Millions of young people in Vietnam are facing a difficult problem of housing as house prices are increasing, while their income is not enough to accumulate to access real estate products. In that context, preferential credit packages are expected to be a practical financial lever, helping them realize their dream of owning a house.

According to experts at the Workshop "Effective financial leverage - settlement opportunities for young people" on June 26 in Hanoi, young people under 35 years old currently account for more than 30% of the Vietnamese population. Most of these live and work in big cities, with urgent housing needs.

However, the common price of 2 to 3 billion VND/unit is far beyond the affordability of this group of people. Meanwhile, the conditions for accessing loans are not easy. Many young people, especially freelancers or workers in informal industries, find it difficult to prove a stable income to have their loan application approved by the bank.

Mr. Ha Quang Hung - Deputy Director of the Department of Housing and Real Estate Market Management (Ministry of Construction) said that recent real estate market surveys show that people aged 22-40 are becoming the main customer group in the housing market, gradually replacing the middle-aged group.

Affirming that the desire to "set up" the young generation is very large, especially in large cities, Mr. Hung cited that Ho Chi Minh City with more than 10 million people, of which 55% are young people, it is estimated that about 30% of this group (equivalent to 1.6 million people) have a need to buy a house.

This is truly a huge demand source for the real estate market. Obviously, the demand for home ownership among young people in Vietnam is at an unprecedented level, both in terms of quantity and proportion in the home buyer structure, he emphasized.

Demand is huge, but according to Mr. Hung, the increase in people's income has not kept up with the increase in housing prices, leading to the actual ownership capacity of the majority of young people... being very limited.

To buy an average house (70m2, selling price of 3-4 billion VND) in big cities, young people need to have 20-25 years of income. This figure shows that the rate of housing/income prices in Vietnam is in the very high group (very difficult to access).

reality also shows that most young urban couples with an average income of 20-30 million VND/month have to rent a house or live with their family, very few people are able to save to buy a commercial house when they reach the age of 30 without financial support from their family or preferential credit programs.

Analyzing the barriers, Mr. Hung said that real estate supply is still limited and prices are increasing compared to the affordability of the majority of people, including young people.

The reason is that projects are facing difficulties in investment procedures; procedures for investment preparation and implementation of real estate projects in many localities are still slow; businesses are facing many difficulties in credit capital, in issuing and paying bonds, difficulties in selling...

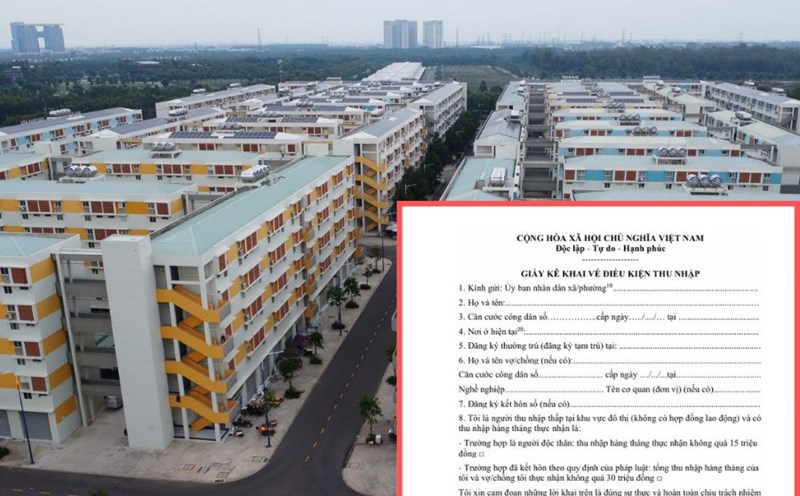

The housing market mainly consists of 2 types: Commercial housing (mainly for sale) and social housing (selling, renting, leasing) that lack models such as long-term rental, flexible rental... which can be solutions for young people to start a business.

Mr. Hung also acknowledged that young people have difficulty having housing due to barriers to personal finance, as well as credit barriers. According to him, banks are willing to lend to buy houses, but commercial lending rates are still quite high, the loan term is not long enough compared to demand.

"Reality shows that only when there are low interest rate incentive packages (5-6%) fixed at the beginning, young people will boldly decide to borrow to buy a house" - Mr. Hung added that "young people really need loans for 20-30 years to reduce the pressure of paying off monthly debts".