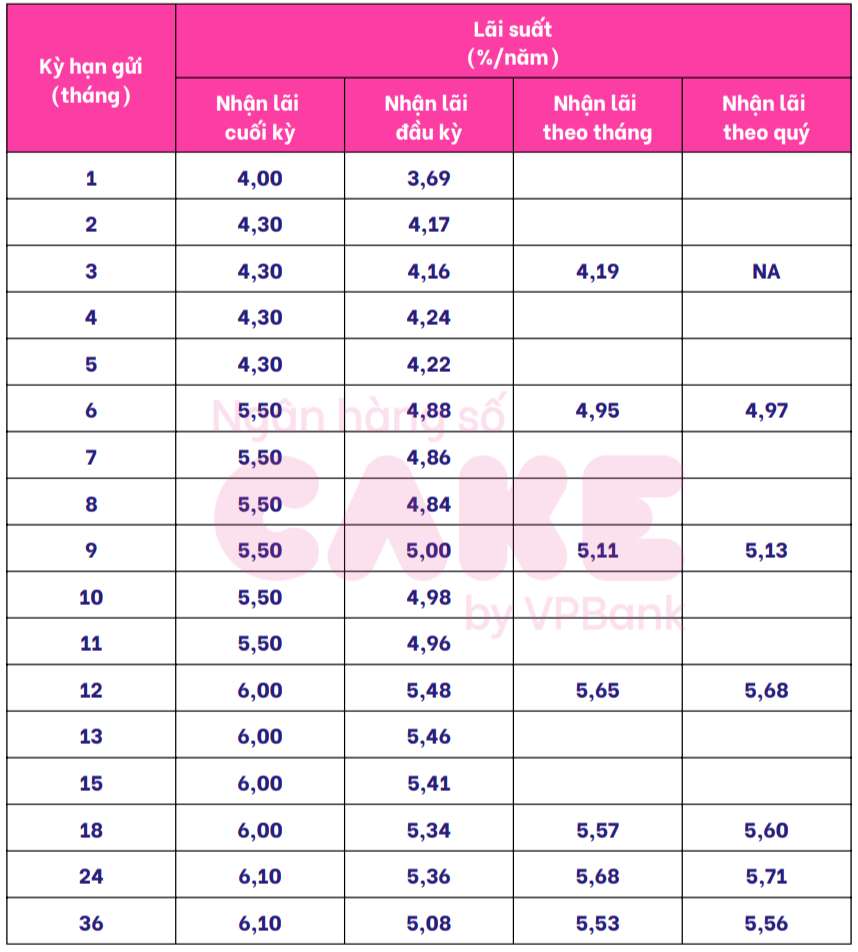

Cake by VPBank is listing the highest interest rate for a 12-month term at 6%/year when customers receive interest at the end of the term. Customers receiving interest monthly and quarterly receive interest rates of 5.65% and 5.68%, respectively. The highest interest rate listed by Cake by VPBank is 6.1% when customers deposit for 24 - 36 months.

