According to Lao Dong Newspaper, in the old Dong Anh district area, land plot prices currently range from about 60 - 260 million VND/m2, depending on location. For example, in Dong Hoi commune (now Dong Anh commune, Hanoi), a corner land plot with an area of 80m2, about 900m from Tu Lien bridge, is being offered for sale at 235 million VND/m2, equivalent to 18.8 billion VND/plot.

In the Dong Tru village area (Dong Anh commune), an 80m2 land plot near Dong Tru bridge is offered for sale by brokers at a price of 20.86 billion VND, equivalent to about 260.75 million VND/m2. Meanwhile, a land plot with a 5m frontage, located on Vo Nguyen Giap street, near the foot of Nhat Tan bridge and Vinhomes Co Loa urban area, an area of 90m2, is being offered for sale at 18.7 billion VND, equivalent to 207 million VND/m2.

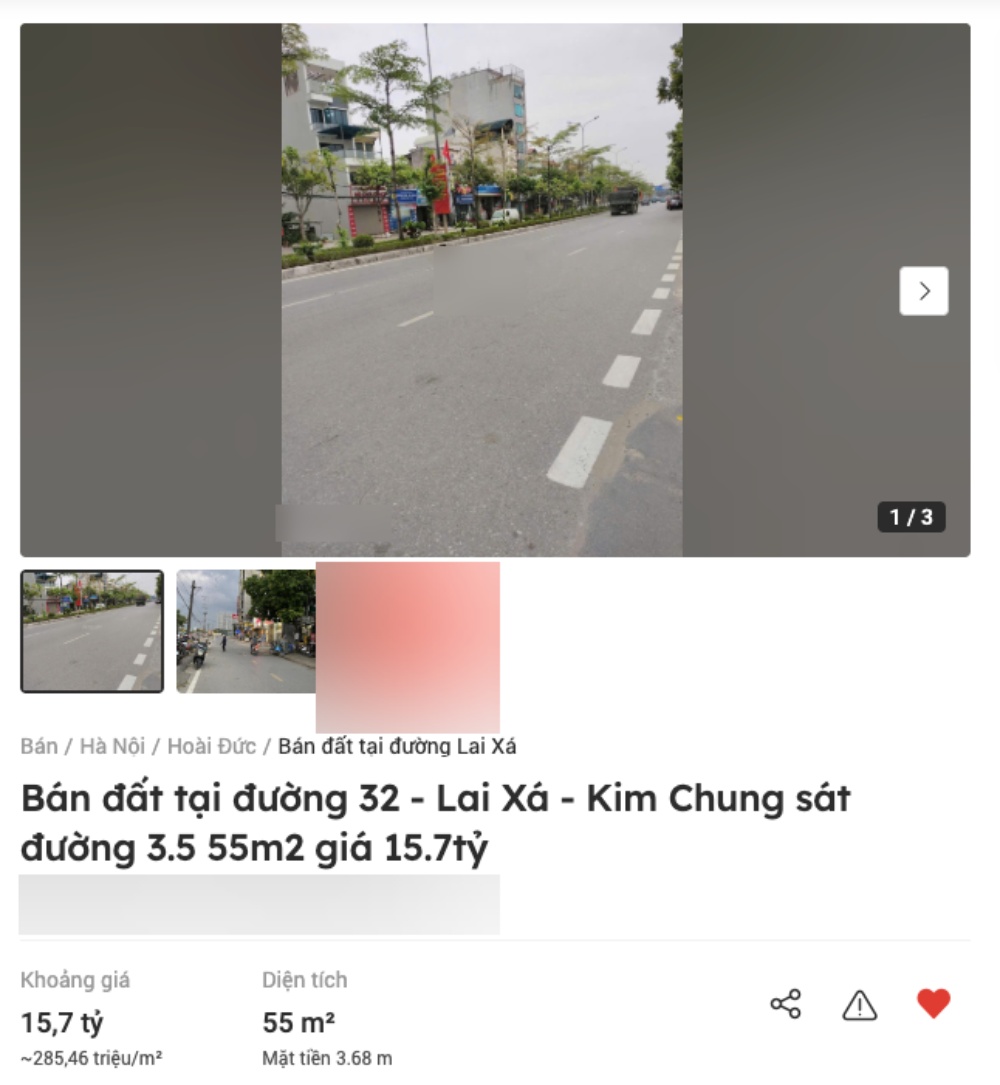

In Kim Chung commune, former Hoai Duc district (now Hoai Duc commune, Hanoi), a land plot located on Road 32, area 55m2, frontage 3.68m, is offered for sale at a price of up to 285.46 million VND/m2, equivalent to about 15.7 billion VND/plot.

In An Khanh commune, a land plot located on Lien Khu 8 road, near Thang Long Avenue, with an area of 58.5m2, is currently being offered for sale at a price of 13.46 billion VND, equivalent to about 230 million VND/m2.

Not only Dong Anh or Hoai Duc, land plot prices in Tan Hoi commune, old Dan Phuong district (now O Dien commune, Hanoi) are also at a high level. According to records, a corner land plot with an area of 60m2, a 5m frontage, located opposite a Vinhomes project, is being offered for sale at 250 million VND/m2, equivalent to about 15 billion VND/plot.

Meanwhile, another land plot not far away, on Dong Ong street, with an area of 95.7m2, a facade of 6.86m, is currently offered for sale at a price of about 180 million VND/m2, the total value of the land plot is about 17.5 billion VND.

Mr. Nguyen The Diep - Vice Chairman of Hanoi Real Estate Club - said that cash flow in the market is showing signs of shifting, towards new segments and investment areas.

According to experts, recent developments show that this trend is becoming clearer. Investors with financial potential are gradually turning to suburban areas, because in the central area of Hanoi, investment opportunities are almost gone when real estate prices, from apartments to townhouses, villas, have been pushed to very high levels.

Mr. Le Dinh Chung - Vice Chairman of the VARS Real Estate Market Research and Evaluation Council, General Director of SGO Homes - said that in 2025, the low-rise and land plot segment recorded an increase in asking prices of 5-10%. For the land plot segment, new asking prices recorded an increase of up to 20% due to prolonged supply scarcity.

General assessment of the land plot market in 2026, Mr. Le Dinh Chung - Member of the VARS Market Research Task Force, General Director of SGO Homes - said that land plots are still a segment that investors are interested in, but the level of interest will gradually decrease compared to the previous period.

Reality in the past period shows that when the market faced difficulties, products serving real housing needs, that is, built-up real estate, often had better liquidity, especially in large cities. At the same time, statistics also showed that built-up real estate achieved better price increases and was more sustainable than land plot products.

According to Mr. Chung, the types prioritized by investors in the coming time include apartments in provincial markets and housing projects with synchronous construction. However, the requirements for product selection of investors have also become stricter. If previously, investment was mainly based on crowd psychology or planning expectations, now investors have set clear criteria such as legal factors to ensure, synchronous infrastructure and proximity to residential clusters.