Pursuant to Article 8 of Decree 103/2024/ND-CP, the calculation of land use fees when converting garden land to residential land is as follows:

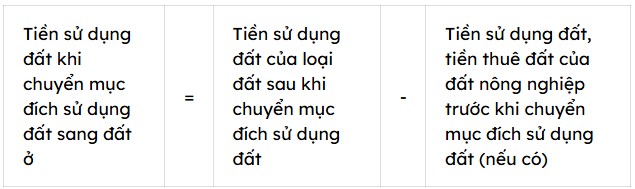

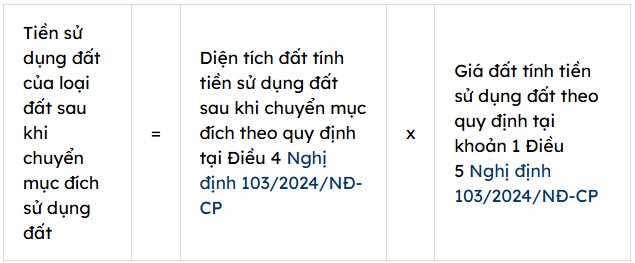

1. When households and individuals are granted a decision by a competent state agency allowing the conversion of land use purpose to residential land, land use fees are calculated as follows:

In which:

- Land use fee, land rent of land types before changing land use purpose (hereinafter referred to as land fee before changing land use purpose) is calculated according to the provisions of Clause 2, Clause 3 of this Article.

- In case the land use fee of the land type after changing the land use purpose is smaller than or equal to the land fee before changing the land use purpose, the land use fee when changing the land use purpose is 0 = 0).

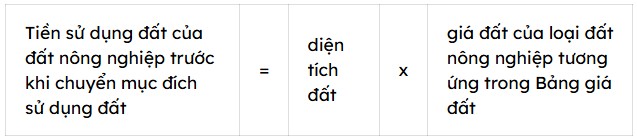

2. Land fee before changing land use purpose is calculated as follows:

- For land before changing the purpose, which is agricultural land of households and individuals allocated by the State without collecting land use fees or agricultural land of legal origin transferred by another household or individual that has been allocated by the State without collecting land use fees:

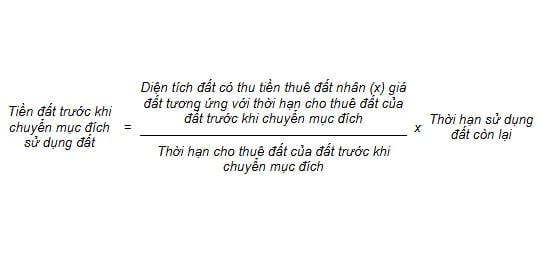

- For land before changing purpose, which is agricultural land leased by the State with one-time land rental payment for the entire lease term:

In which:

+ Land price corresponding to the land lease term of the land before changing purpose is the land price in the Land Price List to calculate the land rent with one-time payment for the entire lease term.

+ The remaining land use term is determined = Land allocation and land lease term before changing land use purpose - Time of land use before changing purpose.

In case the remaining land use period determined according to the formula specified in this point is not round, it will be calculated by month; if the period is not round, the period is not round, from 15 days or more, it will be calculated by rounding out 01 month, less than 15 days, the land use fee will not be calculated for this number of days.

- For land before changing the purpose which is agricultural land leased by the State in the form of annual land rent payment, the land price before changing the land use purpose is 0 = 0).

The land price to calculate land fees before changing land use purposes in the above case is the land price prescribed in Clause 1, Article 5 of Decree 103/2024/ND-CP calculated at the time the competent state agency issues a decision allowing the change of land use purpose.