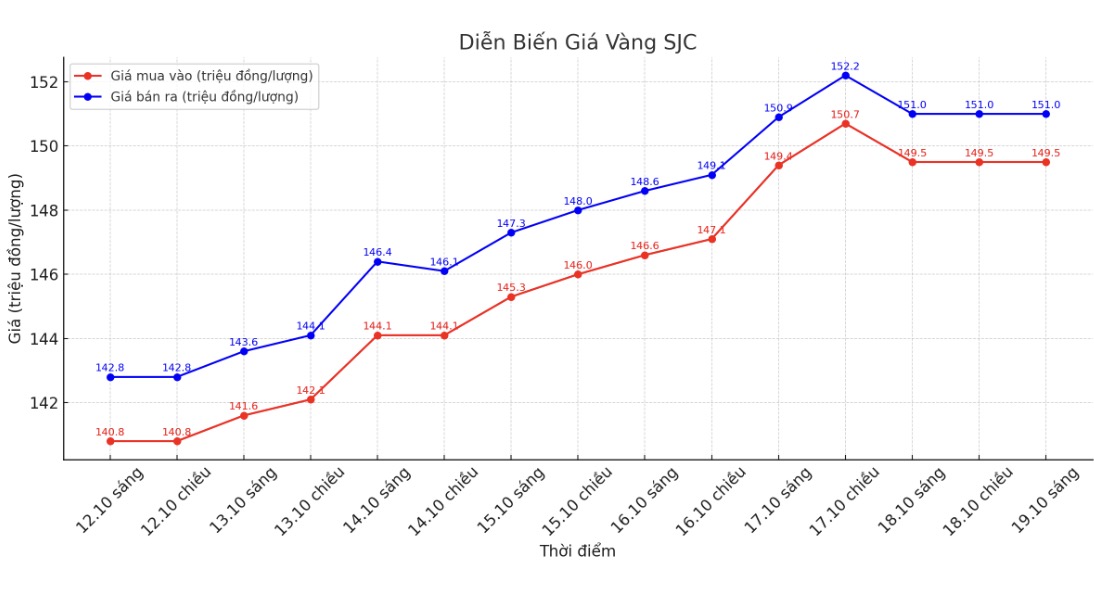

As of 1:00 p.m. on October 19 (Vietnam time), Saigon Jewelry Company SJC listed the price of SJC gold bars at 149.5-151 million VND/tael (buy in - sell out). Compared to last weekend (October 12, 2025), the price of SJC gold bars increased sharply by 8.7 million VND/tael for buying and 8.2 million VND/tael for selling. The difference between the buying and selling prices of SJC gold at this unit remains at 1.5 million VND/tael.

Meanwhile, at Bao Tin Minh Chau, the price of SJC gold bars was listed at 150.5-151 million VND/tael (buy - sell), up 9.7 and 8.2 million VND/tael respectively compared to last week. The difference between buying and selling prices is kept low, at only 500,000 VND/tael.

If investors buy SJC gold on October 12 and sell it today (October 19), the profit achieved is 6.7 million VND/tael at SJC and 7.7 million VND/tael at Bao Tin Minh Chau.

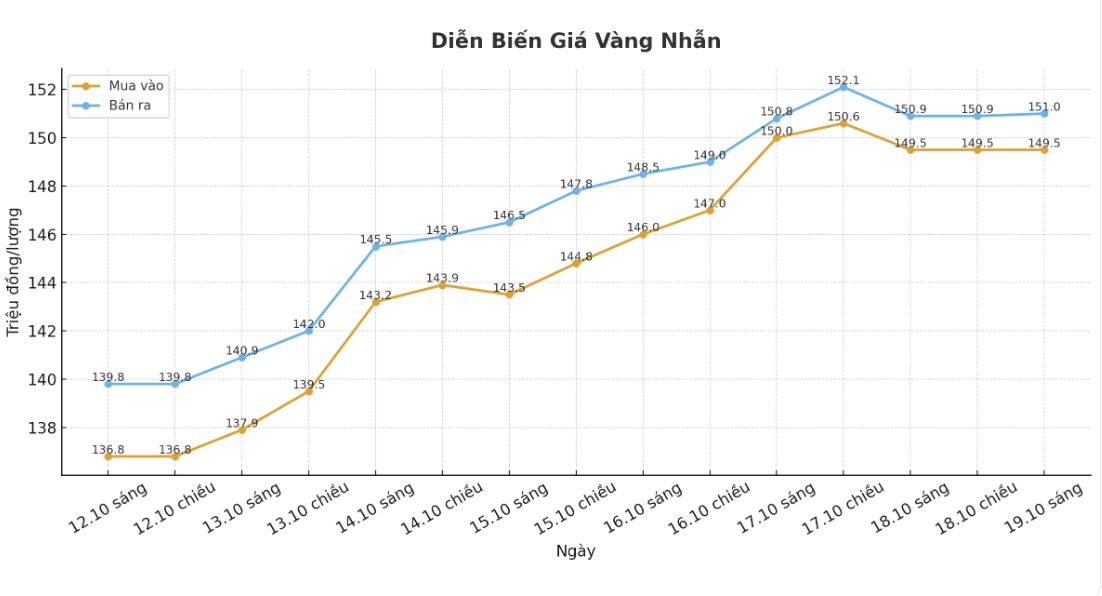

On the gold ring market, Bao Tin Minh Chau listed the price of 9999 gold at 155.5-158.5 million VND/tael (buy - sell), an increase of 17.1 million VND/tael in both directions after just one week. The difference between buying and selling gold rings remains at 3 million VND/tael.

