Ms. N.T.T in Hanoi said that since graduating, she has worked as a civil servant for nearly 10 years at a state agency (with social insurance contributions). In 2019, she went out to work as a freelancer. Currently, Ms. T still participates in voluntary social insurance contributions. So, how will Ms. T receive pension benefits?

Discussing this issue, Lawyer Nguyen Thu Trang, Deputy Director of Heva Law Company Limited, said that according to current regulations, social insurance includes voluntary and compulsory forms. When citizens participate in both of these insurances, they will be guaranteed pension benefits.

Article 17, Decree 158/2025/ND-CP stipulates the pension regime for people who both have time to pay voluntary social insurance and have time to pay compulsory social insurance as follows:

Employees who both have time to pay voluntary social insurance and have time to pay compulsory social insurance, the time for calculating pension benefits is the total time they have paid voluntary social insurance and compulsory social insurance.

Employees with 15 years or more of compulsory social insurance contributions, if they are subject to the provisions of Article 64 of the Law on Social Insurance, or with 20 years or more of compulsory social insurance contributions, if they are subject to the provisions of Article 65 of the Law on Social Insurance, the conditions and pension level shall be implemented according to the compulsory social insurance policy.

People who both have time to pay voluntary social insurance and have time to pay compulsory social insurance but participate in voluntary social insurance before January 1, 2021 and have enough 20 years of voluntary social insurance contribution or more, the age condition for pension is 60 years old for men, 55 years old for women.

The monthly pension level is calculated by multiplying the monthly pension benefit rate by the average income and salary used as the basis for social insurance contributions specified in Clause 5 of this Article.

In case a person has both voluntary social insurance contributions and compulsory social insurance contributions but has participated in social insurance according to the subjects specified in points a, b, c, d, đ, g and i, clause 1, Article 2 of the Law on Social Insurance before July 1, 2025 and has compulsory social insurance contributions according to these subjects for 20 years or more when calculating a monthly pension level lower than the reference level, it is calculated equal to the reference level.

The level of one-time social insurance benefits is calculated according to the provisions of Clauses 3 and 4, Article 70 of the Law on Social Insurance, based on the number of years of social insurance contributions, the average income and salary used as the basis for social insurance contributions specified in Clause 5 of this Article.

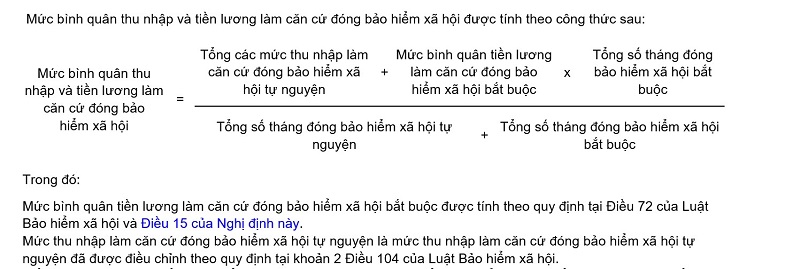

The average income and salary as the basis for social insurance contributions are calculated according to the following formula: