Accordingly, from July 1, the calculation of the average salary as the basis for social insurance (SI) contributions to calculate pensions, one-time allowances, one-time social insurance benefits, and one-time death allowances for employees subject to the salary regime prescribed by the State and having the entire period of social insurance contributions under this salary regime according to the provisions of the Law onSI and Decree No. 158/2025 is calculated as follows:

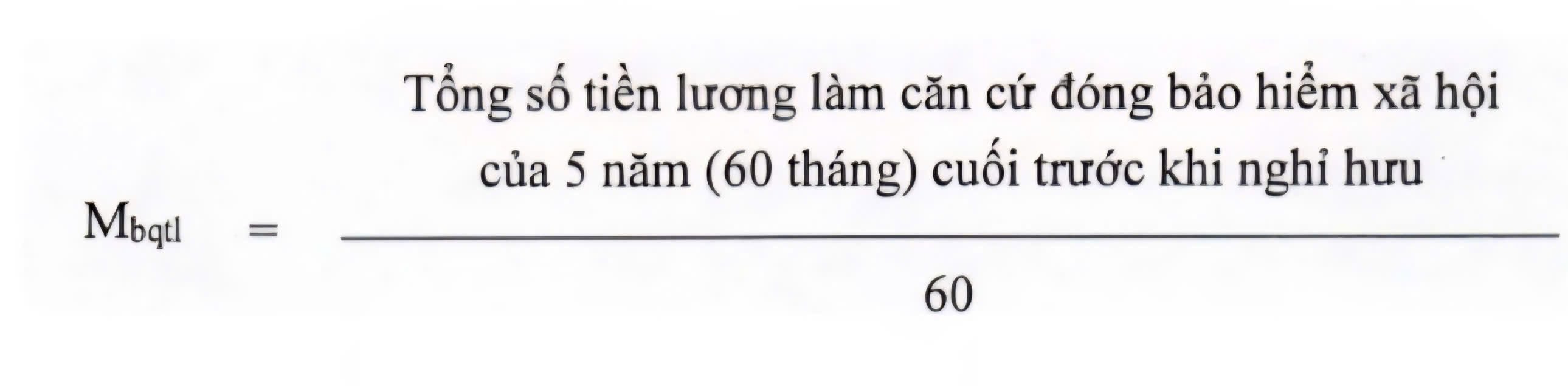

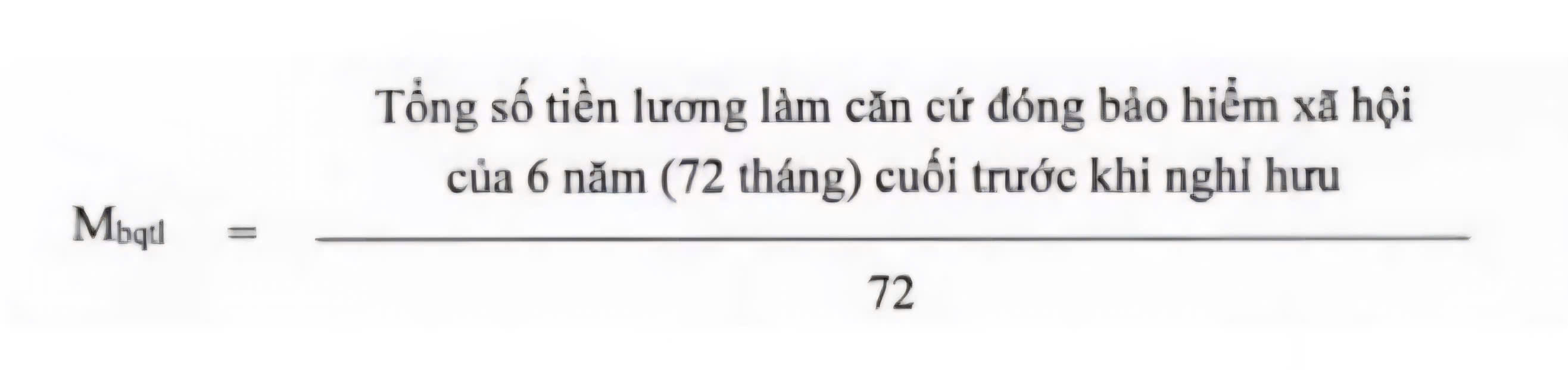

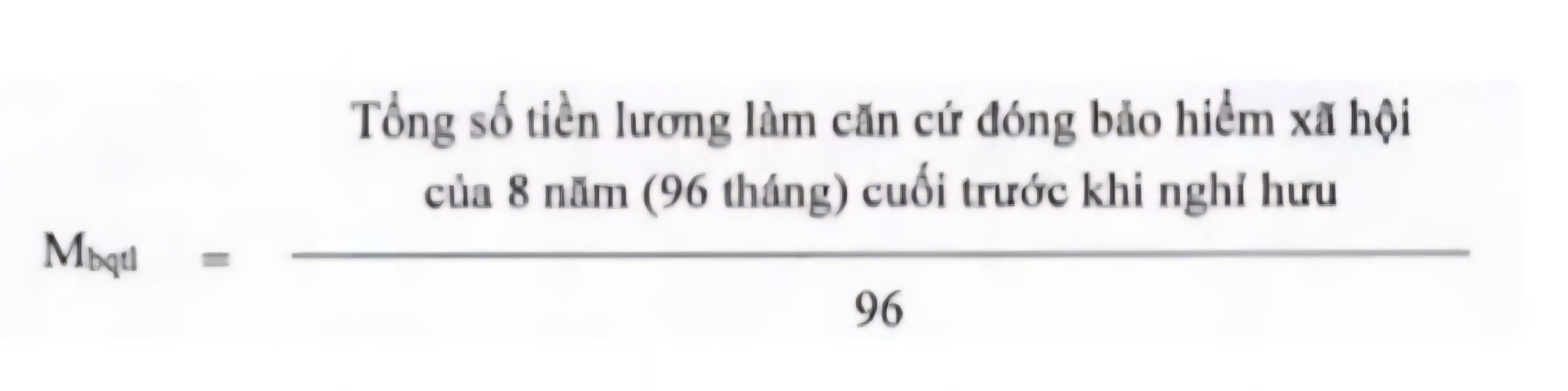

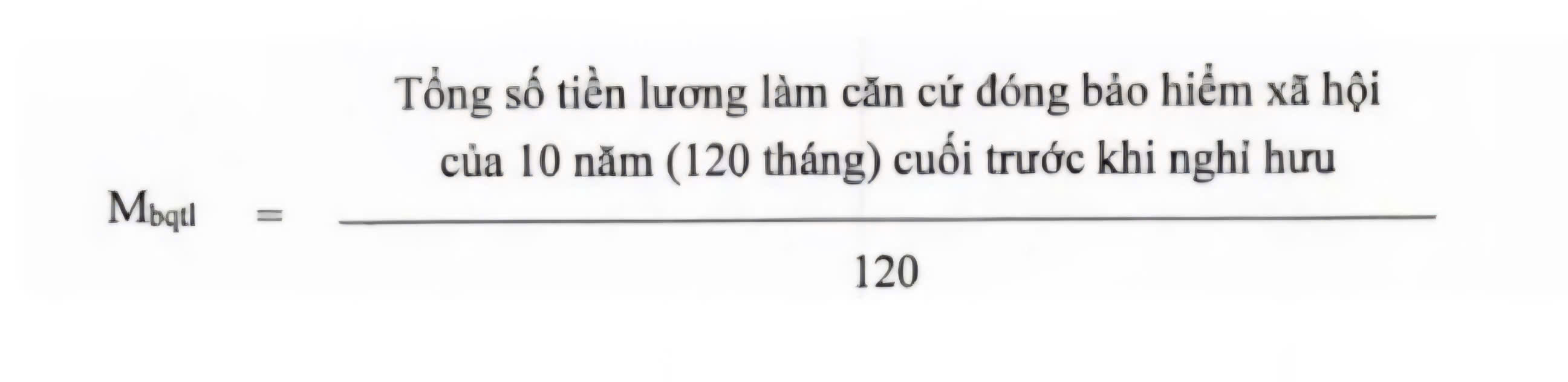

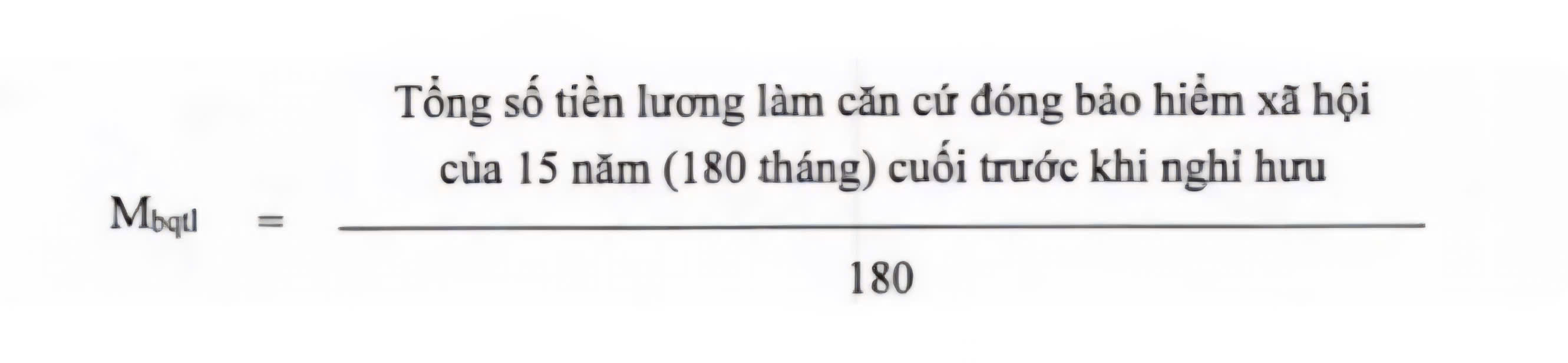

