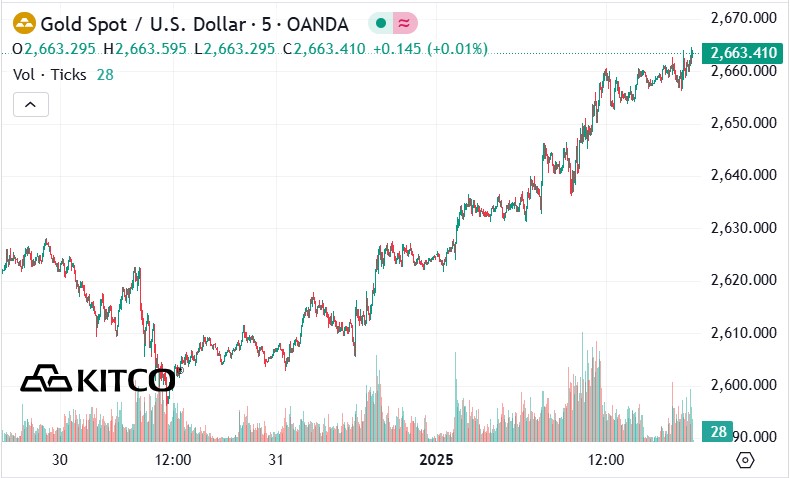

Gold futures entered 2025 on a strong note, hitting a two-week high as the February contract rose $32.10, or 1.22 percent, to settle at $2,671.20. That followed a $19.30 gain on Tuesday, bringing the total gain to more than $50 from a low of $2,608 on Monday, Dec. 30.

According to Kitco, the recent gains appear to be largely driven by market uncertainty surrounding Donald Trump's upcoming economic policies and the possibility of reimposing additional tariffs.

According to Trading Economics (an online platform that provides economic, financial and market data globally), “the rally has been fueled by loose US monetary policy, record buying from central banks and persistent geopolitical tensions, including Russia’s drone attacks on Kyiv on Wednesday and Israel’s military action in Gaza.”

Gold has shown remarkable strength over the past year, rising around 27% – its strongest one-year gain since 2010. The fundamentals that have fueled this impressive rally remain firmly rooted in current market sentiment, suggesting further upside potential.

The World Gold Council (WGC) believes that steady buying from central banks globally continues to support current gold prices and could maintain upward pressure.

Several factors support a bullish outlook for gold in 2025. Prolonged geopolitical tensions in Ukraine and the Middle East, combined with continued central bank accumulation of gold reserves, provide a solid foundation. Additionally, uncertainty surrounding economic policy changes and tariffs proposed by President-elect Donald Trump could continue to provide bullish momentum, pushing gold to new record highs.

However, recent statements from US Federal Reserve officials, including Chairman Jerome Powell, have struck a cautious note, with Powell highlighting new inflation risks that could reduce gold’s appeal as a non-yielding asset.

The Fed's latest Summary of Economic Projections (SEP) showed a significant adjustment in expectations for rate cuts this year, down from four 25 basis point cuts to two, totaling a half-percentage point reduction in the federal funds rate.

The CME FedWatch Tool currently shows an 88.8% chance that the Fed will maintain the current rate range of 4.25% to 4.50% at the January FOMC meeting. For March, the probability of maintaining the current rate is 47.9%, while the May outlook shows a 38.5% chance. The tool shows a 47.1% chance that the Fed will cut rates to a range of 4% to 4.25% by May 2025.

It is worth mentioning that gold's performance this week has been impressive, especially as the USD index has increased by more than 1% this week, opening at 107.707 on Monday and currently fixed at 109.044.

See more news related to gold prices HERE...