows that this is a different price increase compared to previous cycles. When the exchange rate increases its deposit level sharply in the past two and three weeks - this is completely reasonable because the price increases, the fluctuations are also higher - usually the market will decrease for a few days. But this time, each decrease was quickly bought up. This is the strongest correction since the beginning of the cycle.

It will be interesting to see how the market responds this afternoon, especially as physical demand for gold remains strong, he added. The current spot price is about 2 USD higher than the futures contract. CME platforms need to pay attention when this difference is prolonged, because that can make many people request to receive real goods. Supply in London and Shanghai is low, and that is something to be concerned about. But basically, there is no change.

Mr. Haberkorn said that commodity traders have long memories and feel the difference in this price increase cycle.

The difference is that this rally is starting with central bank buying, he said. They dont buy gold to keep it short-term. They will not sell just because the price is down $45 today. On the contrary, this is an opportunity for them to buy more - and in fact we have seen many customers increase their buying position".

Although the market fell sharply in the session last Friday, Mr. Haberkorn did not expect the selling pressure to last until next week. I think prices will rise again next week, he said. "There are people waiting for the opportunity to buy more, there are people who have not had time to participate and will jump in. Gold is flooding the media, and many people don't even know if they will buy it today if prices drop."

He said gold's next target is $4,500 an ounce: "I believe that is the direction the price is heading. Currently, the gold - silver market is like a match, and buyers are in the lead. The resistance levels were all easily broken, prices increased rapidly and strongly".

Todays decline is not the end of the rally, but an opportunity to accumulate more, he stressed. The central bank does not buy gold to surf. If it were a cycle like 2011 or 2008 - started by individual investors and short-term speculators - they might have withdrawn. But this time it's different. This increase has a solid foundation because it is led by central banks.