Teacher salary scale from 2026

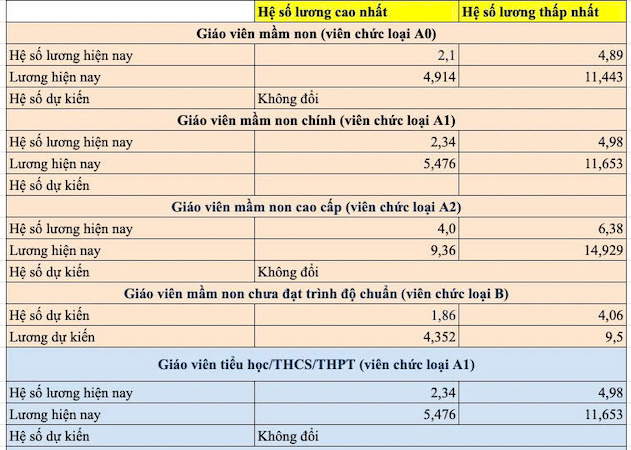

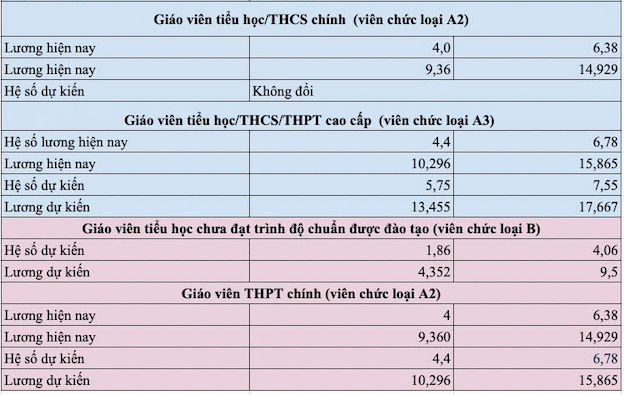

According to the draft Circular regulating the code number, appointment and salary ranking for public teachers, including preschool, general education (elementary, secondary and high school) levels.

Each grade level, teachers are divided into three groups: Teachers, principal teachers and senior teachers, equivalent to grades III, II and I currently.

For preschool level, the salary coefficient is from 2.1 - 6.38 (unchanged compared to the present).

At the primary, secondary, and high school levels, the salary coefficient of teachers is from 2.34 - 7.55, of which the salary coefficient of senior teachers (old grade I) has been increased, from the coefficient of 4.4 - 6.78 to 5.75 - 7.55; the salary coefficient of principal high school teachers (old grade II) has increased from the coefficient of 4 - 6.38 to 4.4 - 6.78.

With an expected coefficient of 2.1-7.55, teachers will receive a salary of 4.9 to 17.66 million VND per month.

From 2026, how much will teachers' salaries have to pay personal income tax?

The National Assembly Standing Committee has approved the adjustment of the family circumstance deduction level of personal income tax (PIT). The Resolution takes effect from the date of signing and is applied from the tax period of 2026.

According to the Resolution, the deduction level for taxpayers is 15.5 million VND/month (186 million VND/year)/the deduction level for each dependent person is 6.2 million VND/month.

Thus, teachers who teach and generate income from wages and salaries in Vietnam will pay PIT according to regulations.

For cases where teachers do not have dependents, personal income tax must be paid when the total income from salaries and wages is over 15.5 million VND/month.

The above income is income from salaries and wages minus the following amounts: Insurance contributions, voluntary pension funds, charity contributions, scholarships, humanitarian aid; Income exempt from income tax; Non-income taxable amounts such as some allowances, allowances, lunch money...

In case teachers register for family circumstance deductions for 1 dependent, the teacher's salary is over 21.7 million VND; if there are 2 dependents, the teacher's salary is over 27.9 million VND, they will have to pay PIT.