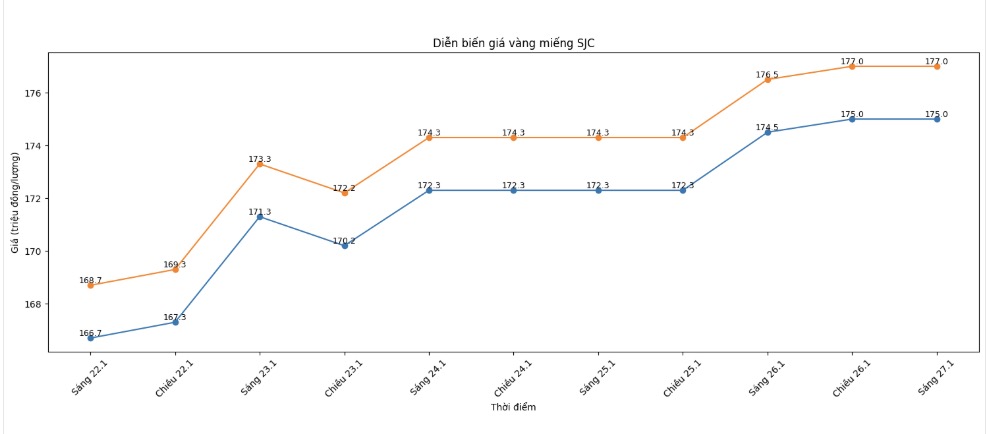

SJC gold bar price

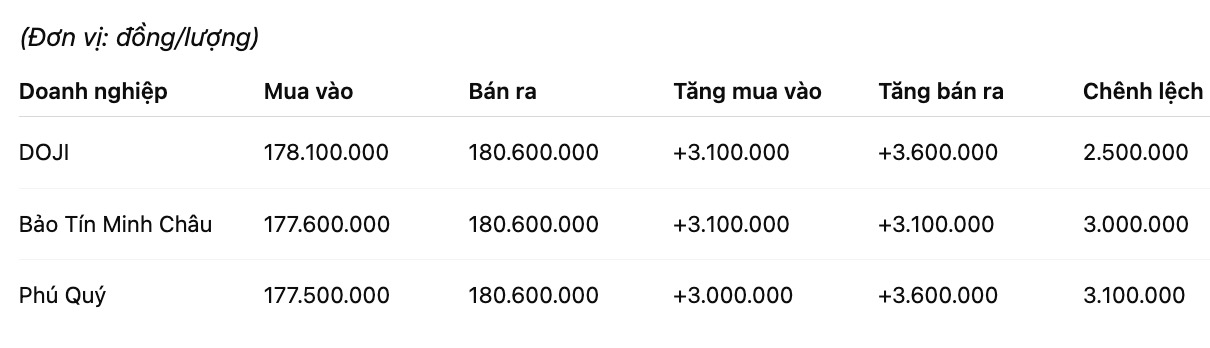

As of 9:30 am, SJC gold bar prices were listed by DOJI Group at the threshold of 178.1-110.6 million VND/tael (buying - selling), an increase of 3.1 million VND/tael on the buying side and an increase of 3.6 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 177.6-180.6 million VND/tael (buying - selling), an increase of 3.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 177.5-180.6 million VND/tael (buying - selling), an increase of 3 million VND/tael on the buying side and an increase of 3.6 million VND/tael on the selling side. The difference between buying and selling prices is at 3.1 million VND/tael.

It can be seen that the buying - selling price difference is being widened by some business units, even up to 3.1 million VND/tael.

