Housing prices are far beyond people's means, it is necessary to regulate speculative behavior with tax policies

According to Associate Professor, Dr. Pham The Anh, Head of the Faculty of Economics, National Economics University (NEU), the first solution to lower housing prices is to have solutions from the supply side. "We must increase project supply and increase the number of houses sold on the market." In particular, the role of the State is to "quickly approve, especially social housing projects".

Associate Professor, Dr. The Anh emphasized that it is necessary to increase the supply of social housing because "most workers are only able to pay for social housing, low cost but cannot afford high-cost commercial housing". However, he said that "supply solutions are only a part", because the current housing market is " spilling too much by speculators". To regulate prices, we must "attack speculative behavior, hoarding, and holding".

First, Associate Professor, Dr. The Anh proposed to tax abandoned real estate. This policy applies to both individuals and businesses. He said that if businesses request projects, hold them but do not implement them, and let them exceed the deadline, the State needs to collect or impose very high taxes. In fact, many large real estate enterprises have hoarded from tens to thousands of hectares of land. Similarly, if individuals buy a house but do not use it or leave it empty, they must pay taxes.

However, if it is determined that the fault belongs to the government such as slow licensing, or problems with administrative procedures, it will be eliminated.

Second, Associate Professor, Dr. The Anh proposed taxing the ownership of many real estates. The gap between rich and poor largely comes from this market, where there are people who have worked all their lives but cannot afford to buy a small apartment, while others own dozens of apartments. Therefore, it is necessary to use tax policies to regulate.

Associate Professor, Dr. The Anh proposed that it is possible not to tax the ownership of one or two houses, but from the third house onwards, tax must be paid. Or in the context of population aging as at present, to encourage childbirth, the State can rely on the number of children in a family to determine the number of houses exempt from tax.

This real estate tax policy, regardless of whether it is the first or second house, is applied in most developed countries. When the State collects taxes, there will be resources to develop infrastructure for society and reduce the act of hoarding, avoiding leaving resources lying dead in society. Hoarding is harmful to the economy, causing inequality in assets and income. Our current tax policies are indirectly encouraging these acts" - Associate Professor, Dr. Pham The Anh shared.

Explaining more specifically, Associate Professor, Dr. The Anh said that it is necessary to impose progressive tax. For example, the owner of a second house must pay 1% tax, the owner of a third house must pay 2% tax according to the value of the house each year.

"Whoever wants to keep it can keep it but must pay taxes. The State and society both welcome it, he said.

Finally, Associate Professor, Dr. The Anh said that it is necessary to tax speculative behavior and quick buying and selling. Mr. Anh called this an "unwards behavior, does not bring added value to society and pushes up real estate prices".

Recently, the Ministry of Finance's removal of the draft on taxes related to real estate is an act of reticulation in real estate market management.

Associate Professor, Dr. The Anh said that the current real estate transfer tax rate is 2%. However, if we adjust the general transfer tax rate to 1% and for owners who buy and resell real estate within 1 year, they will have to pay a higher transfer tax, about 3-4%, for example, if they buy and resell within 2-3 months, they may have to pay up to 10% of the tax on the value of real estate bought and resold. This measure is very simple and when applied, it will minimize the situation of buying and selling in a short time.

Previously, the Ministry of Finance explained that when it removed regulations on real estate tax, it could not calculate the cost of real estate purchase, and could not calculate income. However, the Ministry of Finance can apply the method of taxing based on transaction value or selling price, the rate of tax spent on transactions only needs to be accumulated according to holding time (the longer it is held, the lower the tax rate). Long-term shareholders only have to pay a very low tax rate" - Associate Professor, Dr. The Anh shared.

Credit policy must also distinguish between real home buyers and speculators

Regarding credit policy, Associate Professor, Dr. Pham The Anh said, "it is necessary to distinguish between the behavior of borrowers buying the first house and the behavior of borrowing the second and third houses to speculate and store".

Associate Professor, Dr. The Anh analyzed that currently, even home loans are beyond people's ability to pay. For example, a house of 5 billion VND, if borrowed 70% of its value, the loan amount is 3.5 billion VND. With an average income of 20 million VND/month, people will not be able to pay interest, let alone pay the principal.

"If paying an interest rate of 7%/year for a loan of 3.5 billion VND, the interest in the first year would have reached 245 million VND. This means that for an employee with a monthly income of VND20 million, the entire monthly income of the employee is only enough to pay bank interest" - Associate Professor, Dr. The Anh said.

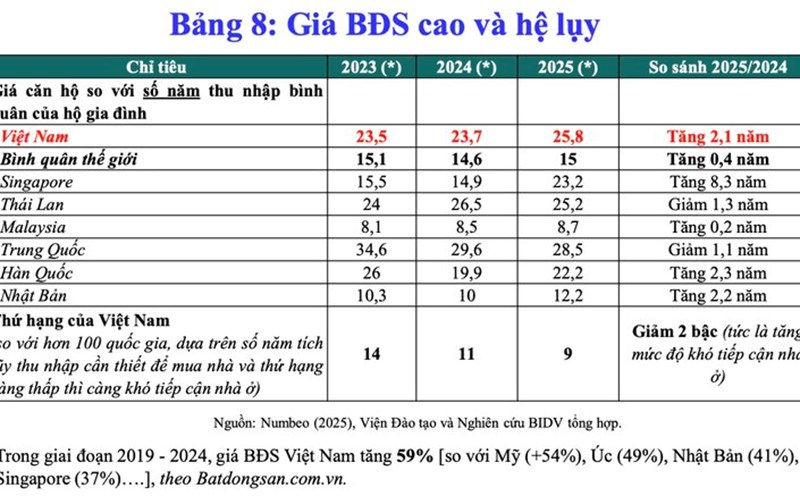

Therefore, Associate Professor, Dr. The Anh said that high housing prices not only take people many years to repay their debts but also make them unable to pay interest. This is the main reason why current real estate transactions are only for the super-rich and speculators, while the majority of workers cannot access them.

"If the majority of middle-income workers access the loan package to buy a first house, the interest rate must be low, must be encouraged, only about 4-5%/year. As for those who borrow to buy a second or third house, ... they have to pay other interest rates... we should not use credit policies to encourage borrowers to speculate and hoard real estate" - Associate Professor, Dr. The Anh said.

He said that the current credit policy cannot distinguish between borrowing to buy the first house or the second or third house, so whenever credit is loosen or interest rates are lowered, capital flows mainly into speculative real estate.

"Simely, credit or interest rate policies must also distinguish between real estate businesses. Enterprises borrow money to develop a real estate project, if they have not completed that project but continue to borrow to keep another project, they must pay other interest rates". - Associate Professor, Dr. The Anh shared.

According to Associate Professor, Dr. The Anh, the current loose credit policy encourages the act of hoarding land and houses, pushing up real estate prices. Therefore, the policy of interest rates for home loans of people needs to distinguish between borrowers who buy the first house or the second house.