Central exchange rate of VND/USD

This morning (October 23), the State Bank of Vietnam announced that the central exchange rate remained unchanged, currently at VND 25,099/USD.

With an margin of plus/ minus 5%, commercial banks today are allowed to trade USD in the range of VND 23,895 - VND 26,303/USD.

At the State Bank of Vietnam Transaction Office, the reference exchange rate today is as follows:

Buy in: VND 23,895/USD.

Selling: VND 26,303/USD.

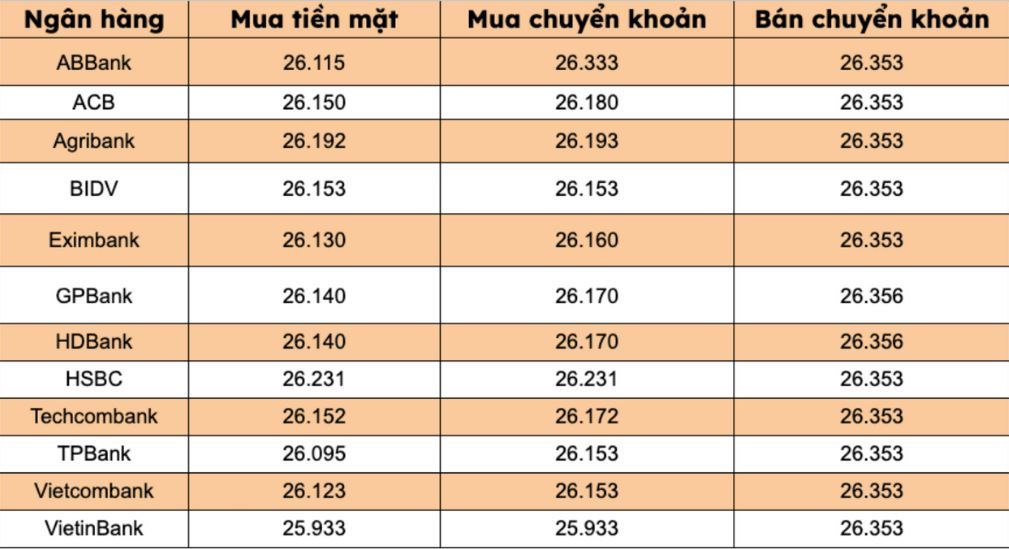

Domestic bank USD and black market USD increase

At most commercial banks, the USD price today increased sharply in the buying direction, decreasing in the selling direction. On the contrary, the black market USD price moved in a bearish trend, fluctuating between 27,263 - 27,383 VND/USD (buy - sell), all increasing by 97 VND/USD compared to the previous session's close.

Banks listed USD selling prices at VND26,353/USD (down VND3/USD).

The bank with the highest cash and transfer price is HSBC (26,231 VND/USD, up 12 VND/USD).

The difference between buying and selling prices at banks ranges from 122-420 VND/USD.

Yen exchange rate against USD

At the time of the survey, the Yen exchange rate against the USD was currently trading at 151.95 USD/JPY, continuing to increase slightly. Meanwhile, in the free market, this pair of exchanges is trading between 177.08 - 178.28 USD/JPY (buy - sell), up and down in opposite directions compared to the previous session's close.

Assessment and forecast

According to Reuters, ECB Chief Economist Philip Lane said that on October 21, banks in the Eurozone could be under pressure if the USD capital source - the lifeline of the financial market - is interrupted, in the context of concerns about Mr. Trump's policies.

Concerns about a shortage of USD liquidity have appeared in the minds of central banks since Mr. Trump imposed trade tariffs and put pressure on the US Federal Reserve (Fed) earlier this year.

The Japanese Yen fell to its lowest level in a week after hardline conservative politician Sanae Takaichi was elected Prime Minister of Japan, as traders bet that her government could make interest rate prospects unpredictable and boost fiscal spending.

Takaichi, Japan's first female prime minister and leader of the ruling Liberal Democratic Party (LDP), won the House of Representatives vote on Tuesday to become head of the government. The move was anticipated by investors after she received support from the right-wing opposition party Ishin.

Mr. Volkmar Baur - foreign exchange and commodity analyst at Commerzbank - commented: "We believe that inflation and purchasing power of households will still be a key issue for the new government to maintain public support. Therefore, the new government may not support jobs to weaken the Yen," he added.