Accordingly, Decree 159/2025/ND-CP stipulates the pension regime for voluntary social insurance participants before January 1, 2021.

For female workers, those who start participating in voluntary social insurance before January 1, 2021 and have paid for 20 years or more will receive a pension when they are 55 years old.

The Decree also stipulates the monthly pension for voluntary social insurance participants receiving pensions according to the provisions of the Law on Social Insurance.

Regarding the regime for voluntary social insurance participants who are not eligible for pension and are not old enough to receive social pension benefits, the Government stipulates that the subjects of application are voluntary social insurance participants who are of retirement age according to regulations but do not meet the conditions for social insurance payment period to receive pension.

At the same time, this group is not eligible for social pension benefits as prescribed in Article 21 of the Law on Social Insurance.

Employees who want to enjoy this regime need not to receive one-time social insurance, not to reserve social insurance payment time and to request monthly allowances.

The period of receiving monthly allowances for social insurance participants according to regulations and meeting the conditions prescribed in Clause 2 of this Article is determined according to the payment period, the average income used as the basis for voluntary social insurance payment or the average salary and income used as the basis for social insurance payment.

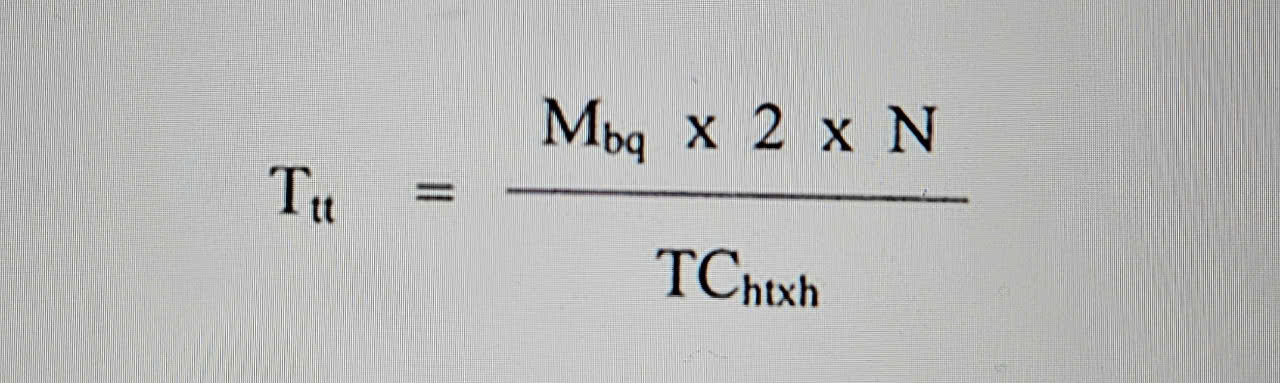

Formula for calculation:

In which, Ttt: Time to receive monthly allowance (monthly).

Mbq: The average income used as the basis for voluntary social insurance contributions is calculated according to regulations for voluntary social insurance participants or the average salary and income used as the basis for social insurance contributions is calculated according to regulations for those who have both paid compulsory social insurance and paid voluntary social insurance (same/month).

N: Number of years of social insurance contributions (from 12 months or more). In case the period of social insurance payment has odd months from 1 month to 6 months, it is counted as half a year, from 7 months to 12 months, it is counted as a year.

TChtxh: Monthly social pension allowance at the time of settlement of monthly allowance ( accumulated/month).