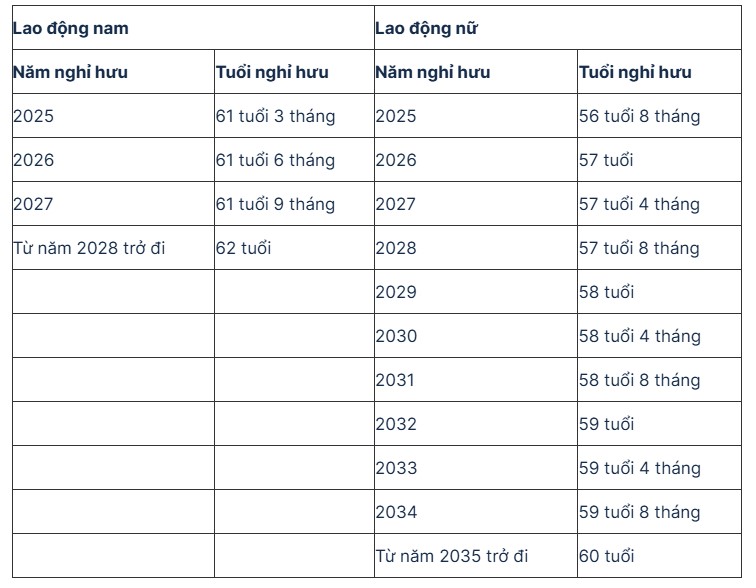

According to current regulations, the retirement age of workers in normal working conditions is adjusted according to a roadmap until reaching 62 years old for male workers in 2028 and 60 years old for female workers in 2035.

According to Clause 2, Article 4 of Decree 135/2020/ND-CP of the Government, the retirement age of workers in normal working conditions in 2026 is determined as follows: Male workers are 61 years and 6 months old, female workers are 57 years old. Thus, from January 1, 2026, male workers born from June 1, 1964; female workers born from January 1, 1969 will reach retirement age.

Article 68 of the Law on Social Insurance stipulates the one-time allowance upon retirement as follows:

Male workers with a social insurance contribution period of more than 35 years, female workers with a social insurance contribution period of more than 30 years, when retiring, in addition to the pension, will also receive a one-time allowance.

The level of one-time allowance for each year of contribution higher than regulations is equal to 0.5 times the average salary level used as the basis for social insurance contributions specified in Article 72 of this Law for each year of contribution higher than retirement age according to the provisions of law.

In case employees have met the conditions for enjoying pensions according to the provisions of Articles 64 and 65 of this Law and continue to pay social insurance, the allowance level is equal to 2 times the average salary level used as the basis for social insurance contributions specified in Article 72 of this Law for each year of contribution exceeding the number of years specified in Clause 1 of this Article from the time of reaching retirement age according to the provisions of law to the time of retirement.

The monthly pension is regulated in Article 66 of the Law on Social Insurance. Accordingly, the monthly pension level of eligible subjects specified in Article 64 of this Law is calculated as follows:

For female workers, it is equal to 45% of the average salary used as the basis for social insurance contributions specified in Article 72 of this Law, corresponding to 15 years of social insurance contributions, then for each additional year of contribution, an additional 2% is calculated, the maximum level is 75%.

For male workers, it is equal to 45% of the average salary used as the basis for social insurance contributions specified in Article 72 of this Law, corresponding to 20 years of social insurance contributions, then for each additional year of contribution, an additional 2% is calculated, the maximum level is 75%.

In case male workers have a social insurance contribution period of 15 years to less than 20 years, the monthly pension level is equal to 40% of the average salary as the basis for social insurance contributions specified in Article 72 of this Law, corresponding to 15 years of social insurance contributions, then for each additional year of contribution, 1% is added.

The monthly pension level for subjects who are workers in certain occupations and jobs with special characteristics in the people's armed forces is regulated by the Government. Funding is implemented from the state budget.

The monthly pension level of eligible subjects specified in Article 65 of this Law is calculated as specified in Clause 1 of this Article, then for each year of early retirement, it is reduced by 2%.

In case the pre-retirement period is less than 06 months, the percentage of pension benefits is not reduced, from 06 months to less than 12 months, it is reduced by 1%.

The calculation of the monthly pension level of employees who are eligible for pensions but have paid social insurance according to the provisions of international treaties to which the Socialist Republic of Vietnam is a member but have paid social insurance in Vietnam for less than 15 years, each year of contribution during this period is calculated at 2.25% of the average salary level used as the basis for social insurance contributions specified in Article 72 of this Law.

The Government details the level of enjoyment and conditions for enjoying pensions.