For employees who started participating in social insurance before January 1, 1995:

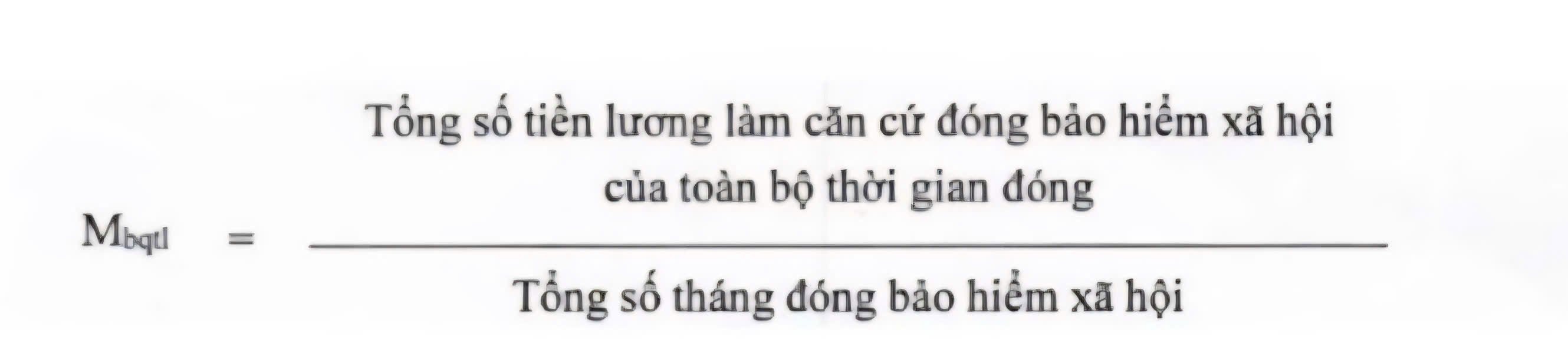

For employees whose entire period of social insurance payment is according to the salary regime decided by the employer, the average salary used as the basis for social insurance payment is calculated as follows:

