Clause 1, Article 7 of Decree 115/2015/ND-CP stipulates the monthly pension level as follows:

The monthly pension of employees is calculated by multiplying the monthly pension rate by the average monthly salary for social insurance contributions.

Accordingly, the pension level for June 2025 of employees is calculated according to the following formula:

Pension level for June 2025 = Monthly pension rate x Average monthly salary for social insurance contributions.

In particular, the monthly pension rate for employees eligible for pension is calculated specifically as follows:

- For employees who retire from January 1, 2016 to before January 1, 2018, the monthly pension rate is calculated at 45% corresponding to 15 years of social insurance contributions, then for each additional year of social insurance contributions, an additional 2% is calculated for men and 3% for women; the maximum is 75%;

- Female workers who retire from January 1, 2018 onwards, the monthly pension rate is calculated at 45% corresponding to 15 years of social insurance contributions, then for each additional year of social insurance contributions, an additional 2% is calculated; the maximum is 75%;

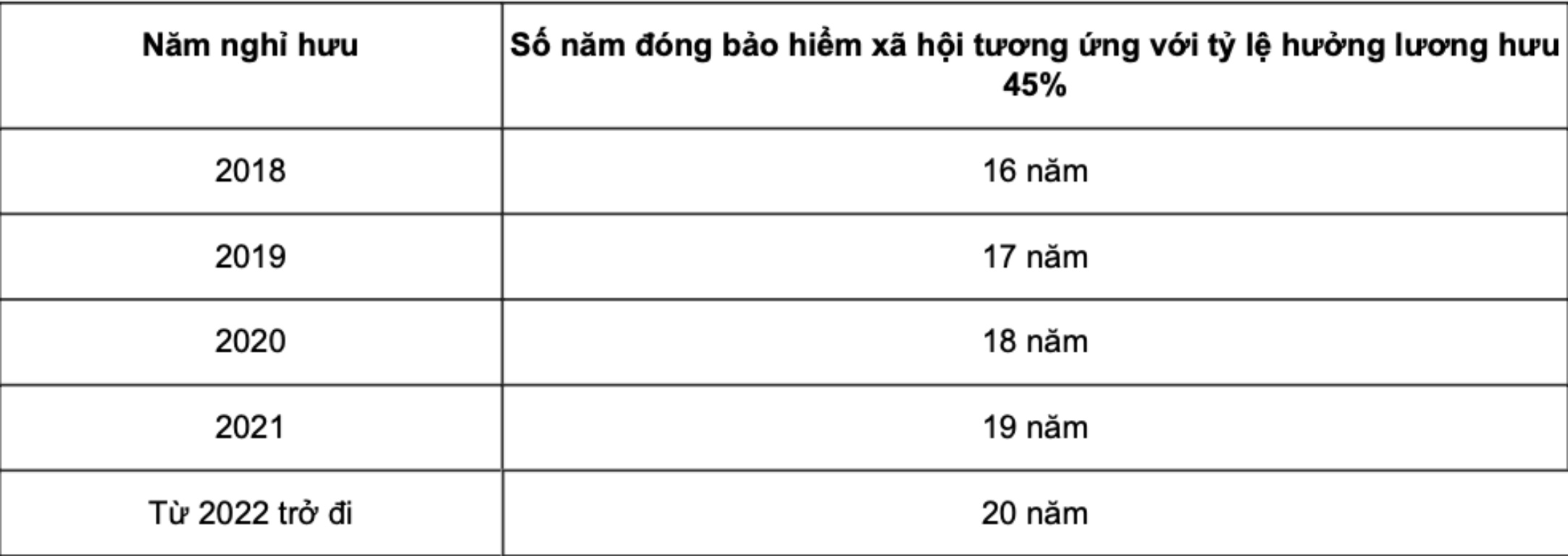

- Male workers who retire from January 1, 2018 onwards, the monthly pension rate is calculated at 45% corresponding to the number of years of social insurance contributions in the table below, then for each additional year of social insurance contributions, an additional 2% is calculated; the maximum rate is 75%:

Thus, the pension level for June 2025 will depend on the monthly pension rate of each subject.