The real estate market recorded a noteworthy development when the land plot segment tended to increase sharply in price, in the context of limited supply but investment and asset accumulation demand still maintained at a high level.

According to Ms. Pham Thi Mien - Deputy Director of the Vietnam Real Estate Market Assessment Research Institute (VARS IRE), the price of newly offered land plots at many projects has increased by 20%. The main reason comes from the prolonged supply shortage, while investment capital continues to turn to products with room to increase in price and long-term holding potential.

On the secondary market, the increase in land plot prices is commonly recorded in the range of 20–100% in some areas with low-priced plots. The average price of low-rise housing also increased by about 20% compared to the same period last year. Transactions are mainly concentrated in projects with prices of 100–200 million VND/m2, located in formed urban areas, with residential areas and relatively complete infrastructure and amenities.

According to the Housing Real Estate Market Report in Ho Chi Minh City and its vicinity in 2025 (the researched vicinity includes Dong Nai, Tay Ninh) of DKRA Group, in 2025, the primary supply of land plots increased by 2% compared to 2024 but is still at a low level compared to the period before 2022. Notably, projects that have been opened for sale before accounted for up to 87% of the total primary supply, while the new supply only accounted for about 13% and there was almost no change compared to 2024.

Regarding demand, the market is assessed to have a clear improvement when consumption increased by about 69% compared to the previous year. However, transactions are still selective, mainly concentrated in projects that have completed infrastructure, full legal status and are implemented by investors with financial capacity.

In the overall picture of the market, Tay Ninh emerged to play a leading role in new supply, with the proportion of supply and consumption reaching 38% and 53% respectively. Compared to the same period in 2024, the primary price level in this area increased by an average of about 6%, while secondary prices increased commonly by 12–15%.

Forecasting the prospects for 2026, DKRA Consulting believes that the new supply of land plots will recover positively thanks to the appearance of large-scale urban area projects, with about 3,500–4,000 plots. Thanks to the advantage of abundant land funds, room to increase prices and increasingly complete regional connectivity infrastructure, localities such as Long An (old), Binh Duong (old) continue to play a key role in supply. Demand in the coming year is forecast to maintain the recovery momentum but still in a cautious direction, focusing on areas with favorable trading conditions and products with complete legal and infrastructure.

Information from the Ministry of Construction on the housing and real estate market situation in the fourth quarter and the whole year of 2025 also shows that the land plot segment continues to record high transaction volumes. In the fourth quarter of 2025 alone, the entire market had 113,517 successful land plot transactions, an increase of 8% compared to the third quarter of 2025 and an increase of about 30% compared to the same period in 2024. Accumulated for the whole year of 2025, the number of land plot transactions reached 441,693 transactions, an increase of about 7% compared to the previous year.

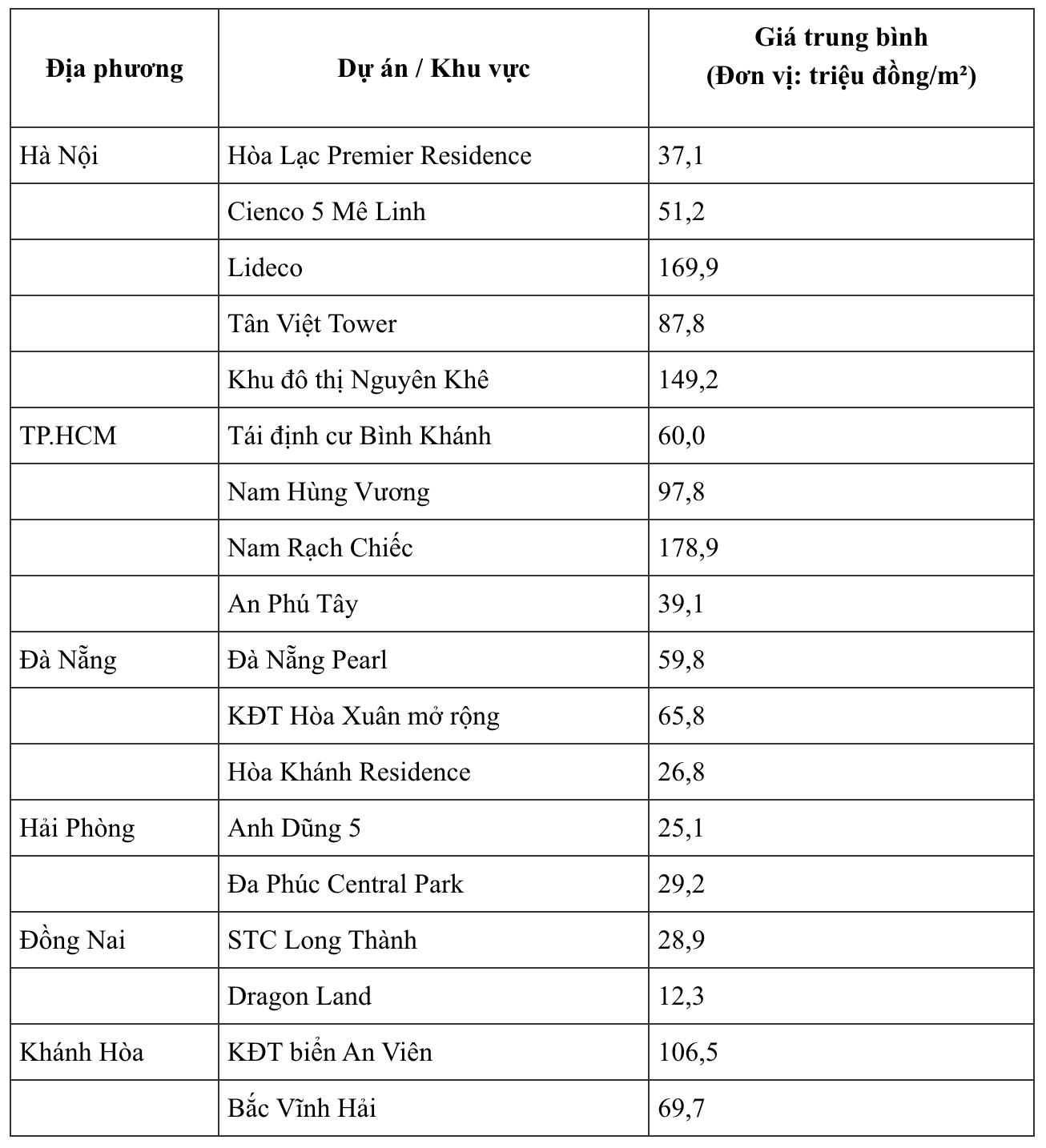

Regarding the price level in Hanoi, the Ministry of Construction said that in the Hoa Lac area, the Premier Residence project has an average price of about 37.1 million VND/m2, the Cienco 5 Me Linh project is about 51.2 million VND/m2. Some other projects recorded higher prices such as Lideco about 169.9 million VND/m2, Tan Viet Tower about 87.8 million VND/m2 and Nguyen Khe Urban Area about 149.2 million VND/m2. This development shows that land plot prices at projects with good locations and complete infrastructure have established a new level after the market recovery period.