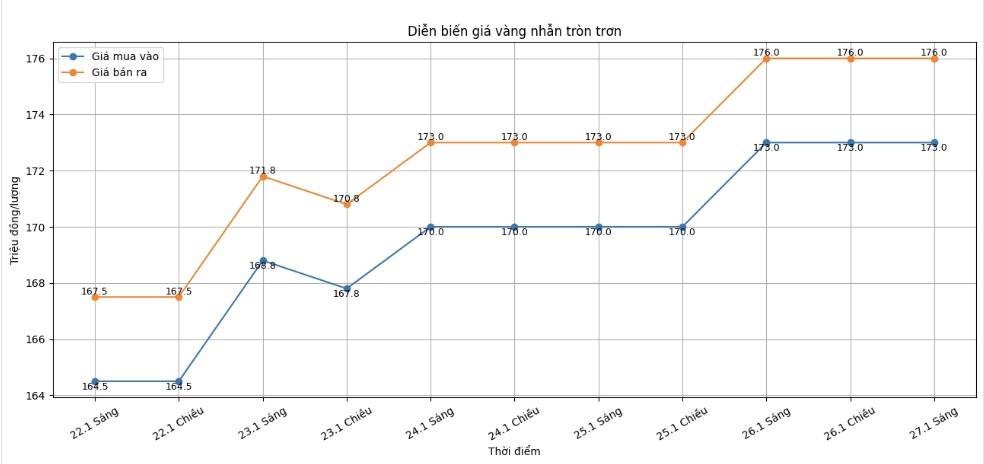

9999 gold ring price

As of 9:30 am, DOJI Group listed the price of gold rings at the threshold of 177.2-180.2 million VND/tael (buying - selling), an increase of 4.2 million VND/tael in both directions compared to the previous day. The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 177.6-180.6 million VND/tael (buying - selling), an increase of 3.6 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 177.3-180.3 million VND/tael (buying - selling), an increase of 3.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

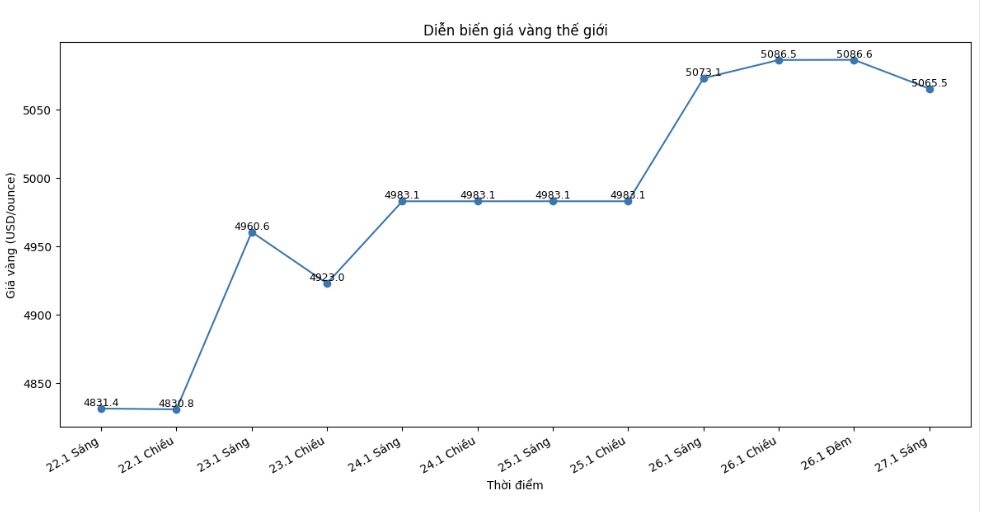

World gold price

At 9:25 am, world gold prices were listed around the threshold of 5,206.1 USD/ounce, up 140.6 USD compared to the previous day.

Gold price forecast

World gold prices are undergoing a period of strong growth, officially exceeding the 5,200 USD/ounce mark. Throughout January, this precious metal has continuously conquered new price peaks, with futures gold contracts increasing by about 100 USD in just a few weeks, reflecting the clear shift of global cash flow in the context of increasing instability.

The upward momentum of gold prices not only stems from short-term speculation but is also linked to structural changes in the world economy. Escalating geopolitical tensions in many regions, the risk of expanding trade conflicts and the risk of global growth decline have boosted demand for safe-haven assets. In addition, large-scale gold buying activities by central banks, especially in emerging economies, continue to play an important supporting role for the market.

Data shows that the net gold purchase volume of central banks has been maintained at a high level for many consecutive months, contributing to forming a relatively solid "float price" zone. In parallel with that, the return of capital to gold ETF funds in the West, along with the demand for physical gold holdings of wealthy investors, has created many layers of support for the current upward trend.

However, after gold increased by more than 17% in less than a month and silver increased by 45%, the market also began to record increased profit-taking pressure, causing prices to fluctuate sharply in the short term. Some organizations warn individual investors to be cautious about the risk of "top-fishing" if participating in too high prices.

However, the medium and long-term prospects of gold are still positively assessed by many experts. Mr. John Plassard - Head of Investment Strategy at Cite Gestion, said that the upward momentum of gold comes not only from geopolitical instability but also reflects the trend of "de-USDization" and expectations that US interest rates will remain lower in the near future.

Meanwhile, independent analyst Ross Norman said that the fact that gold prices move towards higher levels, even exceeding 6,000 USD/ounce, is only a matter of time, although short-term technical corrections may appear in the market.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...