Interest in apartments increases again

According to online data from Batdongsan.com.vn in May 2025, apartments continue to be the most popular type of real estate in the Hanoi and Ho Chi Minh City markets.

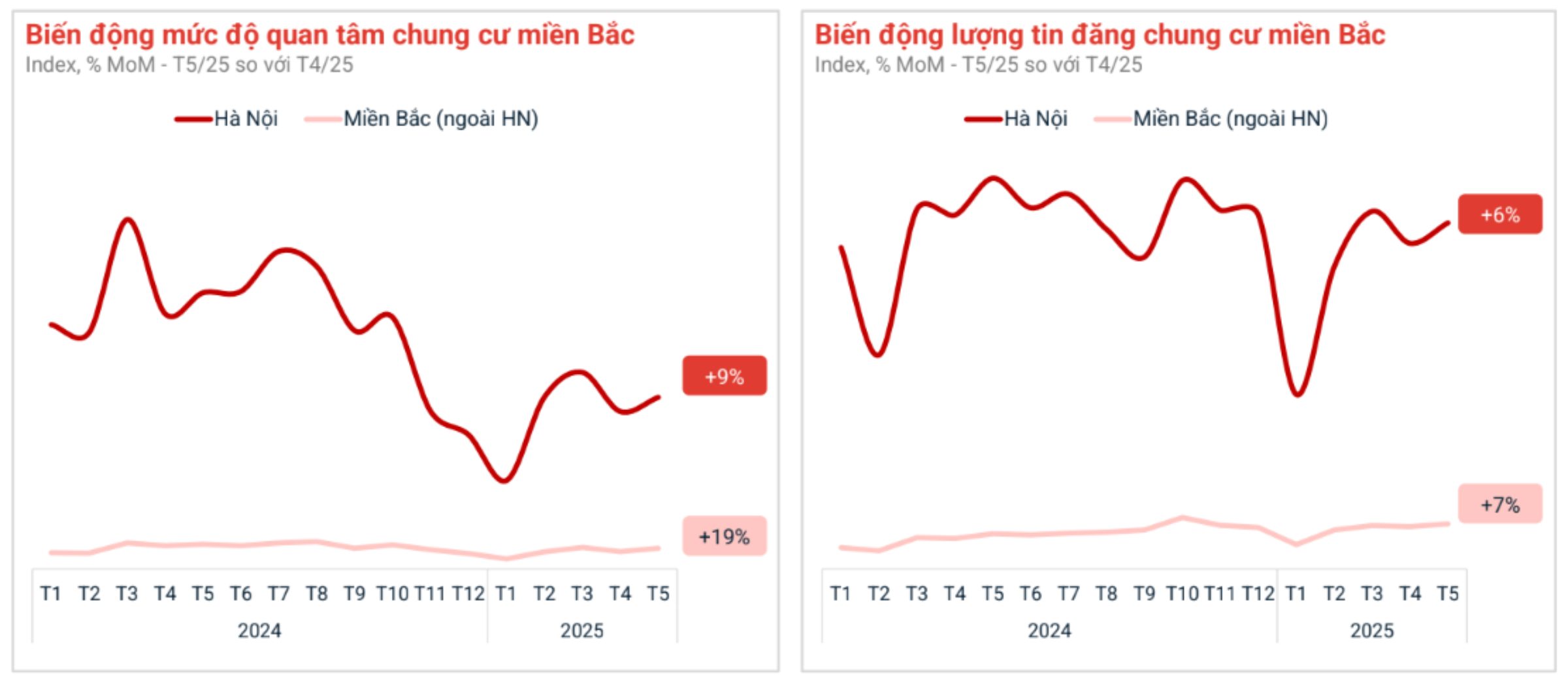

Notably, Hanoi apartments are the only type to record the number of people interested in jumping back in May, an increase of 9% compared to the previous April. S segments such as land, private houses, townhouses, villas have the opposite trend when the number of people interested has decreased by 15%, 8%, 8% and 4%, respectively.

Land occupies the entire Northern market (outside of Hanoi). However, in May, the level of interest in land unexpectedly decreased by 5% compared to April. While apartments increased by 19%, private houses and villas both increased by 9%.

In May, the interest in apartments in Hanoi and the Northern provinces recorded a sharp increase, respectively 9% and 19, compared to the previous month. This is a signal that the psychology of buyers is returning to the market, especially in the provinces bordering Hanoi - where prices are still attractive and new supply is expanding.

Compared to April, the number of people interested in apartments in Ho Chi Minh City increased by 17%, land and private houses increased by 7%, townhouses increased by 4% and villas increased by 22%.

Apartment prices and rental prices in Ho Chi Minh City continue to increase, and other provinces outside of Ho Chi Minh City also slightly increase their selling prices. Accordingly, the average selling price of apartments in Ho Chi Minh City is about 60 million VND/m2, an increase of 46% compared to the first quarter of 2021. Ho Chi Minh City apartment rental prices increased by about 9%, reaching 12 million VND/unit. In the southern provinces (outside Ho Chi Minh City), rental prices have not fluctuated much, around 7 million VND/unit.

Land shows signs of slowing down

After reaching a peak in March, the level of interest in land showed signs of slowing down in April. The reason is that the market is affected by long holidays, becoming cautious after tariff information and waiting for clearer changes in the merger of provinces and cities.

