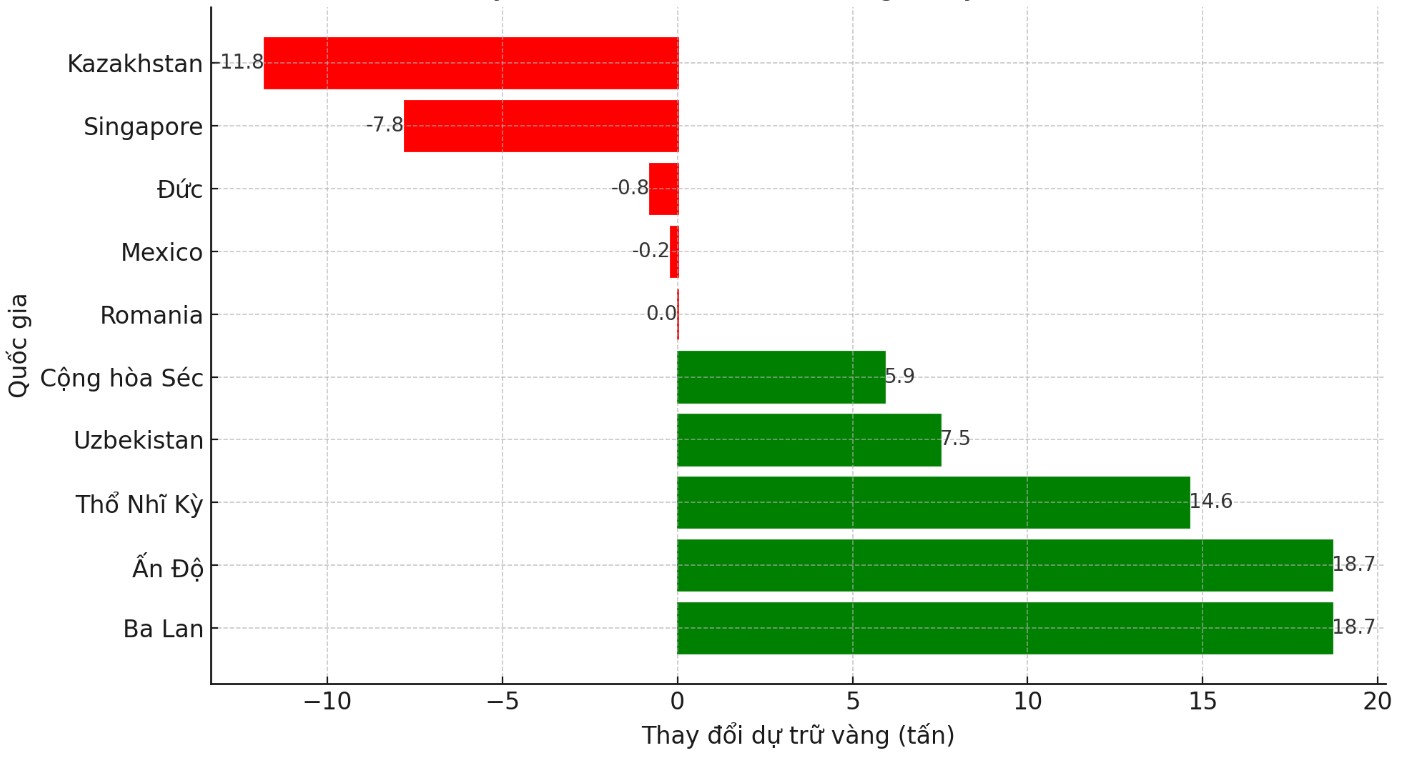

With 100 tonnes of gold purchased in 2024, Poland's central bank has become the largest buyer of gold at the national level. However, the country is not alone.

While much of the attention this year has focused on China’s massive central bank gold purchases, followed by a pause as gold prices hit record highs, Eastern European countries have quietly emerged as the biggest buyers of gold, and are seen as a major driver behind the gold rally.

“We need to reduce volatility,” Ales Michl, governor of the Czech Central Bank, told Bloomberg earlier this month after visiting the country’s gold vault in London. “And to do that, we need an asset that is not correlated with stocks, and that is gold.”

Ales Michl has set a goal of doubling the Czech Republic's gold reserves, currently at 100 tonnes, within the next three years. Since taking office in 2022, he has increased the country's gold reserves fivefold.

“Central banks around the world are hoarding gold as a hedge against external shocks, such as potential trade wars under President-elect Donald Trump or geopolitical tensions in Ukraine and the Middle East,” Bloomberg reported.

However, Eastern European countries have been particularly active in increasing their gold reserves, with Poland being the largest buyer of gold among central banks worldwide in the second quarter of 2024. The country borders Ukraine, is a NATO member and is one of Kyiv's strongest allies against Russia.

Adam Glapinski, governor of Poland's central bank, has said that gold and foreign exchange reserves are an important safeguard for the country's economy. Under his leadership, Poland has increased its gold reserves to about 420 tonnes by the end of September, about half the total reserves of India or Japan.

“We are joining the exclusive club of the world's largest gold-owning countries,” Glapinski said at a press conference in October, highlighting the goal of increasing the share of gold in total reserves to 20%.

The Czech Republic is also ramping up its gold purchases. “The central bank in Prague holds around $150 billion in foreign exchange reserves – almost half of its GDP – one of the largest in the world,” the report said.

The Central Bank of Hungary has increased its gold holdings by more than 10%, reaching 110 tonnes by 2024.

Meanwhile, Serbian President Aleksandar Vucic repatriated the country's foreign gold reserves in 2021. This year, he pledged to buy gold with "all the surplus money" remaining in the state treasury to "ensure safety and stability in difficult times."

The Governor of the Central Bank of Serbia - Jorgovanka Tabakovic - has also overseen a tripling of the country's gold reserves to 48 tonnes since taking office in 2012.

“Gold increases in value and importance during times of global uncertainty, especially geopolitical conflicts and periods of high inflation. Unfortunately, both of these factors have been present in recent years,” Tabakovic said.