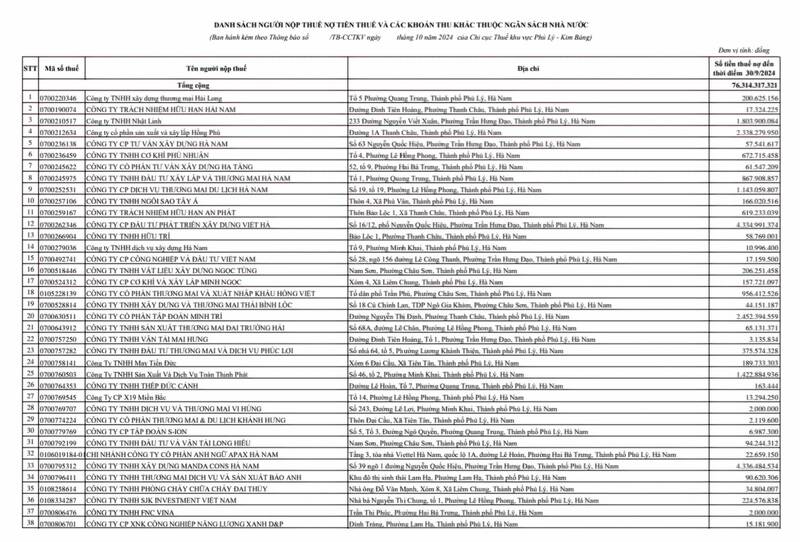

Ha Nam Provincial Tax Department informed that Phu Ly - Kim Bang Regional Tax Branch has just signed and issued Document No. 2509/TB-CCTKV on publicizing the list of 184 enterprises and taxpayers with tax debts and other revenues to the State budget up to September 30, 2024 with an amount of more than 76 billion VND.

Notably, leading the list of tax arrears are Huu Phuoc Stone Mining and Processing Joint Stock Company (Kim Bang district) with a tax arrears of more than 12.2 billion VND; Dong Son Company Limited (Thanh Son commune, Kim Bang district) with a tax arrears of more than 10 billion VND; Viet Ha Construction Development Investment Joint Stock Company and Manda Cons Ha Nam Construction Company Limited (Phu Ly city) both with tax arrears of more than 4.3 billion VND.

Next is Tien Son Company Limited (Tuong Linh Commune, Kim Bang District) with tax debt of more than 4.1 billion VND; Hung Phu Company Limited (Tuong Linh Commune, Kim Bang District) with tax debt of more than 3.5 billion VND; Minh Tri Group Joint Stock Company (Phu Ly City) with tax debt of more than 2.4 billion VND; Hong Phu Production and Construction Joint Stock Company (Phu Ly City) with tax debt of more than 2.3 billion VND...

According to the Ha Nam Provincial Tax Department, the reason for publicizing taxpayers violating the provisions of Point a, Clause 1, Article 100 of the Tax Administration Law No. 38/2019/QH14 and Point g, Clause 1, Article 29 of Decree 126/2020/ND-CP of the Government dated October 19, 2020.

Regarding this issue, the Tax Directorate previously directed that for taxpayers with tax arrears of more than 90 days or tax arrears subject to enforcement, tax departments must immediately apply enforcement measures to recover tax arrears to the State budget.

In case the enforcement decision expires and the taxpayer has not paid or has not paid the full amount of tax debt subject to enforcement to the State budget, it is necessary to promptly switch to applying appropriate enforcement measures in accordance with regulations.

The Tax Directorate also requires tax departments to publicly disclose information of taxpayers with overdue tax debts in accordance with the law, especially focusing on taxpayers with large and long-term tax debts.