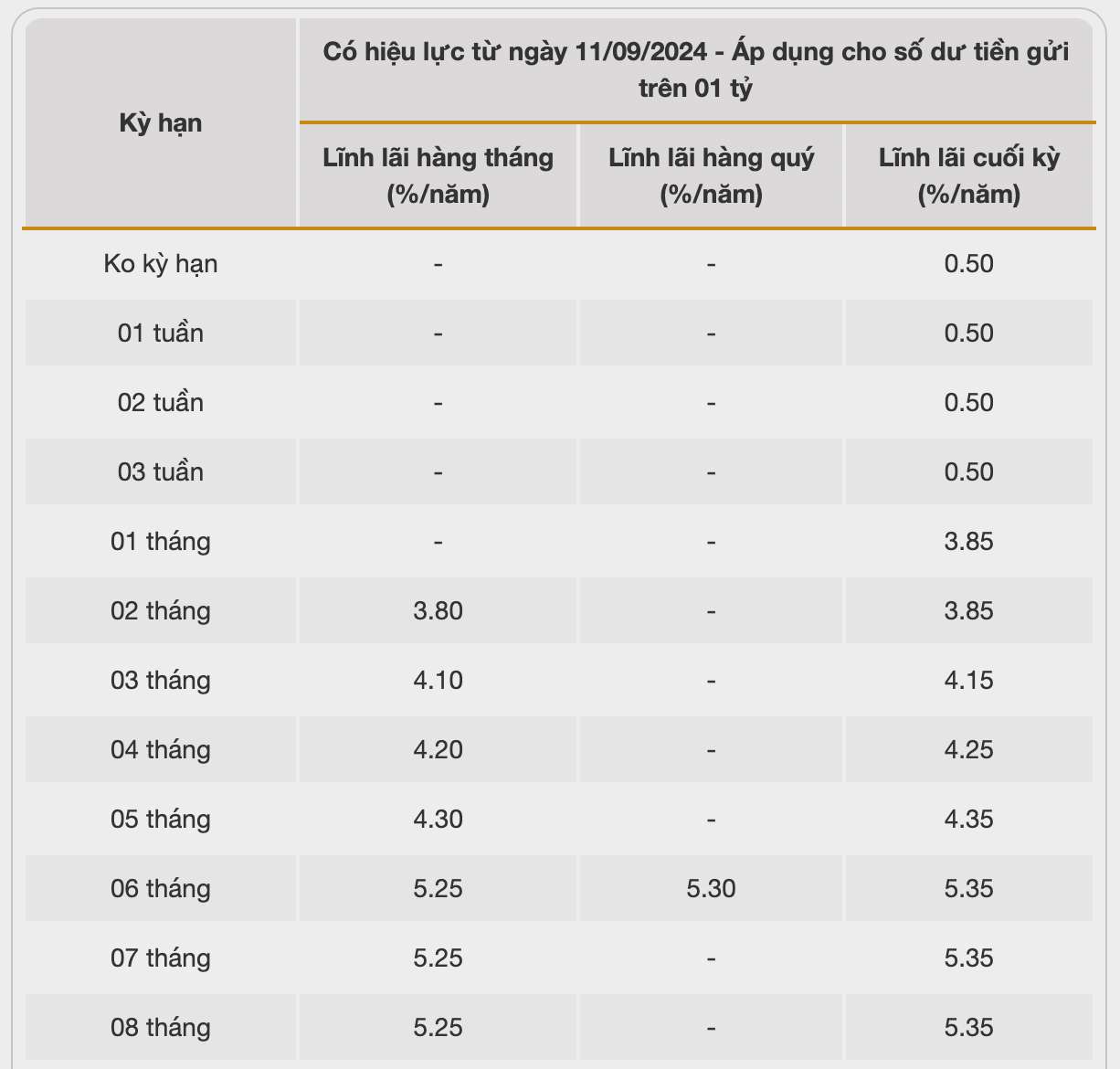

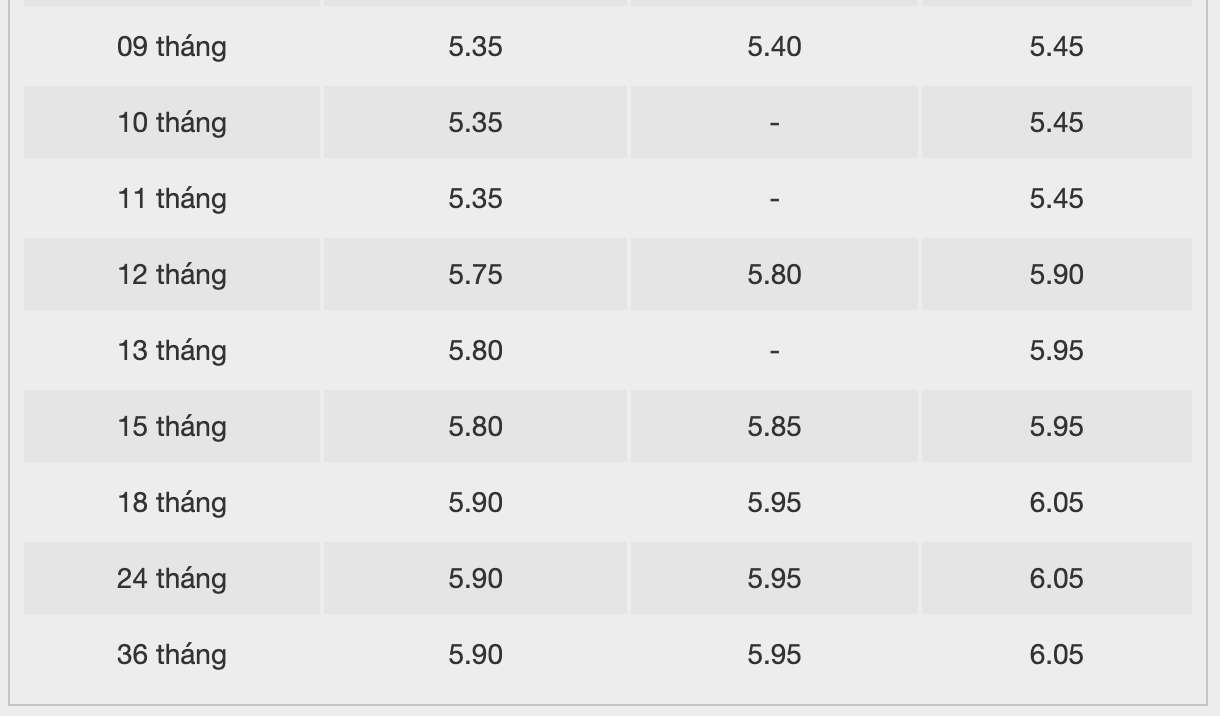

BacABank is listing the highest interest rate for a 12-month term at 5.9%/year when customers receive interest at the end of the term. Customers receiving interest in advance, monthly and quarterly will receive interest rates of 5.75% and 5.8%/year, respectively.

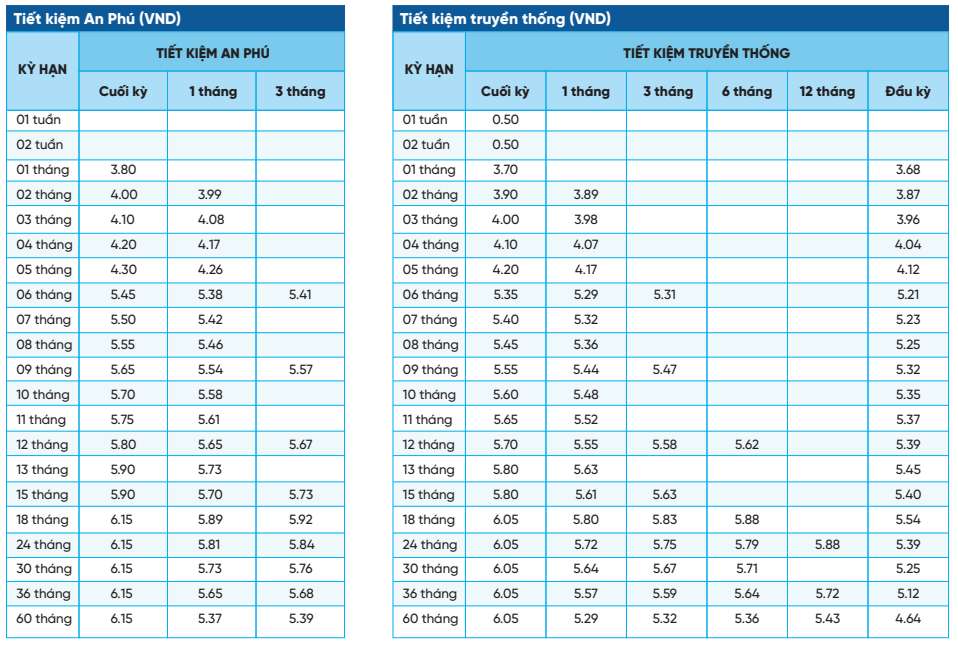

NCB is listing the highest interest rate for a 12-month term at 5.8%/year when customers deposit savings at An Phu, receiving interest at the end of the term. Customers depositing traditional savings receive the highest interest rate at 5.7%/year.

How much interest do you receive if you save 700 million VND for 12 months?

You can refer to the interest calculation method to know how much interest you will receive after saving. To calculate interest, you can apply the formula:

Interest = deposit x interest rate %/12 x number of months of deposit.

For example, you deposit 700 million VND in Bank A, term 12 months and enjoy interest rate 6%/year, the interest received is as follows:

700 million VND x 6%/12 x 12 = 42 million VND.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more information about interest rates HERE.