Nghe An Provincial People's Committee has just issued a new land price list applicable from May 21 with the strongest increase in the adjustments so far, some places have increased up to 15 times compared to the period 2020-2024.

In Vinh City, the adjustment level is concentrated on central roads and regional connecting routes. For example, Quang Trung Street increased from 52 million VND to 150 million VND/m2; the two-way lot on the frontage increased from 53 million VND to 165 million VND/m2.

In Nghi Xuan commune, the road connecting provincial road 535A to provincial road 353B increased from 1.2 million VND to 18 million VND/m2 (an increase of 15 times). The 72m road connecting Vinh City - Cua Lo increased from 3 million VND to 35 million VND/m2.

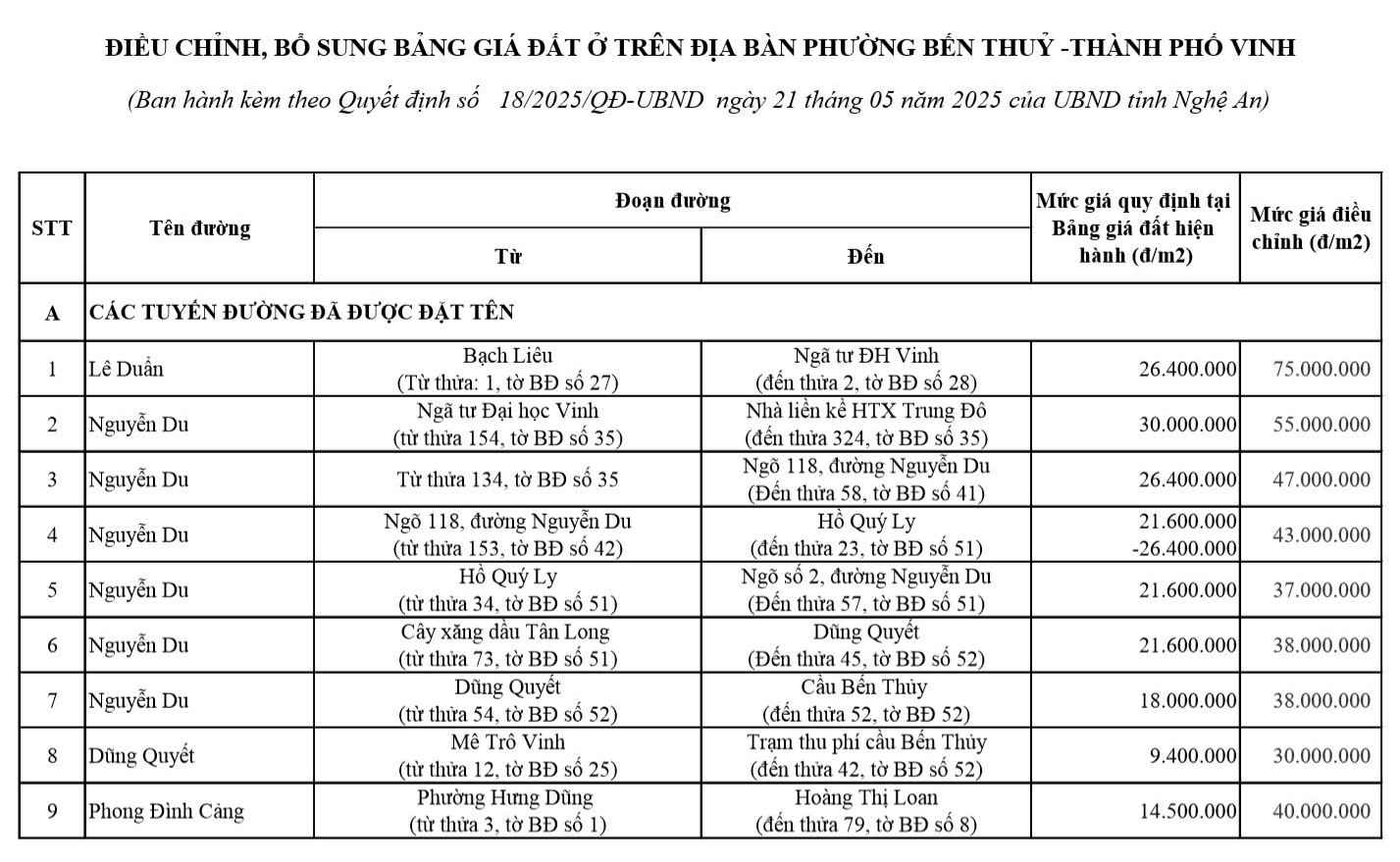

In Ben Thuy ward, the new land price list also recorded a strong increase on many named roads. Le Duan Street, from Bach Lieu to Vinh University intersection, increased from 26.4 million VND to 75 million VND/m2 - nearly 3 times.

Nguyen Du Street, from Vinh University intersection to Trung Do Cooperative, increased from 30 million to 55 million VND/m2. Also on Nguyen Du Street, the section from Tan Long gas station to Dung Quyet increased from 21.6 million to 38 million VND/m2.

Dung Quyet Street, from Metro Vinh to Ben Thuy Bridge toll station, the price increased from 9.4 million to 30 million VND/m2 - more than 3.1 times. Phong Dinh Cang Street, from Hung Dung Ward to Hoang Thi Loan Street, increased from 14.5 million to 40 million VND/m2.

Nghe An Provincial People's Committee explained the price adjustment to approach market prices, increase transparency in transactions, and at the same time serve as a basis for state management of land, determine financial obligations to people and businesses.

However, the reality shows that the sudden increase in the land price list has caused many people to have difficulty in changing the purpose of land use, including many cases with land areas that have been used before 1980, 1993, 2004.

In this situation, there are opinions suggesting that it is necessary to consider adjusting in the direction of closely following the reality of each area, avoiding causing shock and creating barriers to the legitimate needs of people in the use and transfer of land use rights.

It is known that the Ministry of Finance is seeking opinions to amend Decree 103/2024 regulating land use fees and land rents, in which it is considered reducing land use conversion tax from 100% to 50% as before.

However, with the increase in land prices many times, with the tax reduction from 100% to 50%, people still have to pay a high tax.