From Kiva systems to a new wave of startups

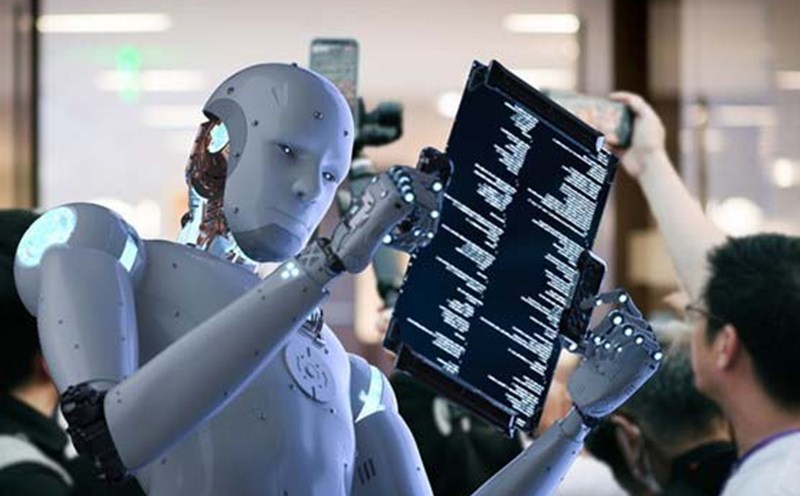

The global robotics industry is entering a period of strong development, not only thanks to the support of artificial intelligence (AI) but also thanks to remarkable advances in hardware, sensors and production costs.

In 2015, when famous adventure investor Seth Winterroth left GE Ventures to co-found Eclipse, robots were still a young field, receiving little attention from venture capital funds.

Most of the capital at that time was poured into mature apps. The early stage robot companies were almost unable to raise capital. But after a decade, everything has changed, said Mr. Seth Winterroth.

According to Crunchbase, in just the first seven months of 2025, robot startups have raised $6 billion, expected to go well beyond 2024. This is one of the few non-AI fields that have seen growth in investment flows.

The real turning point came in 2012, when Amazon acquired Kiva systems, according to Winterroth.

It was a deal to create 1,000 robot companies, Winterroth said.

Names like 6 River systems or Clearpath Robotics were born from this wave, success or failure both leave valuable experience for the next generation.

Kira Noodleman, a partner at bee Partners, agreed: The past decade has been like a trial period. Thanks to that, companies now understand what customers need in robots and automation".

A typical example is Rapid Robotics, which failed before finding a suitable market, but the lesson from that helped the next generation of founders have a more realistic view.

Cheaper hardware, AI-enabled but not decisive

In addition to market lessons, another factor that helps robots take off is the sharp decrease in production costs.

Fady Saad, co-founder of Cybernetix Ventures, said that robot manufacturing is now much cheaper than it was five years ago. sensors, batteries, and computing have all improved, creating the perfect time for a comprehensive solution.

AI, especially large language models, plays an important role but is not the only factor.

Robots learn from real data more than online information. We need time to accumulate and train parallel operating models with humans, Fady Saad emphasized.

Opportunities and challenges ahead

Investors agree that the industrial robotics, warehousing, construction and healthcare sectors have great potential. The aging population and the shortage of labor make robots taking care of the elderly or providing home support an attractive direction.

However, not all areas are promising. Consumer robots and autonomous robots are still high-risk areas.

However, the increase in investment shows that the market has matured. 15 years ago, people were still skeptical about whether there was a real market for robots, Winterroth said. Now, customers are more ready than ever.

The robotics industry with its rich technology foundation and capital, many experts assess, is in the golden age, where startups have the most opportunities to break through.