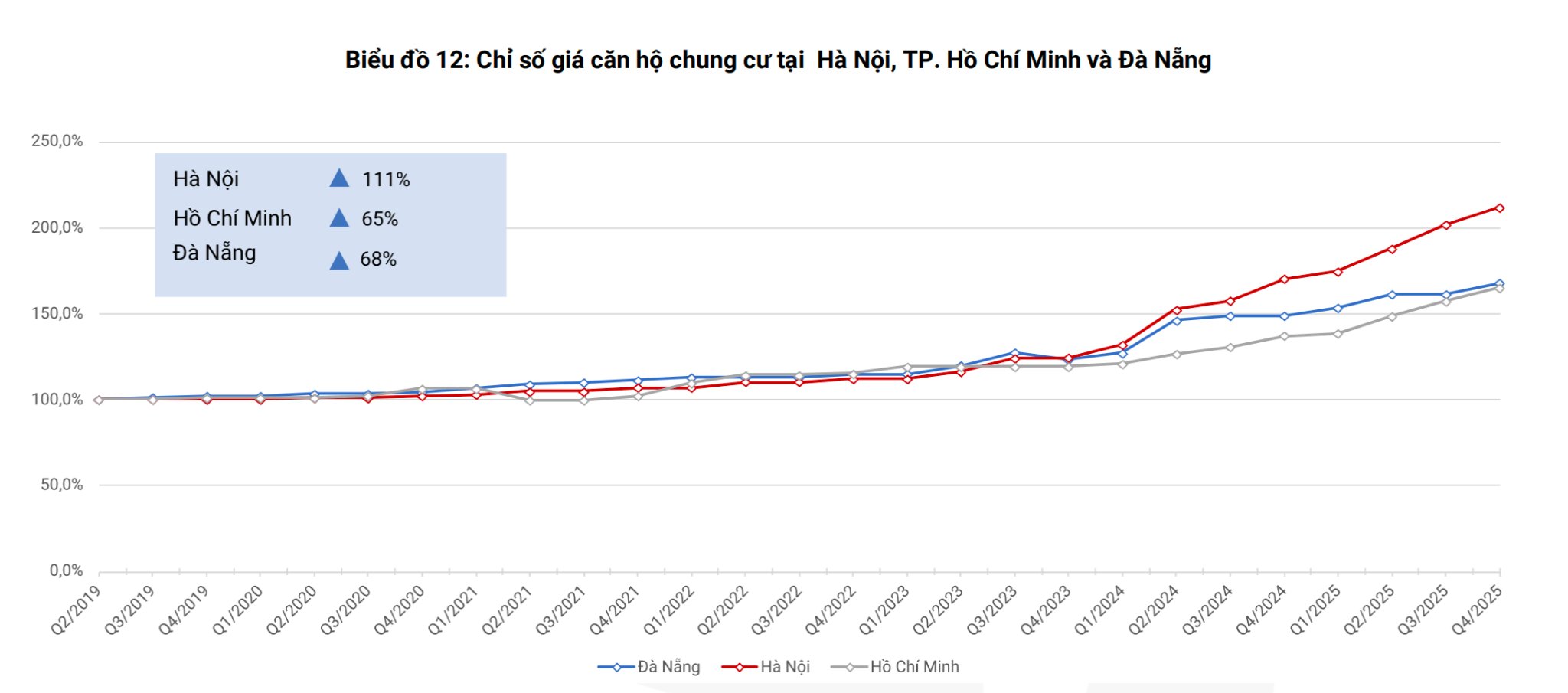

Apartment prices in Hanoi increase the most

According to data from the Vietnam Association of Realtors (VARS), in 2025, the apartment price level continued to linger at a high level, recording strong increases in both the primary and secondary markets, although the upward momentum showed signs of strong differentiation towards the end of the year.

In the primary market, newly offered prices set record highs in major cities. In Hanoi, newly opened apartment prices reached about 100 million VND/m2, an increase of about 40% compared to 2024. Ho Chi Minh City (old territory) recorded an average price of about 111 million VND/m2, an increase of 23% compared to the previous year. In Da Nang, newly offered prices reached about 83 million VND/m2, an increase of 14% compared to 2024.

In the secondary market, price movements have clear differences between localities. In Hanoi, secondary apartment prices increased rapidly in the first months of the year, many projects recorded increases from several hundred million to billions of VND in a short time.

In Ho Chi Minh City, secondary apartment prices continue to accelerate, mainly concentrated in areas with large infrastructure projects being implemented, reflecting investors' long-term expectations for connectivity and value increase. Meanwhile, in Da Nang, selling prices increased sharply thanks to increased investment demand, especially from capital flows from investors from Hanoi. However, market liquidity slowed down at the end of the year, prices tended to move sideways after a period of rapid increase.

Mr. Le Dinh Chung, Vice Chairman of the Research and Evaluation Council of the VARS real estate market, said that in the secondary market in Hanoi, apartment selling prices increased rapidly in a short time, many areas recorded increases from hundreds of millions to billions of VND per unit. However, the upward momentum tended to slow down at the end of the year, appearing a situation of "cut-loss" sales by a part of investors buying according to FOMO psychology during the hot increase period. However, in general, the price level in the central area is still maintained stably.

The housing market report for the fourth quarter and the whole year 2025 released by the Ministry of Construction also shows that in the fourth quarter of 2025, apartment prices in Hanoi, Ho Chi Minh City and major cities were basically stable and continued to be maintained at a high level compared to the previous quarter.

For the whole year 2025, apartment prices across the country increased by about 20-30% compared to 2024, in which some areas recorded higher increases, concentrated in the mid-range and high-end segments.

In Hanoi alone, the average primary apartment selling price in 2025 reached about 100 million VND/m2. Some projects have high asking prices such as Green Diamond from 130-170 million VND/m2; Richland Southern from 90-102 million VND/m2; Golden Park Tower from 110-124 million VND/m2.

In Ho Chi Minh City, the average primary apartment selling price reaches about 111 million VND/m2, with some projects such as Midtown Phu My Hung advertising from 118-150 million VND/m2; Riverpark Premier new phase from 130-153 million VND/m2.

Apartment prices are forecast to slow down in the coming period

Forecasting the price trend in the coming period, Ms. Do Thi Thu Hang - Senior Director, Research and Consulting Department, Savills Hanoi, said that in 2026, apartment prices in Hanoi will continue to increase, but the increase may be lower than in the previous period.

Ms. Hang commented: "The price level is unlikely to cool down at least in the first half of 2026. First of all, the impact of the new Land Law and the 2026 land price list, expected to be applied from January 1, 2026 with prices closer to the market. This increases input costs for investors, including land use fees, site clearance costs and compensation.

Construction costs continue to be pressured by raw material prices, labor costs and financial costs, forcing investors to reflect them into selling prices. At the same time, the supply-demand mismatch has not been thoroughly resolved. Although the supply in 2026 is forecast to improve compared to the previous period, most of the new supply is still concentrated in the mid-range and high-end segments, while affordable housing projects continue to be scarce. This keeps the average price level of the entire market at a high level," Ms. Hang analyzed.

It's a bit of a bit of a bit of a bit of a bit of a bit.