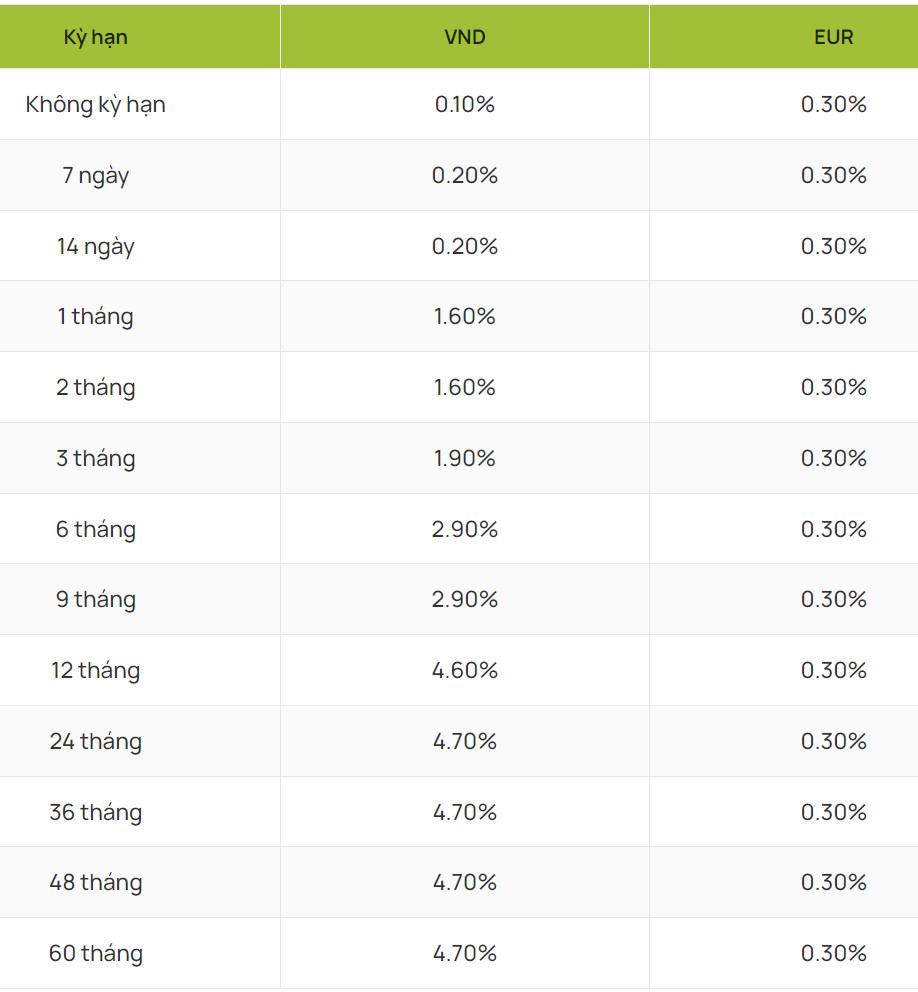

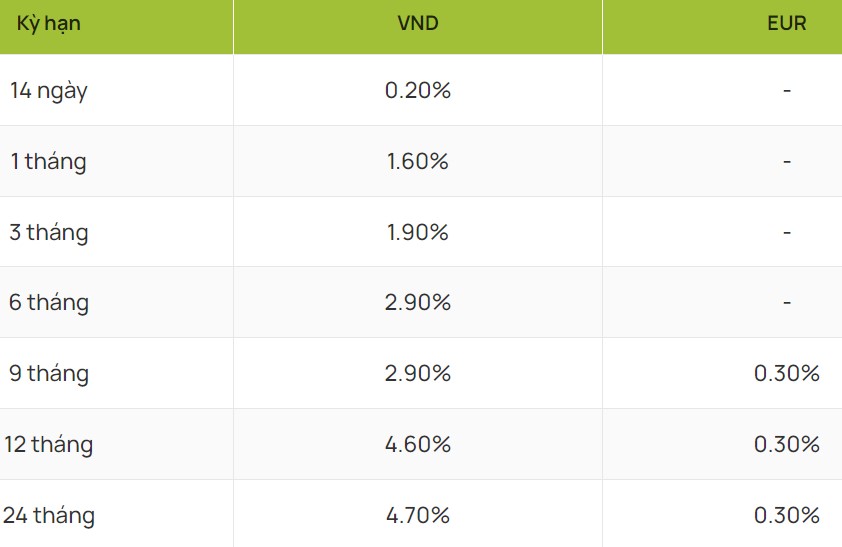

Full set of current Vietcombank interest rates

