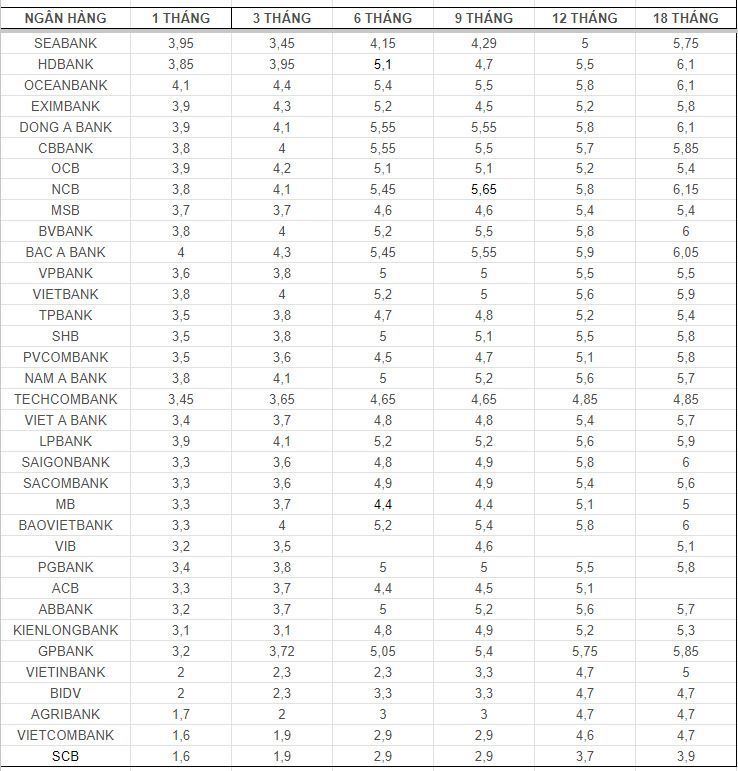

Where to deposit money with the highest interest?

According to Lao Dong, at the 1-month term, the highest deposit interest rate currently belongs to OceanBank with an interest rate of 4.1%/year.

At the 3-month term, the highest interest rate is 4.4%/year currently listed by OceanBank.

At term 6, CBBank leads with interest rate of 5.55%/year.

At 9-month term, the highest interest rate is 5.65%/year at NCB.

At the 12-month term, the leading bank with the highest interest rate is Bac A Bank with an interest rate of 5.9%/year.

For the 18-36 month term, NCB leads with the highest interest rate of 6.15%/year.

Experience in saving money in banks to get good profits

Term deposit from 6 - 12 months

At banks, deposits are divided into many terms depending on each person's future capital needs.

However, in case the idle money is not used for a long time, a term of 6-12 months is the most optimal choice. Normally, terms over 6 months will have more preferential interest rates, and the capital turnover time is not too long.

Divide money into small amounts to save in the bank

Financial experts advise that if you have idle money, you should not put all your "eggs in one basket". Sharing the amount of money into several deposits at the bank can minimize the situation of not receiving interest on deposits when you have to withdraw money urgently or withdraw money before the maturity date.

When dividing into savings, instead of withdrawing a large amount of money, you can close a few savings books in advance without affecting the other books. Note that when dividing savings books, you should base on your savings goals and actual needs to maximize the profits received.

Consider between savings interest rate and bank brand

In fact, small banks often offer savings interest rates 0.5 - 1.5% higher than large commercial banks to attract customers.

However, people should not use deposit interest rates as a measure of credibility. Currently, information about banks is widely publicized on the media, so before depositing money, people can carefully research information about the banks they intend to "choose the right face to entrust their gold".

Understand how to calculate interest rates on savings deposits at banks

According to Article 5 of Circular 14/2017/TT-NHNN, the formula for calculating bank savings interest rates is as follows:

Interest amount = (Actual balance * number of days maintaining actual balance * Interest Rate for calculating interest) / 365

Note on savings book maturity date

The maturity date is the last day of the savings period from the time you open the book. On this day, the bank will allow you to withdraw the principal and interest from the savings book at the prescribed interest rate.

At some banks, when the maturity date has passed, the money in the savings account will be transferred to the status of non-term savings with a lower interest rate than when depositing for a term. Therefore, before opening a book, you should carefully ask the bank staff for advice on this issue.

Online savings

Compared to the form of saving at the counter, online savings books are gradually dominating and becoming the leading trend today because online deposit interest rates are often higher than the form of saving at the counter for the same term.

People can also proactively deposit money and renew their books simply, quickly, anytime, anywhere with a mobile device connected to the internet.

Details of deposit interest rates at banks, updated on October 12, 2024