According to information from the Ministry of Finance, the total state budget revenue in the first half of the year is estimated at VND 1,332.3 trillion, equal to 67.7% of the annual estimate and up 28.3% over the same period in 2024. Of which, domestic revenue reached VND 1,158.4 trillion, accounting for nearly 87% of total revenue; revenue from crude oil VND 24.6 trillion; balanced revenue from import-export activities VND 148.7 trillion.

Notably, the non-state economic sector contributed the largest to domestic revenue with VND258,739 billion, equal to 70% of the estimate. Revenue from this sector exceeds total revenue from both state-owned enterprises and foreign-invested enterprises, continuing to affirm the driving role of the private economic sector.

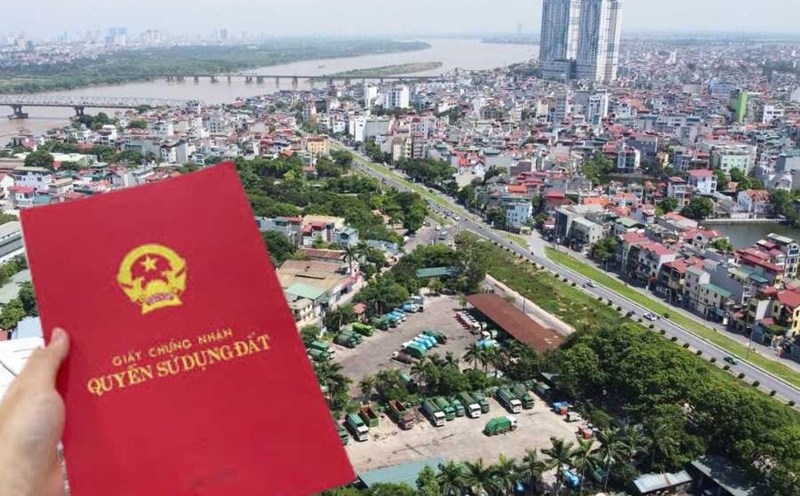

In particular, land use fee collection reached VND 243,644 billion, equal to 96% of the annual estimate. Compared to the same period in 2024 (more than VND 91,300 billion), this revenue has increased by more than 2.6 times, showing a significant recovery in the real estate market and land use rights transfer activities in localities.

Some other taxes also recorded positive results, such as personal income tax reaching VND 125,054 billion (equal to 69.3% of the estimate), revenue from lottery activities reached VND 32,195 billion (65.3% of the estimate). The Ministry of Finance assesses that most tax revenues and regions have a growth rate of 2070% over the same period last year.

Regarding state budget expenditure, the accumulated 6 months are estimated at 1,102 trillion VND, equal to 43.2% of the total annual estimate. Of which, development investment expenditure is about 268.1 trillion VND. The Government and the Prime Minister have issued many directives to promote the disbursement of public investment capital, especially for key national projects and projects affected by the reorganization of local organizational structures.

The management agency requires ministries, branches and localities to review and allocate detailed capital plans in accordance with actual implementation progress; prioritize capital allocation for projects with good progress, and strengthen inspection and supervision to promptly remove arising problems.

Interest payment in the period is estimated at about 55.7 trillion VND, fully and on time, contributing to strengthening the national credit rating. Regular expenditure is estimated at about 776 trillion VND, ensuring the operation of the state apparatus, national defense - security and social security, timely payment of regimes and policies to those receiving salaries, pensions and subsidies from the budget.

However, besides the bright spots in budget revenue and public investment, the economy still faces many difficulties. Domestic demand is increasing slowly, smuggling and trade fraud are still complicated, risks from exchange rates, gold prices, natural disasters and epidemics are still tiem nang, requiring proactive and flexible management solutions in the coming time.