Phu Quy Group also adjusted the price of gold rings to 148-151 million VND/tael, an increase of 10.7 million VND/tael in both directions compared to October 12. The difference between buying and selling is at 3 million VND/tael.

If buying gold rings last week and selling today, buyers at Bao Tin Minh Chau will make a profit of up to 14.1 million VND/tael, while the profit in Phu Quy will reach 7.7 million VND/tael.

Thus, in just one week, domestic gold prices recorded a strong increase, up to more than 17 million VND. Subtracting the difference between buying and selling listed by business units, investors can still make a profit of up to 14 million VND/tael.

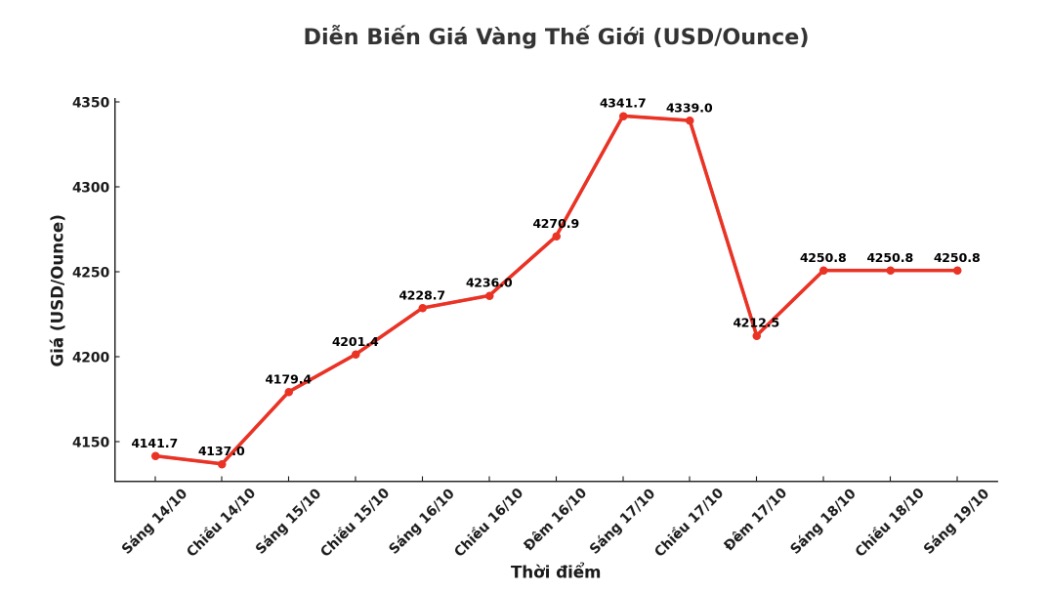

The increase in domestic gold is partly due to the impact of the world market. Despite a sharp decline on Friday, world gold still recorded an increase of up to 234.4 USD/ounce last week. Recorded at 1:00 p.m., the world gold price was listed at 4,250.8 USD/ounce.

Although domestic gold prices broke out strongly last week, the buy-sell gap remains high, causing investors to face the risk of losses if prices reverse in the short term. With a common difference of 1.5-3 million VND/tael, just a slight decrease in price, buyers can suffer heavy losses.

In the world market, gold prices have just ended a 9-week consecutive increase streak - the longest increase streak in many years. However, experts say that it is very difficult to extend to the 10th week when the increase shows signs of slowing down, especially after the sharp decline last weekend.

Mr. Alex Kuptsikevich - senior analyst at FxPro said that after more than two consecutive months of increase, gold prices are likely to decrease next week.

"Investors have lost faith in bonds and currency, looking to precious metals. But gold has been rising for nine consecutive weeks something that has only happened five times since the 1970s, he said.

According to the latest survey from an international financial information platform, the Western mentality this week has clearly differentiated. Although the number of people forecasting an increase is still the majority, the proportion has decreased compared to some previous weeks. Of the 15 analysts participating, 9 people (60%) predict gold prices will increase next week, 4 people (27%) think prices will decrease and 2 people (13%) predict prices will go sideways.

In the context of strong fluctuations and high differences in gold prices, experts recommend that investors be cautious, avoid the "fomo" mentality - fear of missing opportunities, especially when the market can adjust at any time after a long increase.

See more news related to gold prices HERE...