Ms. Pham Thi Hai (character's name has been changed) questioned about policies and regimes for cadres, civil servants, public employees, workers and armed forces in implementing the organizational arrangement of the political system according to the provisions of Decree No. 178/2024/ND-CP dated December 31, 2024.

Ms. Hai informed that her father was born in December 1975, is a civil servant who worked in an area with particularly difficult socio-economic conditions and participated in social insurance from November 1998 to the end of February 2020.

Since March 2020, he has not worked in areas with particularly difficult socio-economic conditions (according to the list of the Ministry of Labor, War Invalids and Social Affairs).

Ms. Hai wondered whether her father could apply the retirement age prescribed in Appendix I issued with Decree No. 135/2020/ND-CP to calculate the benefits of the policies prescribed in Decree No. 178/2024/ND-CP dated December 31, 2024 of the Government or must retire at the right age according to Appendix II issued with Decree No. 135/2020/ND-CP.

"In case the conditions for applying the retirement age specified in Appendix I issued with Decree No. 135/2020/ND-CP are met to calculate the policies specified in Decree No. 178/2024/ND-CP, what allowances and subsidies will they be entitled to? What is the specific benefit level? We hope that the Ministry of Home Affairs will respond" - Ms. Hai suggested.

Regarding Ms. Pham Thi Hai's reflection and recommendation, the Ministry of Home Affairs has responded on the Electronic Information Portal.

According to the Ministry of Home Affairs, Clause 6, Article 5 of Decree No. 178/2024/ND-CP dated December 31, 2024 of the Government on policies and regimes for cadres, civil servants, public employees, workers and armed forces in implementing the reorganization of the apparatus of the political system clearly stipulates how to determine salary to calculate policies and regimes; in which there is no regulation on regional allowances and special allowances in areas with particularly difficult socio-economic conditions.

Meanwhile, Article 169 of the 2019 Labor Code stipulates that employees who ensure the conditions for the prescribed period of social insurance payment are entitled to receive pensions when they reach retirement age.

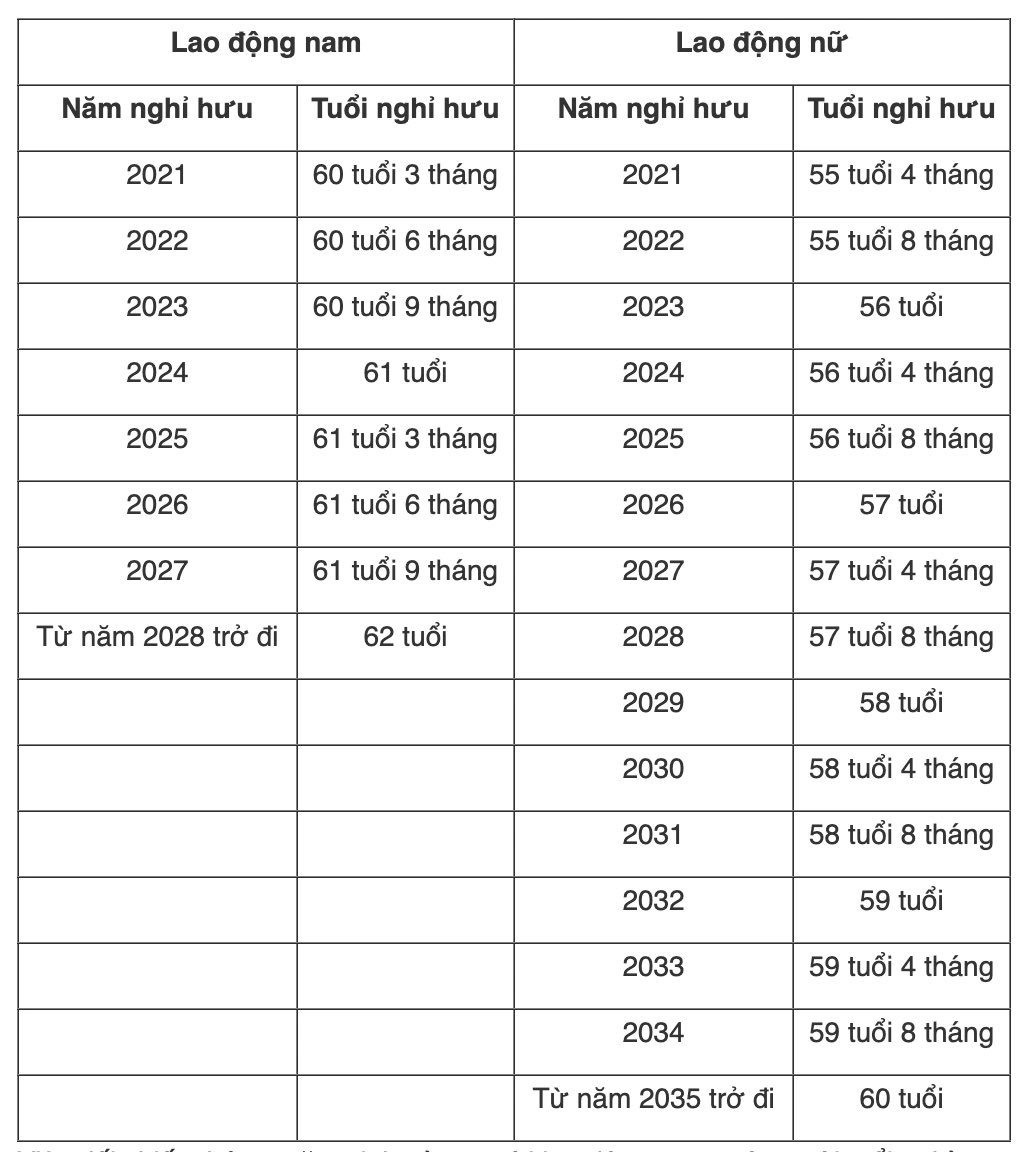

The retirement age of employees in normal working conditions is adjusted according to the roadmap until reaching 62 years old for men in 2028 and 60 years old for women in 2035.

The Government issued Decree No. 178/2024/ND-CP dated December 31, 2024 stipulating the regime and policies for cadres, civil servants, public employees, workers and armed forces in implementing the organizational arrangement of the political system.

Accordingly, in case of aging 10 years or less compared to the retirement age under normal working conditions and 5 years or less compared to the retirement age under working conditions in extremely difficult areas and having enough time to pay compulsory social insurance to retire, they will enjoy 3 regimes:

Receive a one-time pension for early retirement;

Receive early retirement policy;

Cadres, civil servants and public employees who are eligible for early retirement and are rewarded for their contributions but still lack time working in leadership positions at the time of retirement will have their early retirement time calculated corresponding to the remaining time of the election term or the appointment period of the current position to be considered for reward for their contributions.