Bank raises interest rates by 0.7 percentage points

According to Lao Dong's record on October 4, the Export-Import Commercial Joint Stock Bank (Eximbank) issued a new interest rate schedule, increasing locally at 3-month and 18-24-month terms.

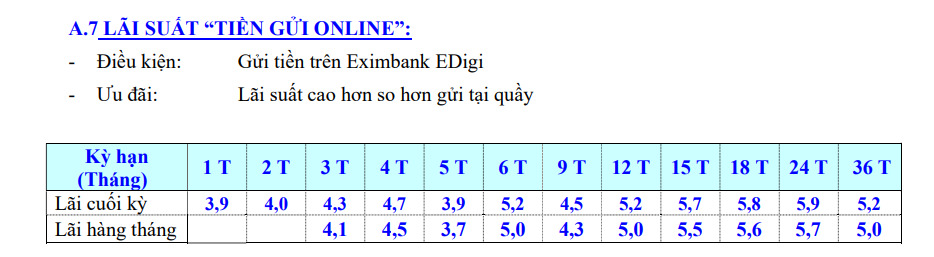

Eximbank's online deposit interest rate table records the following changes:

The 1-month Interest Rate increased by 0.1 percentage point to 3.9%/year.

Interest Rate for 3-month term is 4.3%/year.

Interest Rate for 6-month term is 5.2%/year.

Interest Rate for 9-month term is 4.5%/year.

Interest Rate for 12-month term is 5.2%/year.

The 18-month Interest Rate increased by 0.7 percentage points to 5.8% per year.

Interest Rate for 24-month term increased by 0.7 percentage points, to 5.9%/year.

Interest Rate for 36-month term is 5.2%/year.

Similarly, Eximbank's counter deposit interest rate table recorded an increase of 0.1 percentage points for the 15-month and 18-month deposit terms. Counter deposits at Eximbank are currently significantly lower than online deposits, fluctuating between 2.8-4.7%/year.

Banks increase interest rates, close to peak

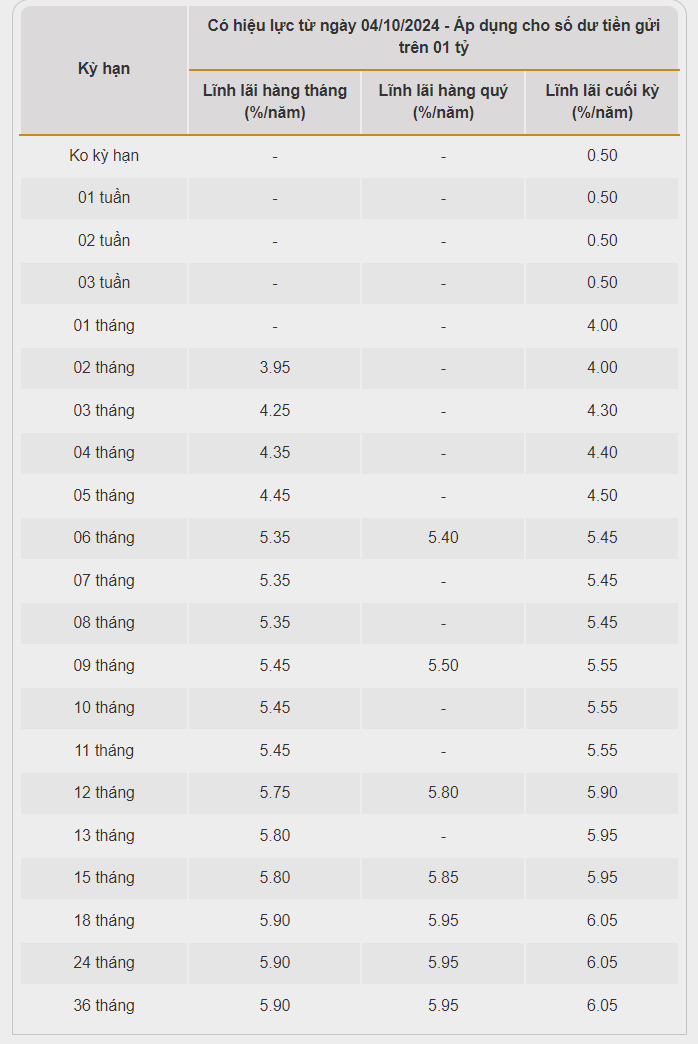

On the same day, Bac A Commercial Joint Stock Bank (Bac A Bank) recorded a change in interest rate schedule with a significant upward trend.

With a deposit balance of over 1 billion VND, the interest rate at Bac A Bank changes as follows:

The 1-month Interest Rate increased by 0.15 percentage points to 4.0% per year.

The 3-month Interest Rate increased by 0.15 percentage points to 4.3% per year.

Interest Rate for 6-month term increased by 0.1 percentage point, to 5.45%/year.

Interest Rate for 9-month term increased by 0.1 percentage point, to 5.55%/year.

Interest Rate for 12-month term is at 5.9%/year.

Interest Rate for 18-16 month term is at 6.05%/year.

After increasing interest rates, Bac A Bank is currently the leading bank with savings interest rates for terms of 1-3-18-36 months. The savings interest rate with a deposit balance of less than 1 billion VND is currently listed by Bac A Bank 0.2% lower than the above interest rate for terms.

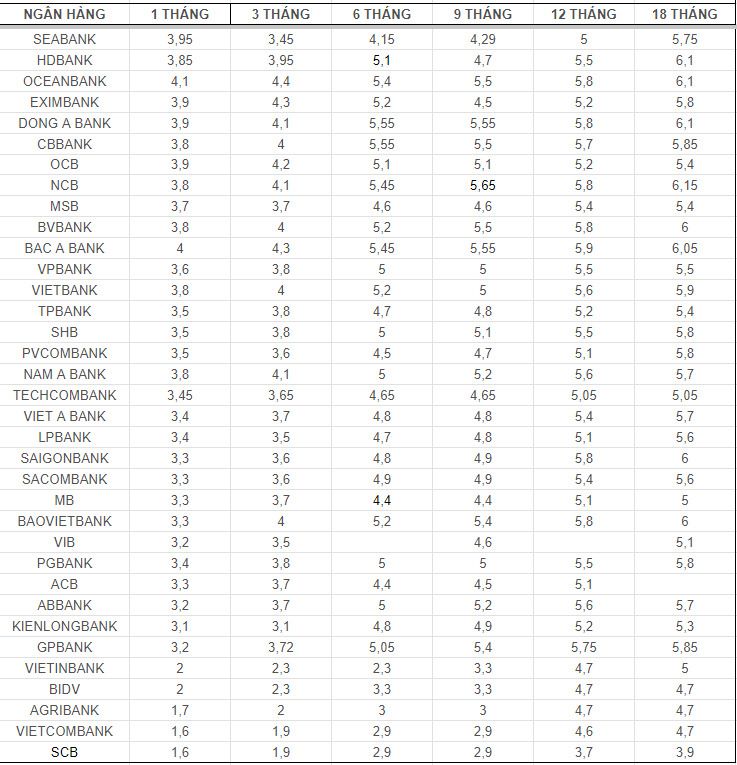

Details of savings interest rates at banks, updated on October 4, 2024