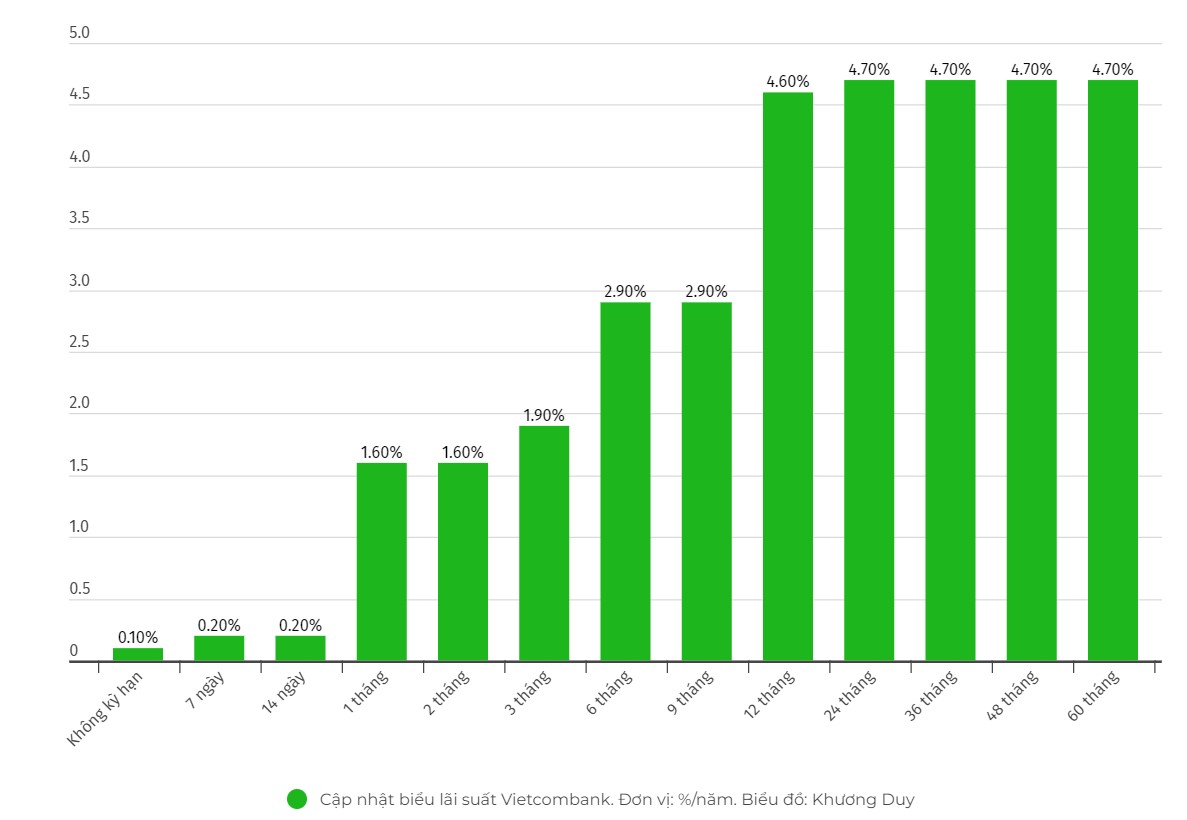

Savings interest rates at Vietcombank currently fluctuate around 1.6 - 4.7%.

