USD Index

On November 21, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies increased by 0.13%, returning to 100.26 points.

Minutes from the Fed's October meeting showed a divide among policymakers, with many members ruled out a rate cut in December, while some said a rate cut was likely.

This division highlights uncertainty about the US economic outlook and has led traders to reduce expectations of a short-term policy easing.

At the October meeting, some FOMC members opposed the decision to cut rates, and many were expected to keep rates unchanged in December, said analysts at ING in a report. This confirms that Mr. Powell's hawkish press conference represents the views of a significant part of the Committee".

In addition, the change in the schedule for issuing economic data after the federal government shutdown is also a factor that is not favorable for interest rate cuts next month.

The September jobs report is expected to be released in the next session, and is expected to show a job growth rate of 50,000. However, this report is now a few months outdated and may be ignored because it is no longer updated.

The November jobs report and the October salary table estimate (without unemployment data) will be released on December 16, after the Fed's meeting, which is scheduled to end on December 10.

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on November 21, the State Bank announced that Vietnam's central exchange rate decreased by 2 VND, currently at 25,130 VND.

The reference USD exchange rate at the State Bank's Buying - Selling Transaction Office is currently at: 23,924 VND - 26,336 VND, down 2 VND.

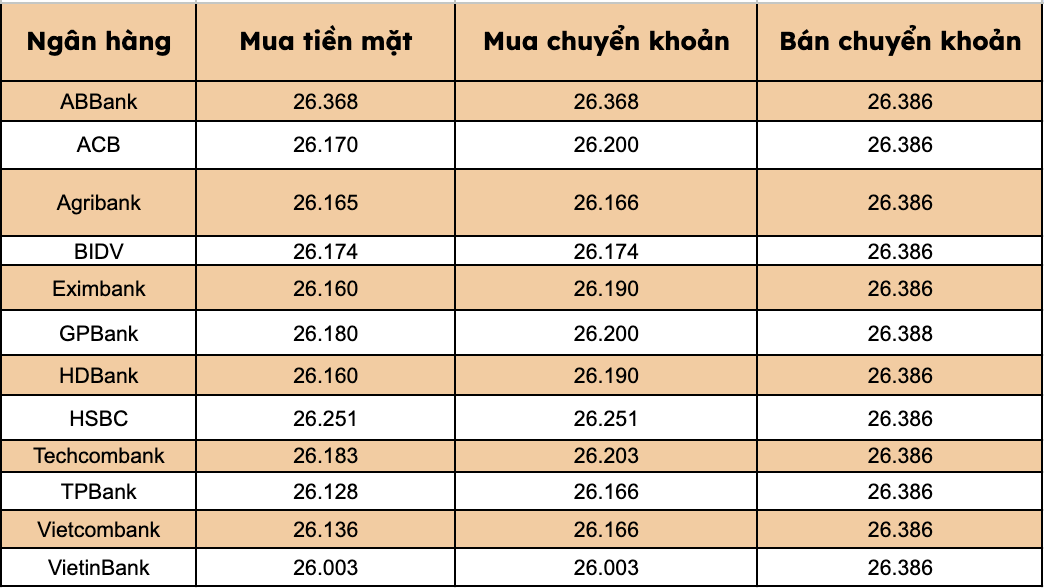

At commercial banks, USD prices have fluctuated.

Most banks listed USD selling prices at VND26,386/USD, down VND2/USD.

Bank with the highest cash and bank transfer price: ABBank (26,368 VND/USD, up 2 VND/USD).

The difference between buying and selling prices at banks ranges within a large range of 18-383 VND/USD.