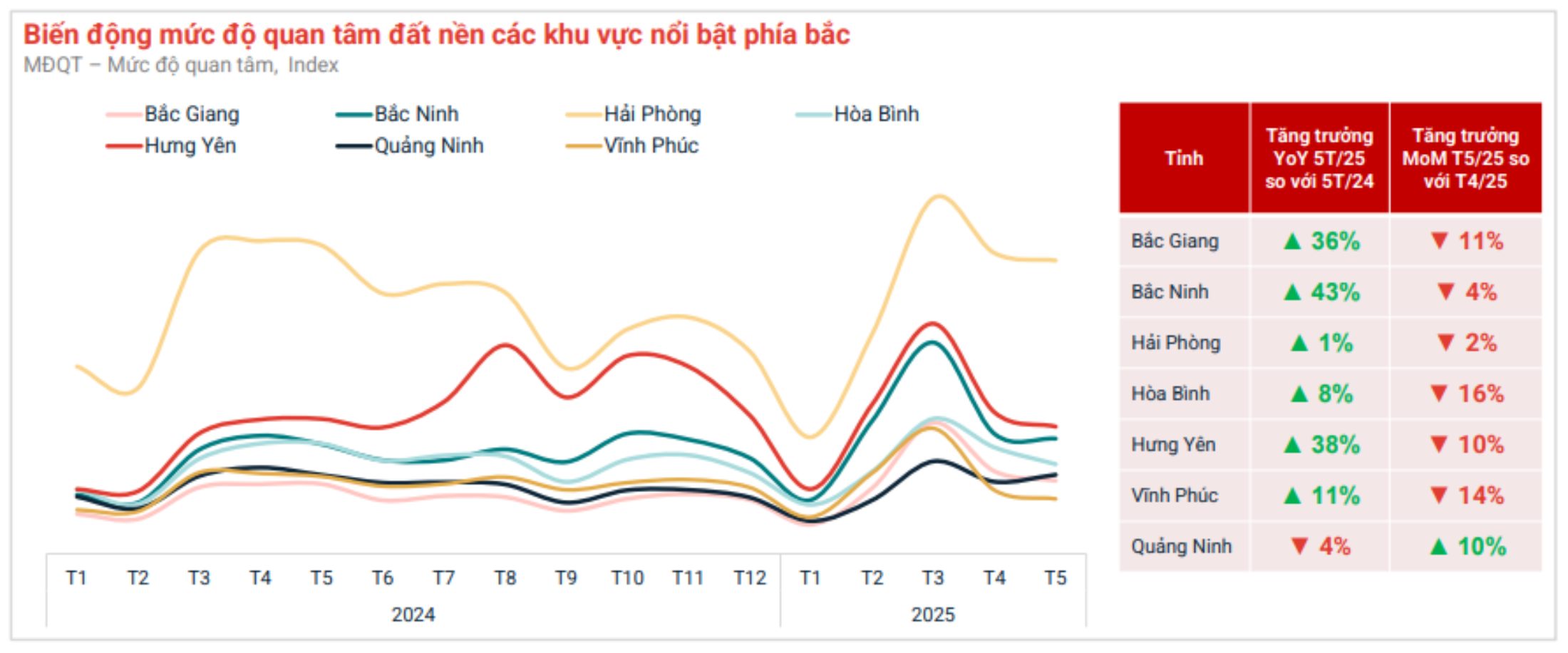

In the first 5 months of 2025, the level of interest in land in the Northern provinces (outside of Hanoi) increased compared to the same period last year; most clearly demonstrated in Bac Ninh, Hung Yen and Bac Giang.

Accordingly, Bac Ninh leads with an increase of 43% compared to the first 5 months of 2024, followed by Hung Yen 38% and Bac Giang 36%. However, compared to April 2025, the market has shown signs of a slight decrease in interest in most provinces - reflecting signs of caution after the counterpart tax information. Quang Ninh was the only bright spot with an increase of 10%.

Although the level of interest tends to slow down, the land price level in the northern provinces remains stable compared to the peak in March 2025, many localities even recorded impressive growth compared to the beginning of 2024.

For example, Hoa Binh recorded the highest increase in the North at 67% compared to January 2024, remaining stable compared to March 2025. Hung Yen continues to be a bright spot with a 59% increase compared to January 2024, also unchanged compared to the peak in March.

Vinh Phuc and Bac Giang have increased by 47% and 39%, respectively, compared to the beginning of last year. However, compared to the peak in March, while Vinh Phuc maintained a growth rate of 14%, Bac Giang recorded a decrease of 7%. Bac Ninh increased by 20% compared to the beginning of last year and continued to increase by 3% compared to March 2025. Quang Ninh increased by 12% compared to the peak. Meanwhile, Hai Phong did not have significant price fluctuations compared to January 2024 or the peak of March.

Commenting on the developments in the real estate market in May, Mr. Nguyen Quoc Anh - Deputy General Director of Batdongsan.com.vn said that one of the most notable points is the sharp increase in interest in apartments, especially in Hanoi and the Northern provinces.

This could be the first signal that investors and buyers are returning to the trend of choosing a safe segment. Investors often tend to repeat psychological rotations. When they saw the market hot, they poured into the same soil as last March. When they feel unsafe, they will return to the type with cash flow and liquidity like apartments" - Mr. Quoc Anh said.