Provincial apples before investing in provincial land

The market in 2025 received a series of positive signals from the macro such as loose monetary policy, cooling loan interest rates and a clear sign of a "cheap money" cycle taking shape. Credit packages, public investment, and strong FDI inflows from international corporations are also a great driving force, strengthening the confidence of domestic and foreign investors.

Mr. Tran Quang Trung - Business Development Director of OneHousing commented that concerns about inflation and economic instability have been somewhat relieved. Market sentiment has shifted from defense to calculated risk acceptance. Gold prices hit a historic peak, the stock market attracted strong cash flow - these are factors that make real estate continue to be a safe haven and have long-term profit potential.

One factor that caused the local market explosion was information (even though it was only at the rumor level) about the policy of merging provinces and reallocating administrative centers. This is a strong "catalyst" that makes investors rush to gather land in areas such as Hai Phong, Bac Ninh, Bac Giang, Hai Duong, Hung Yen, Phu Tho...

However, expert Tran Quang Trung also warned that information about provincial mergers is a catalyst that causes FOMO investors (fearing to miss) to collect land massively, but if they are not alert, investors can easily get stuck in the long term because the price has far exceeded the real value.

Focusing on liquidity - controlling financial leverage, investors must answer the questions: Who will buy back? Who will rent? Who will live there?", Mr. Trung advised.

There is still room for apartment prices to increase - especially in the high-end segment

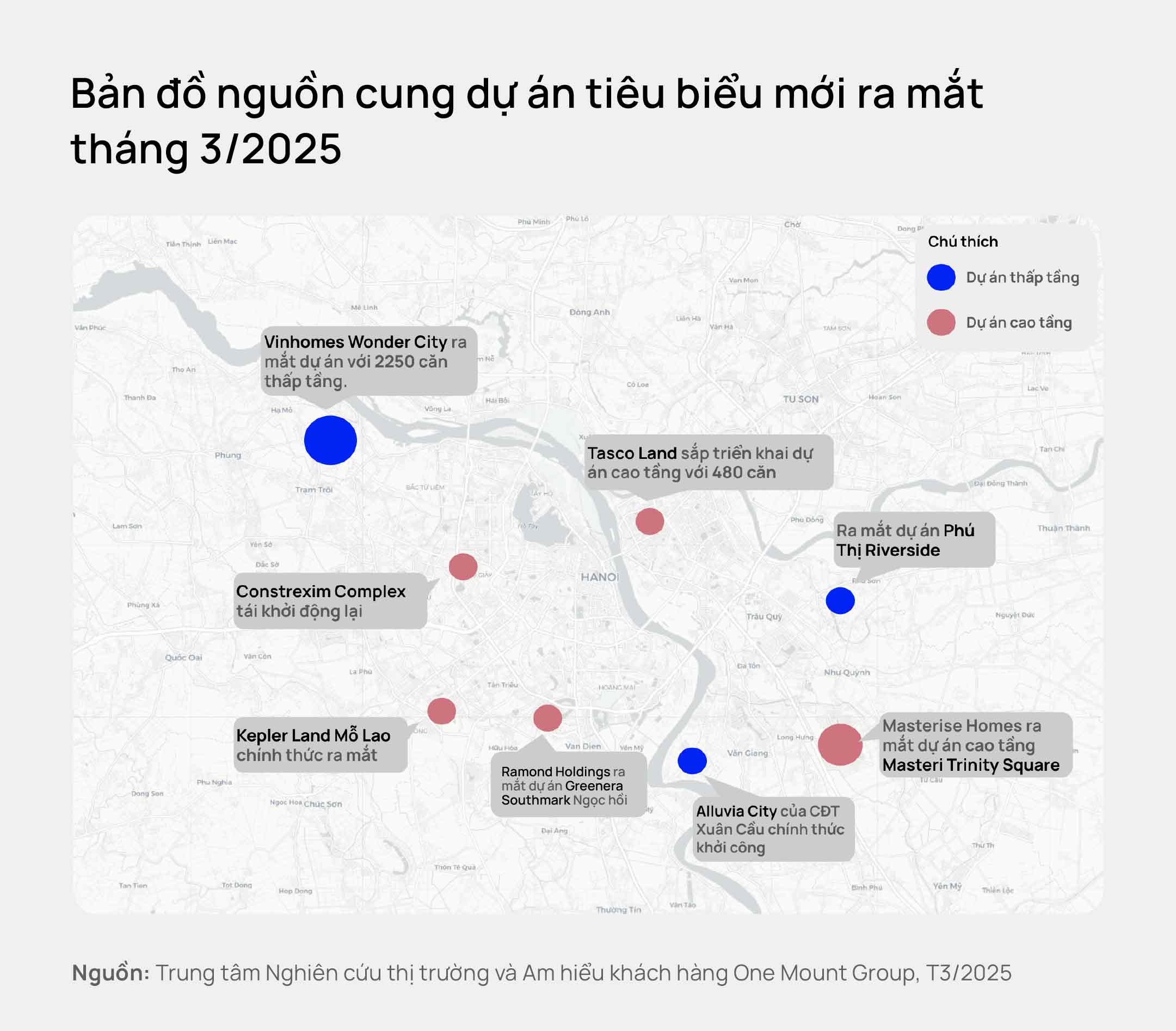

In March 2025, the real estate market recorded a series of special developments. In Hanoi, the primary market has recorded 3 low-rise projects and 5 high-rise projects officially launched with a total product fund of about 10,000 apartments. In addition to major investors such as Vinhomes, Masterise Homes, MIK Group, new projects of other investors: Xuan Cau, Tan Hoang Minh, ... appeared in the market.

The richer new supply also helps home buyers and investors have more options and references. Investors launching projects and starting construction are a signal that the legality of projects is " released", the market is "excited".

Mr. Tran Quang Trung said that in 2025, he will solve part of the housing needs of real buyers. However, if home buyers continue to wait to buy a house in the inner city, the western region or even a new market like Co Loa to have cheap products, it will be very difficult.

I highly appreciate the living conditions in the eastern area of Hanoi, including neighboring areas such as Van Giang. With a distance of only 8km by flight route and about 13km actually traveling to the center of Hoan Kiem, Van Giang is one of the areas closest to Hanoi. In fact, this distance is equivalent to or even shorter than traveling between inner-city districts such as Nam Tu Liem or Ha Dong to the center, said Mr. Trung.

It is forecasted that by 2030, Hanoi will increase by about 2 million people - equivalent to needing more than 1 million houses. Meanwhile, the supply in 2025 is expected to be only about 30,000 units - showing great potential for price increase if considering long-term supply - demand factors.

The current period is likened to dividing the cake alert people will be able to choose the delicious part if based on data and analysis. Investors need to look at cash flow, infrastructure completion, population and actual needs, Mr. Trung emphasized.