Real estate market in December grew in both supply and demand

According to the Batdongsan.com.vn technology platform, in December 2025, the real estate market showed some signs of recovery after fluctuations in deposit interest rates in November. Previously, commercial banks' adjustments to raise deposit interest rates due to a shortage of credit sources have raised concerns about business capital costs and lending interest rates in the coming period.

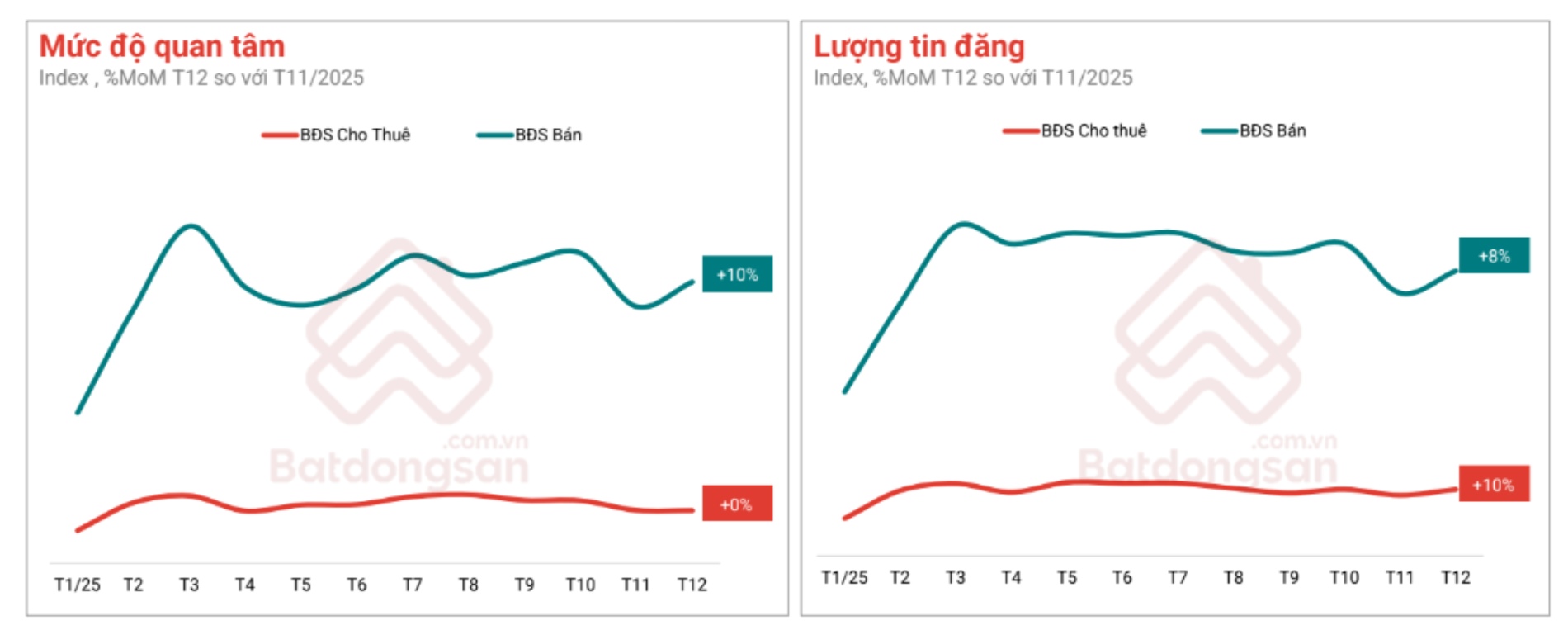

However, actual data from Batdongsan.com.vn shows that both the level of interest and the number of real estate news postings nationwide increased compared to November. Accordingly, the level of interest in real estate sales increased by about 10%. The number of news postings for sale and lease also improved by 8% and 10% respectively. This development reflects the "opening up" sentiment of sellers after interest rate fluctuations in November.

This recovery is quite uniform between regions. Hanoi, Ho Chi Minh City and other provinces and cities all recorded positive growth in both the amount of news posted and the level of interest, although the speed is different.

Selective semi-recovery real estate

December 2025 witnessed the recovery of two types of real estate that were previously under great pressure in the previous period: villas and townhouses.

According to data from the Batdongsan.com.vn technology platform, the level of interest in street-front houses in December 2025 increased by about 16%, villas increased by about 15% compared to November. The number of news items posted for sale in these two segments also increased by two digits.

This reflects the interest in gradually returning to high-value products, good locations and the ability to exploit cash flow. Meanwhile, apartments, private houses and land plots still maintain a stable increase, showing that real housing demand continues to be the "backbone" of the market.

From a long-term perspective, real estate asking prices nationwide maintained their upward momentum over the past 2 years. Apartment buildings are the segment that recorded the strongest increase, reflecting limited supply pressure while demand is still high, especially in large cities. As of the fourth quarter of 2025, the average asking price of apartment buildings nationwide has increased by 56% compared to the first quarter of 2024.

Considering each area, Hanoi recorded many positive indicators in December. After a period of stagnation due to interest rate fluctuations in November, the level of interest in real estate sales in Hanoi increased by about 11% compared to the previous month. The villa, private house and street-front house segments in Hanoi all had a double-digit increase in the amount of interest.

Ho Chi Minh City's real estate market also grew in December, but at a slower pace than the capital. Specifically, the amount of real estate for sale increased by 6% compared to the previous month.

The street-front house segment in Ho Chi Minh City witnessed an increase in interest of 19% and a 20% increase in the number of news items for sale. The villa segment also showed excitement with growth of 15% in search demand and 16% in new supply compared to November 2025.

Conversely, the apartment segment sold in Ho Chi Minh City showed signs of slowing down when the level of interest decreased by 4%.

Stable rental market

The rental real estate segment maintains a stable demand but shows signs of increasing supply. The number of rental news posting nationwide increased by 10% in December 2025. Especially in Hanoi, the number of news posting renting houses and street-front houses increased by 20% and 22% respectively compared to November.

The boarding house segment became a bright spot when the level of interest increased by 14% compared to the previous month. In terms of cost, street-front houses have the highest rental price increase in the past 2 years (up 21%), while other segments such as apartments or private houses still maintain stable rental prices.

In general, Mr. Nguyen Quoc Anh - Deputy General Director of Batdongsan.com.vn said that in the last month of 2025, the real estate market has overcome the sensitive period of interest rate fluctuations, entering a selective recovery state. Cash flow has not returned massively, but interest has emerged in the segments with valuable use and the ability to exploit cash flow.

Stepping into 2026, along with data transparency and real estate identification policies, the market is expected to operate in a more substantive direction, where real value gradually replaces short-term speculative expectations.