Wall Street analysts are optimistic that a new rally could be taking shape. The key factor next week will be the US August employment report, data that can decide the roadmap for interest rate cuts by the US Federal Reserve (FED).

Darin Newsom - senior analyst at Barchart.com - affirmed: "The spot gold index is in a quiet position to set a new record high monthly closing price. That is clearly not a negative thing.

Adrian Day - Chairman of Adrian Day Asset Management - was more cautious: I predict the market will continue to fluctuate within the range seen since April. With gold prices at the peak of the range, there is a strong possibility of a retreat next week. But that is only a small, short-term adjustment. I don't think there will be any deep declines before gold really breaks out. Basically, I think gold will be almost unchanged next week.

On the more positive note, Rich Checkan - Chairman and COO of Asset Strategies International said that gold's rally has not stopped: "The market is almost certain that the Open Market Committee (FOMC) will cut interest rates at the September meeting - with up to 87% expectation for this. Therefore, I believe that gold prices will continue to increase.

According to him, although prices have surpassed the psychological threshold of 3,400 USD/ounce - which often triggers profit-taking, the increase is still maintained thanks to the context of tense politics. The war between US President Donald Trump and Fed Governor Lisa Cook will cause investors to continue to abandon the USD, looking to gold as a safe haven. And that happens as soon as investors return to the market after the summer vacation.

Mark Leibovit - founder of VR Metals/Resource Letter - emphasized that gold stocks are the most attractive investment channel at the moment: "Stock is where to focus".

Independent analyst Jesse Colombo - founder of BubbleBubble Report - went into the technical aspect. He compared the gold price situation to "a spring that has been suppressed since the beginning of April", now unleashing.

There was no special catalyst for this dance. I think the main reason is simply the end of summer, the return of transaction cash flow, especially after the upcoming US Labor Day holiday.

Colombo said gold has gone through five months of accumulation and is no longer overbought, so the current technical foundation is ready for a new uptrend.

Colombo noted that buying from Western ETFs will be an important driver in the final period of the year - unlike 2024 when the increase will be mainly due to Asian investors and central banks.

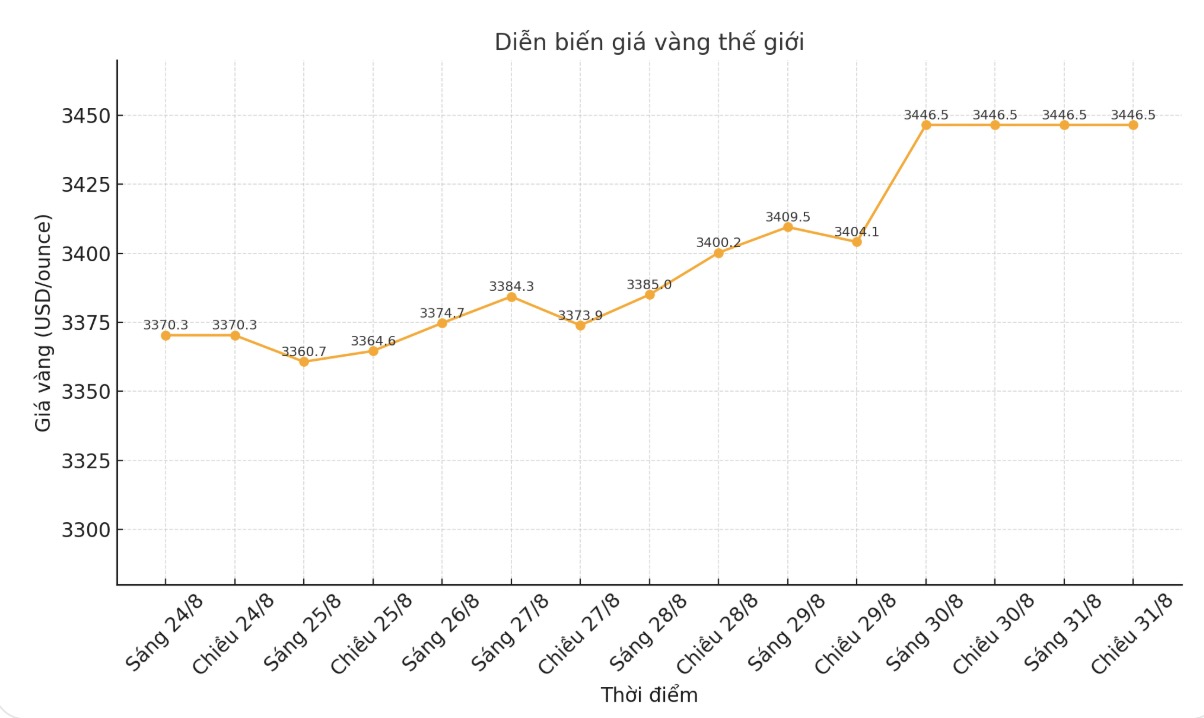

Marc Chandler - CEO of Bannockburn Global Forex acknowledged: Attacks aimed at the independence of the Fed, combined with the ability to report on unsatisfactory jobs, will be a supporting factor for gold. The precious metal had two strong rallies last week, surpassing $3,400 an ounce and then moving sideways before the weekend. The next target is the July peak around $3,439/ounce and then the June peak at $3,451/ounce.

Jim Wyckoff - senior analyst at Kitco predicted: "Technical charts are increasingly supporting the uptrend. US monetary policy is also gradually easing. I expect gold prices to continue to move up steadily next week.

See more news related to gold prices HERE...