Of which, Vietcombank listed interest rates for 24-month, 36-month, 48-month and 60-month deposits at 4.7%.

The interest rate for 12-month deposits is lower at 4.6%. Meanwhile, for 6-month and 9-month deposits, Vietcombank's interest rate is 2.9%.

3-month deposit term, lower interest rate at 1.9% and 1-month, 2-month term interest rate is 1.6%.

Currently, Vietcombank's lowest non-term interest rate is 0.1%.

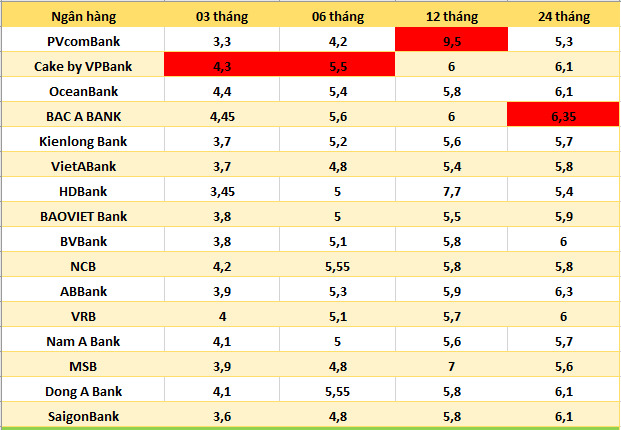

In addition, readers can update interest rates of other banks through the table below:

In the market, the interest rate of many banks listed exceeds 7%/year. However, to receive this interest rate, special conditions must be met.

PVcomBank is currently leading in special interest rates when customers deposit money at the counter, with 9.5% for a term of 12-13 months. However, the condition to receive this interest rate is that customers must have a minimum deposit balance of VND 2,000 billion.

Next is HDBank with a particularly high interest rate, up to 8.1%/year for a 13-month term and 7.7% for a 12-month term, with a minimum balance of VND500 billion. This bank also applies a 6% interest rate for an 18-month term.

MSB applies interest rates for deposits at the counter up to 8%/year for a 13-month term and 7% for a 12-month term. The applicable conditions are that the savings book is newly opened or the savings book is opened from January 1, 2018, automatically renewed with a term of 12 months, 13 months and the deposit amount is from 500 billion VND.

Dong A Bank has a deposit interest rate of 13 months or more, with the final interest rate applied to deposits of 200 billion VND or more at 7.5%/year. This bank also applies an interest rate of 6.1% for a 24-month term.

Bac A Bank applies an interest rate of 6.35% for a 24-month term, applicable to deposits over 1 billion VND. In addition, an interest rate of over 6%/year is also being listed by some banks for long-term deposits but without a minimum deposit requirement.

Currently, Cake by VPBank applies an interest rate of 6.1% for a 12-month term; OceanBank applies an interest rate of 6.1% for a 24-month term; ABBank applies an interest rate of 6.3% for a 24-month term.

BVBank and Cake by VPBank also apply an interest rate of 6% for 24-month and 12-month terms; VRB and Dong A Bank apply an interest rate of 6% for 24-month terms; SaigonBank applies an interest rate of 6% for 13, 18 and 24-month terms, and 6.1% for 36-month terms.

How to receive interest if saving 150 million VND at Vietcombank?

Formula for calculating bank deposit interest:

Interest = Deposit x interest rate (%)/12 months x deposit term.

For example, you deposit 150 million VND in Vietcombank, depending on the deposit term with different interest rates, the interest you receive is as follows:

+ 3-month term: 712,500 VND.

+ 6-month term: 2,175 million VND.

+ 9-month term: 3,2625 million VND.

+ 12-month term: 6.9 million VND.

+ 24-month term: 14.1 million VND.

+ 36-month term: 21.15 million VND.

+ 48-month term: 28.2 million VND.

+ 60-month term: 35.25 million VND.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.