According to the World Gold Council (WGC), the Chinese gold market has just recorded one of the strongest months ever. However, investment demand may stagnate as US-China trade tensions ease.

Ray Jia - Head of China Market Research at WGC - said that global gold prices continued to increase in April and this was clearly reflected in the domestic market.

Our model shows a weakening USD, geopolitical instability and strong capital flows into gold ETFs are the main factors driving gold prices up.

Gold prices according to the LBMA ( London Silver Market Association) standard in USD have increased the most in April since 2011, while the price of gold traded in Shanghai (SHAUPM) in the yuan recorded the highest increase in 19 years, he said.

Meanwhile, gold prices according to the LBMA standard increased by 27%. The main difference comes from the fact that the yuan has increased by 1% so far in 2025.

The demand for wholesale gold also continues to recover. The industry has withdrawn 153 tonnes of gold from the Shanghai Gold Exchange (SGE), up 27% from the previous month and 17% from the same period last year, said Mr. Jia.

Domestic gold prices have a large difference, averaging $37/ounce in April significantly higher than the $2/ounce in March.

Two key factors driving strong demand growth are investor purchasing power still high, with gold considered an outstanding asset in the context of trade tensions and jewelry companies hoarding goods for the Labor International holiday in early May, after the unusually low demand for gold in the first quarter.

However, the focus of April was capital flowing into gold ETFs in China, with a record increase. Total assets of gold ETFs in this country increased by 49 billion yuan ($6.8 billion), bringing total assets to 158 billion yuan ($22 billion), up 57% for the month. Gold holdings by these funds also increased by 65 tons, to a record 203 tons.

This unprecedented attraction comes from strong performance of domestic gold prices, concerns about trade wars and falling domestic bond yields due to expectations of monetary policy easing, said Mr. Jia.

In the first 4 months of the year, total assets and holdings of Chinese gold ETFs increased by 125% and 77%, respectively.

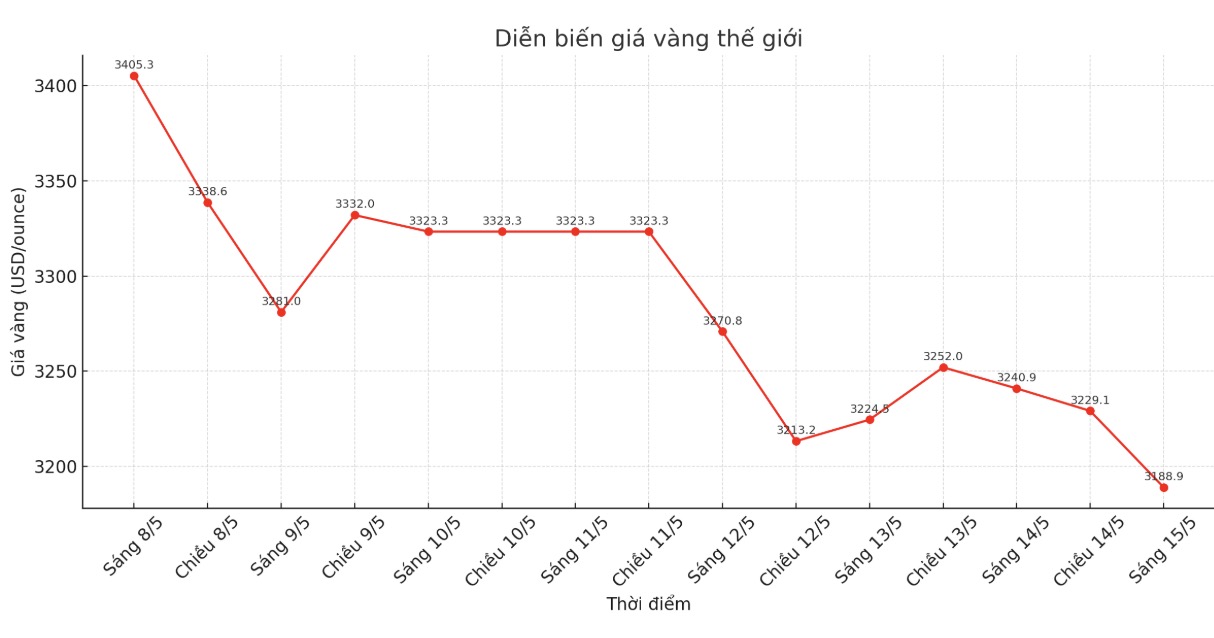

Although investment through ETFs continued strong in May, the increase slowed down. Investors seem to have fully reflected previous trade risks, which are cooling down after the trade talks in Geneva. Domestic gold prices have also stabilized, said Mr. Jia.

Gold futures trading on the Shanghai Commodity Exchange (SHFE) also increased dramatically in April. The average daily trading volume reached a record of 859 tons, double the previous month. In the first 5 sessions of May, the average volume remained high, about 756 tons/day, showing that investors were still interested in gold, although prices have been adjusted.

The People's Bank of China (PBoC) also contributed to demand as it continued its gold buying streak for the 6th consecutive month. In April, China added 2.2 tonnes of gold, bringing its total reserves to 2,295 tonnes, equivalent to 6.8% of total national reserve assets.

The value of gold reserves increased by 6% for the month, to 243.6 billion USD. Since the beginning of the year, the PBoC has announced the purchase of a total of 14.9 tons of gold.

In contrast, gold imports remained gloomy. China net imported only 46 tons of gold in March up slightly from the previous month but still much lower than the same period last year. 183 tons. Total imports in the first quarter reached 73 tons, the lowest since 2021, when China was still limited by COVID-19.

The main reason is the weak demand for gold jewelry in the first quarter, causing domestic gold prices to sometimes shift to a discount compared to the international level, reducing import momentum.

The WGC forecasts that demand for gold jewelry in China will remain weak in the coming time as it is entering the low season, although the recent price adjustment may create a supporting force.

In the long term, demand for gold investment in China is still expected to remain positive thanks to outstanding performance, prolonged global economic and political risks and the trend of asset allocation of organizations such as insurance companies.