What costs form housing prices?

At the Conference on September 22, the Prime Minister emphasized the fact that current housing and apartment prices are high, putting great pressure on people's access to housing.

So, what types of costs are current housing prices "bearing"?

Analyzing the input costs of a commercial housing project today, Mr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, said that to make a project including: 25% of land cost, the closer the project is to the land cost center, the higher the golden position is, accounting for 40-50% of the cost, real estate value.

Next is the cost of investment procedures accounting for about 5-10% of the total cost, which can increase to 15% if the procedure is prolonged. Capital costs account for about 5-10%.

In addition, there is a group of construction costs ( materials, labor, machinery) that are being pushed up due to escalating prices and increasing labor rental costs.

Sharing the same view, Mr. Nguyen Thanh Tung, director of a real estate company in Hanoi, said that the current apartment selling price is formed from the main costs including: site clearance fees, land use fees, infrastructure and construction costs, capital costs, interest costs, project development costs and gross profits of investors.

He analyzed that site clearance costs are increasingly high due to market prices; land use fees also increase based on current prices; infrastructure and construction costs continue to increase due to high material prices; capital costs are also high due to long project implementation time and high interest rates. According to Mr. Tung, among the factors, only the gross profit of investors can decrease, but this will cause profits to decrease, forcing businesses to manage well.

Real estate businesses make big profits with impressive profit margins

In fact, financial reports from some listed real estate enterprises show that the profit margin is quite high. In some enterprises, the gross profit margin is up to 40-50%, the net profit margin is about 18-25%.

That shows that, in the context of increasing input costs, businesses are still maintaining a high profit margin, meaning that product prices are accepted by the market at a level that causes businesses to earn large profits. This is also one of the factors that contribute to the difficulty of housing prices in the market decreasing.

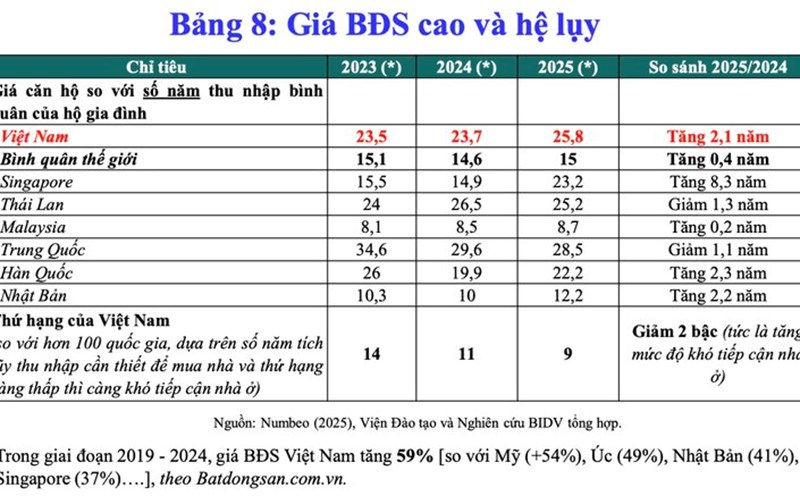

At the VWAS 2025 Vietnam Financial Consulting Summit on the afternoon of September 25, 2025, Dr. Can Van Luc - Chief Economist of BIDV also shared statistics from the BIDV General Training and Research Institute, showing that in 2024, the after-tax profit of listed real estate enterprises decreased by 1.7%; stock prices decreased by 2% (mainly due to sharp increase in costs +31.1% in 2024).

In the first 6 months of 2025, the after-tax profit of listed real estate enterprises increased by 73% over the same period; bond price +99.6% compared to the end of 2024 (until September 19, 2025); showing a fairly positive market recovery, but he emphasized high prices.

Mr. Luc frankly acknowledged: "There are 2 subjects "taking advantage of" the investor himself intentionally pushing up prices and some brokers participating in price-taking, pushing up real estate prices.

According to the reporter's research, at Nam Long Investment JSC (Code: NLG), this unit has made a huge profit thanks to sales from a series of large projects.