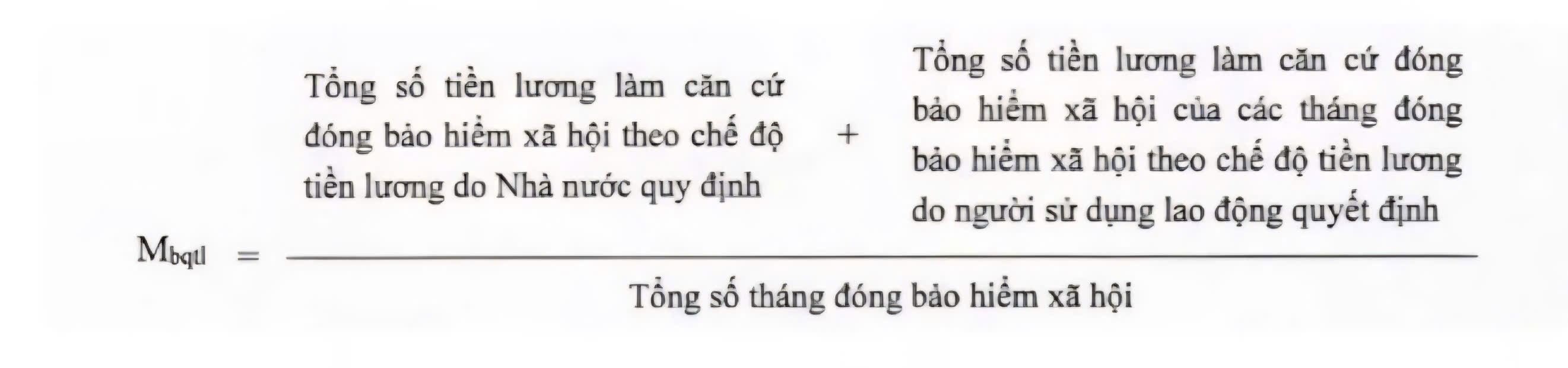

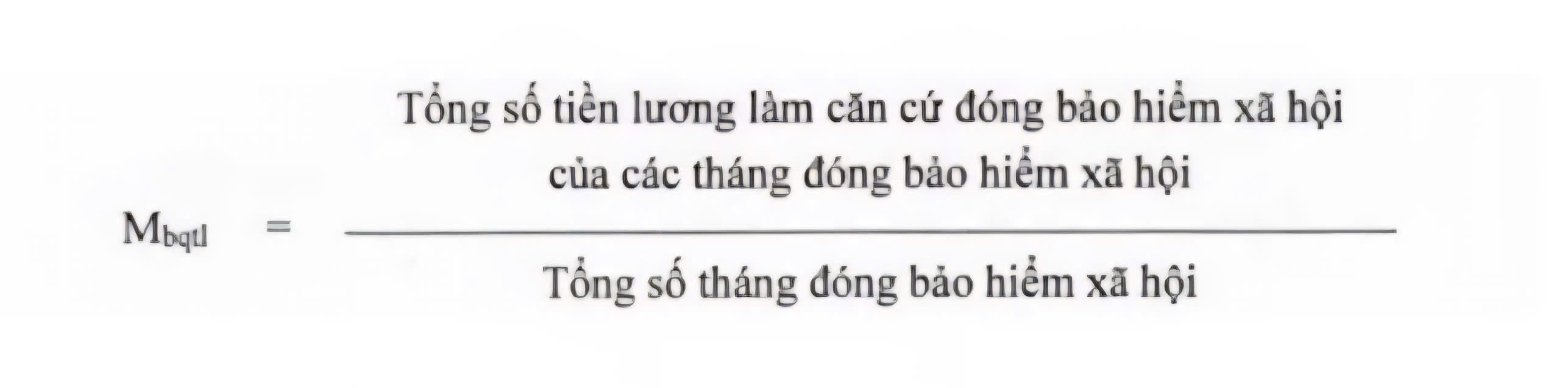

The average salary used as the basis for social insurance contributions for employees who have paid social insurance under the salary regime prescribed by the State and have paid social insurance under the salary regime decided by the employer is calculated as follows: