USD Index

On November 20, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies increased by 0.41%, returning to 100 points.

The USD returned to the high price race when it was 100.36 points away from the peak on November 5. The price increase is also maintaining a slight increase compared to the Yen after reaching the highest level in more than 9 months. At the same time, the USD increased against the EUR as investors were concerned about Japan's fiscal stance and waited for data from the US to find a signal for the next step of the US Federal Reserve (FED).

Data from the Fed Cleveland shows that 39,000 Americans were forecast to be laid off last month, and a report from ADP Research shows employers cutting an average of 2,500 jobs per week for four weeks as of November 1. This comes as investors continue to worry about the weakening of the US economy, and expectations of interest rate cuts are declining.

Investors are looking ahead to the US jobs report due on Thursday to find a signal on the Fed's action potential.

Fed Governor Christopher Waller continues to strengthen the case for a rate cut as the Fed is experiencing internal policy debate, while Fed Vice President Philip Jefferson believes the Central Bank should " handle it cautiously".

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on November 20, the State Bank announced that Vietnam's central exchange rate remained unchanged, currently at VND 25,132.

The reference USD exchange rate at the State Bank's Buying - Selling Trading Department is currently at: 23,926 VND - 26,338 VND, unchanged after a sharp increase.

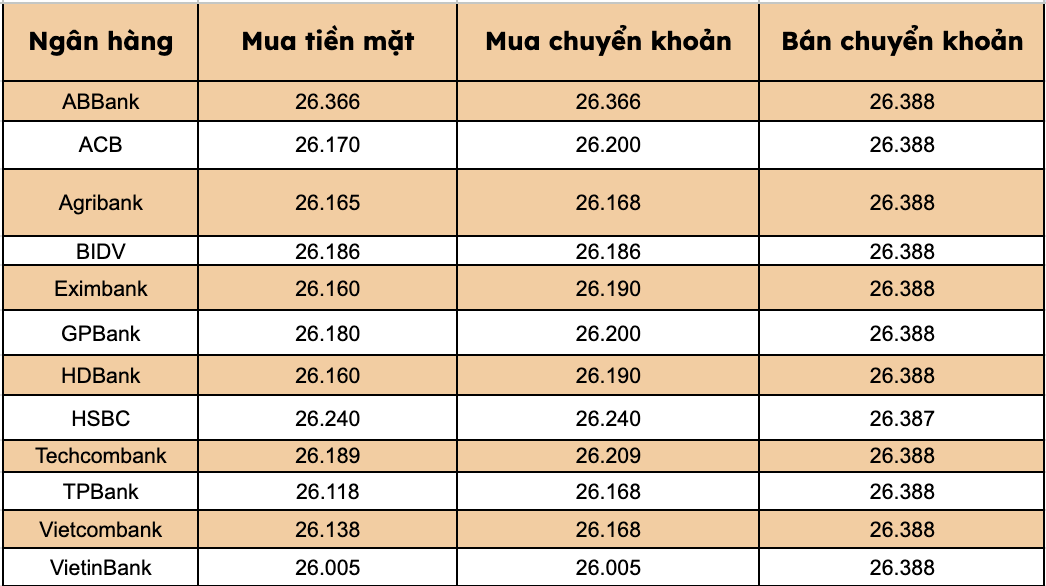

At commercial banks, USD prices have fluctuated.

Most banks listed USD selling prices at VND26,388/USD.

Bank with the highest cash and bank transfer price: ABBank (26,366 VND/USD, down 6 VND/USD).

The difference between buying and selling prices at banks fluctuates within a large range of 22-383 VND/USD.