USD Index

On November 18, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies increased by 0.17%, reaching 99.47 points.

Investors are increasingly confident that the US Federal Reserve (FED) is unlikely to have the ability to ease policy in the short term, a change conveyed by some Fed policymakers, who emphasized that inflation remains persistent and labor market conditions are not clearly weak.

Market sentiment has been further affected by the recent lack of data due to the US government's shutdown, leaving investors without key macroeconomic indicators for weeks.

The government shutdown has delayed reports from the Bureau of Labor Statistics, including the September non-farm payrolls report, due out on Thursday.

This week, the USD is likely to enter an accumulation phase, while any positive economic data released could be a catalyst to help the currency recover.

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on November 18, the State Bank announced that Vietnam's central exchange rate decreased by 2 VND, currently at 25,120 VND.

The reference USD exchange rate at the State Bank's Buying - Selling Transaction Office is currently at: VND 23,914 - VND 26,326.

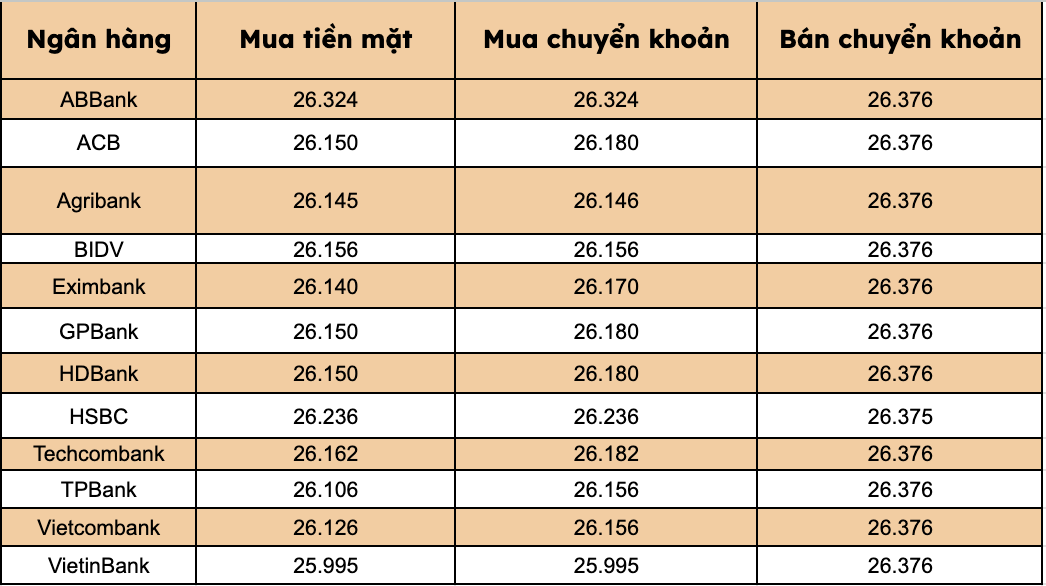

At commercial banks, USD prices have increased and decreased in different directions.

Most banks listed USD selling prices at VND26,376/USD.

Bank with the highest cash and bank transfer price: ABBank (26,324 VND/USD).

The difference between buying and selling prices at banks ranges from 52-381 VND/USD.