In 2024, Nam Long recorded business results with clear growth. Net revenue reached VND 7,196 billion, 2.2 times higher than VND 3,118 billion last year. In particular, revenue from selling land use rights, apartments, townhouses and villas reached VND6,965 billion, 2.4 times higher than in 2023.

The selling price of goods in 2024 is VND 4,138 billion, an increase of 2.5 times compared to the previous year. In particular, the capital price from land, apartments, townhouses and villas is VND2,939 billion. Thanks to that, the gross profit reached VND 3,057 billion, nearly double the VND 1,562 billion of the previous year. Gross profit margin reached about 42.5%, meaning that for every 100 VND in revenue from product sales, the enterprise retained more than 42 VND in gross profit. This is a fairly good profit margin that the enterprise has achieved.

In 2024, Nam Long will open for sale a number of key projects, including apartments, townhouses, villas, etc. According to FIDT's 2024 Analytical Report, the total sales achieved by Nam Long are VND 5,204 billion. This revenue is mainly concentrated in Akari projects (1,562 billion VND), Southgate (1,561 billion VND), Can Tho (642 billion VND) and partly in Mizuki, Izumi.

During the period, expenses also increased significantly, including financial expenses of VND 331 billion, sales expenses of VND 742 billion and business management expenses of VND 651 billion. After deducting expenses, Nam Long's after-tax profit for the whole year of 2024 reached VND 1,387 billion, up 73% over the same period.

Thus, the company's net profit margin in 2024 reached 19.2%, a fairly impressive figure, showing that the profitability of the products is quite good in the context of the market not really recovering.

Entering the first half of 2025, Nam Long recorded net revenue of VND 2,063 billion, 4.5 times higher than the same period last year, of which the majority still came from projects selling land, apartments, townhouses and villas.

With a capital of VND 1,319 billion, Nam Long achieved a gross profit of VND 744.9 billion, bringing the gross profit margin to about 36.1%. Although lower than the level in 2024, this is still a good rate for real estate businesses.

Expenditures for the period include financial expenses of VND 48 billion, sales expenses of VND 121 billion and business management expenses of VND 85 billion. After deducting expenses, Nam Long reported a profit of 207 billion VND, 2.2 times higher than the same period last year.

Khang Dien Housing Investment and Trading Joint Stock Company (Code: K Human) also maintains an impressive profit margin.

Khang Dien recorded net revenue in 2024 of VND 3,278 billion, up 57% over the previous year. In particular, real estate transfer activities continued to account for a large proportion with VND 3,241 billion, up 54% over the same period. The selling price of goods is up to 1,539 billion VND, three times higher than in 2023, the capital price from real estate transfers alone reached 1,493 billion VND. Thanks to that, the gross profit reached VND 1,739 billion, bringing the gross profit margin to 52.8%.

Revenue in the year mainly comes from the handover of more than 98% of the net revenue value, equivalent to over VND 3,200 billion, focusing on the remaining part of The Classia project (about 20%) and about 60% of products in The Privia project. Meanwhile, the arising costs include financial costs of 216 billion VND, sales costs of 222 billion VND and business management costs of 209 billion VND.

After deducting expenses, Khang Dien forecasts a profit of VND803 billion in 2024, up 10% over the previous year. The net profit margin of enterprises this year reached 24.5%, a fairly high figure for real estate enterprises.

Entering the first half of 2025, Khang Dien's net revenue reached VND 1,759 billion, up 79% over the same period. Of which, the majority comes from real estate transfer activities with 1,740 billion VND. The recorded capital price is 1,048 billion VND, the capital price from real estate transfers alone is 1,024 billion VND. Thanks to that, the gross profit reached VND 710 billion, equivalent to a gross profit margin of about 40.3%. Revenue is mainly recorded from the handover of more than 400 apartments in The Privia project and some land plots.

Expenditures during the period increased, including financial expenses of 101 billion VND, sales expenses of 117 billion VND, business management expenses of 110 billion VND and corporate income tax expenses of 95.5 billion VND. After deducting these expenses, Khang Dien reported a profit of VND314 billion in the first half of the year, down 8.7% over the same period last year. However, the company's net profit margin still reached nearly 18% in the first half of this year.